Bank BRI Bagikan Dividen: Target 85% Laba 2024 Dan Tren Sejak 2020

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bank BRI Bagikan Dividen: Target 85% Laba 2024 dan Tren Sejak 2020

Bank Rakyat Indonesia (BRI), the largest bank in Indonesia by assets, has announced plans to distribute a significant portion of its 2024 profits as dividends. This follows a consistent trend of generous dividend payouts in recent years, solidifying BRI's position as a lucrative investment for shareholders. The announcement sent positive ripples through the Indonesian stock market, highlighting the bank's robust financial performance and commitment to shareholder returns.

Target 85% Dividend Payout for 2024: A Strong Signal of Confidence

BRI aims to distribute 85% of its net profit for the fiscal year 2024 as dividends. This ambitious target underscores the bank's confidence in its future performance and its dedication to rewarding its investors. The substantial dividend payout reflects BRI's strong financial health and its ability to generate significant profits, even amidst challenging economic conditions. This move is expected to attract further investment and reinforce BRI's standing in the Indonesian financial landscape.

Analyzing the Dividend Trend Since 2020: A Consistent Record of Returns

To understand the significance of the 2024 target, it's crucial to examine BRI's dividend distribution history. Let's take a look at the trend since 2020:

- 2020: [Insert Percentage and details about dividend payout in 2020, citing reliable sources]. This payout demonstrated resilience despite the initial impact of the COVID-19 pandemic.

- 2021: [Insert Percentage and details about dividend payout in 2021, citing reliable sources]. A significant increase reflects a strong recovery and growth.

- 2022: [Insert Percentage and details about dividend payout in 2022, citing reliable sources]. Continued growth showcases consistent profitability and investor confidence.

- 2023: [Insert Percentage and details about dividend payout in 2023, citing reliable sources, if available. Otherwise, mention projected figures if available from reputable sources]. Provides context for the 2024 target.

This consistent upward trend clearly indicates BRI's commitment to shareholder value and its strong financial performance throughout a period encompassing both economic challenges and recovery.

Factors Contributing to BRI's Strong Financial Performance

Several key factors have contributed to BRI's ability to consistently deliver strong profits and generous dividends:

- Strong Market Position: BRI's extensive branch network and dominance in the Indonesian market provide a significant competitive advantage.

- Focus on Digitalization: BRI's investment in digital banking services has attracted a younger demographic and improved efficiency.

- Government Support: As a state-owned enterprise, BRI benefits from government policies aimed at supporting the Indonesian economy.

- Effective Risk Management: The bank's robust risk management framework has protected it from significant losses.

Implications for Investors and the Indonesian Economy

The announcement of the 85% dividend payout has positive implications for both investors and the broader Indonesian economy:

- Increased Investor Confidence: The high dividend payout attracts both domestic and foreign investment, boosting the Indonesian stock market.

- Economic Growth: Dividends contribute to increased household income and stimulate consumer spending, supporting economic growth.

Conclusion: A Bright Outlook for BRI and its Shareholders

BRI's commitment to distributing a significant portion of its profits as dividends reinforces its position as a reliable and lucrative investment. The consistent upward trend in dividend payouts since 2020 reflects the bank's strong financial performance and its dedication to shareholder value. The 85% target for 2024 further solidifies this commitment and paints a positive outlook for both BRI and its investors, contributing positively to the Indonesian economy as a whole. This makes BRI a compelling investment opportunity for those seeking strong returns and long-term stability. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bank BRI Bagikan Dividen: Target 85% Laba 2024 Dan Tren Sejak 2020. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

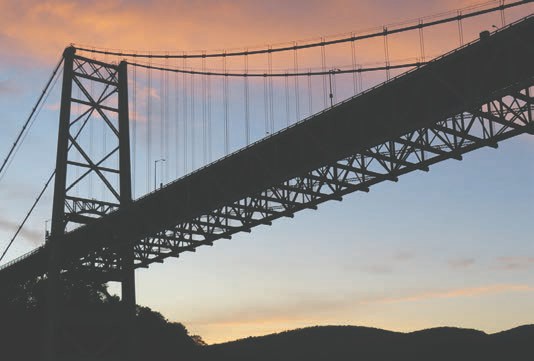

Bear Mountain Bridge Safety New Anti Climb Fencing A Possibility

Mar 18, 2025

Bear Mountain Bridge Safety New Anti Climb Fencing A Possibility

Mar 18, 2025 -

Can Stephen Curry And The Warriors Cool Down Nikola Jokic And The Denver Nuggets

Mar 18, 2025

Can Stephen Curry And The Warriors Cool Down Nikola Jokic And The Denver Nuggets

Mar 18, 2025 -

Jalen Greens 30 Point Performance Vs Philadelphia 76ers Full Highlights

Mar 18, 2025

Jalen Greens 30 Point Performance Vs Philadelphia 76ers Full Highlights

Mar 18, 2025 -

San Antonio Spurs Regret The Missed Opportunity Of Austin Reaves

Mar 18, 2025

San Antonio Spurs Regret The Missed Opportunity Of Austin Reaves

Mar 18, 2025 -

Hollywoods Elite Meagan Good Jamie Foxx Headline La Premiere Photos

Mar 18, 2025

Hollywoods Elite Meagan Good Jamie Foxx Headline La Premiere Photos

Mar 18, 2025

Latest Posts

-

Metal Mario Hot Wheels Price Specs And Pre Order Information

Apr 30, 2025

Metal Mario Hot Wheels Price Specs And Pre Order Information

Apr 30, 2025 -

Police Incident At Rideau Centre Ottawa Downtown Lockdown

Apr 30, 2025

Police Incident At Rideau Centre Ottawa Downtown Lockdown

Apr 30, 2025 -

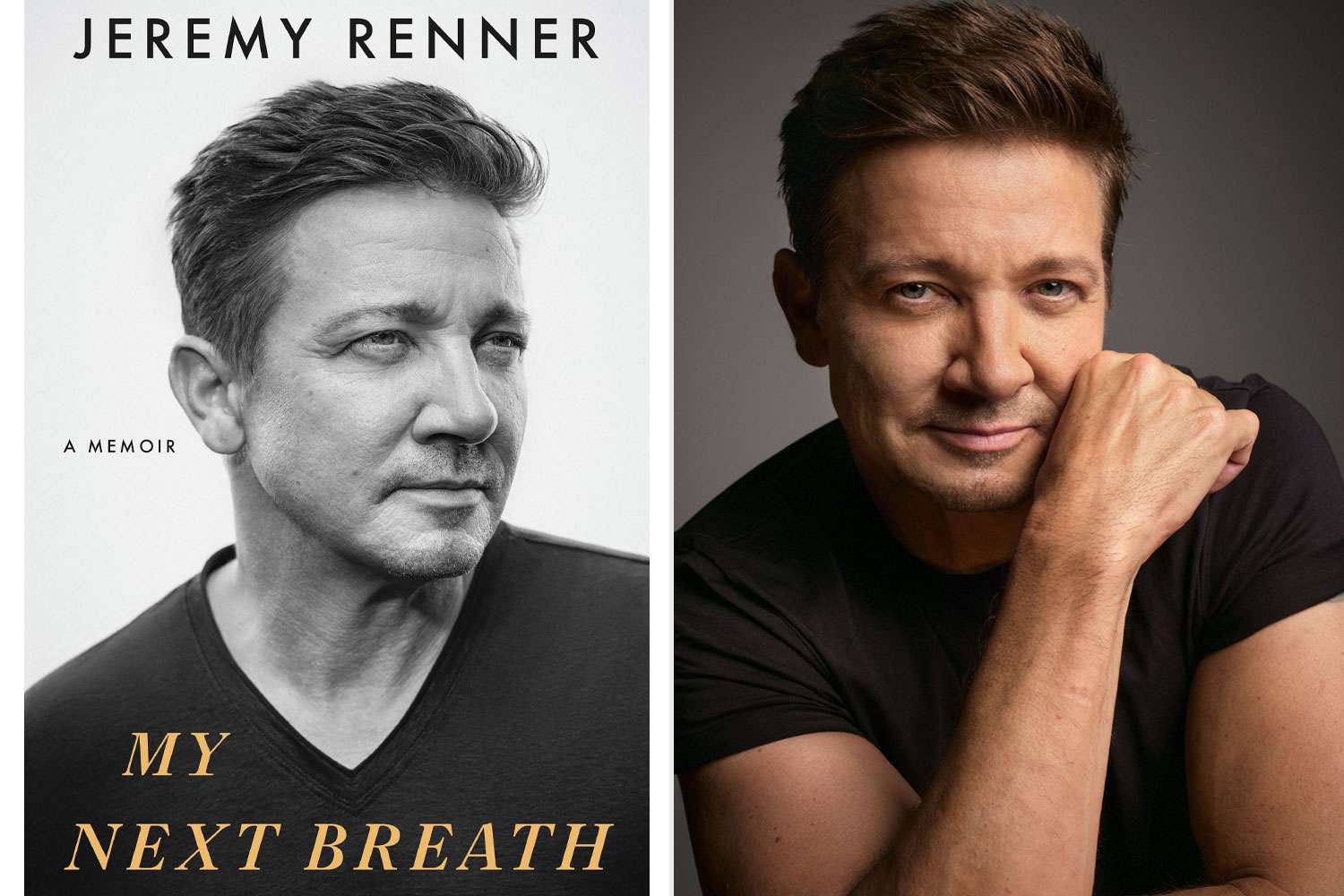

Jeremy Renners 2023 Near Fatal Accident A First Hand Account Of His Injuries

Apr 30, 2025

Jeremy Renners 2023 Near Fatal Accident A First Hand Account Of His Injuries

Apr 30, 2025 -

Beyond Verification Building True Security In The Web3 Ecosystem

Apr 30, 2025

Beyond Verification Building True Security In The Web3 Ecosystem

Apr 30, 2025 -

Ukrainian Journalist Dies In Russian Prison Reports Of Extensive Torture Emerge

Apr 30, 2025

Ukrainian Journalist Dies In Russian Prison Reports Of Extensive Torture Emerge

Apr 30, 2025