Banks Explore Stablecoins: Expanding Liquidity And Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Banks Explore Stablecoins: Expanding Liquidity and Deposits – A New Era of Finance?

The traditional banking sector is showing increasing interest in stablecoins, exploring their potential to revolutionize liquidity management and attract new deposits. This shift signals a significant development in the intersection of traditional finance and decentralized finance (DeFi), promising both opportunities and challenges for the future of banking.

The Allure of Stablecoins for Banks:

Stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, offer several compelling advantages for banks:

-

Enhanced Liquidity: Banks can potentially leverage stablecoins to improve their liquidity positions, especially during periods of market volatility. The instant transferability of stablecoins offers a faster and more efficient alternative to traditional interbank transactions.

-

Lower Transaction Costs: Compared to traditional wire transfers or correspondent banking relationships, stablecoin transactions can significantly reduce costs, particularly for international payments. This efficiency boost can translate to increased profitability.

-

Access to New Deposit Sources: Stablecoins could open up avenues to attract deposits from a broader customer base, including those who are more comfortable interacting with digital assets. This expansion of the deposit base can bolster a bank's lending capacity and overall financial strength.

-

Improved Cross-Border Payments: The speed and efficiency of stablecoin transfers offer a significant advantage for facilitating cross-border payments, streamlining international trade and reducing delays.

Challenges and Regulatory Considerations:

Despite the numerous benefits, banks face several hurdles in adopting stablecoins:

-

Regulatory Uncertainty: The regulatory landscape surrounding stablecoins is still evolving. Banks need clear guidelines and regulatory frameworks to ensure compliance and mitigate risks. Lack of clarity poses a significant barrier to widespread adoption.

-

Volatility Concerns (Even for Stablecoins): While designed for stability, the history of some stablecoins demonstrates that they are not entirely immune to price fluctuations. This inherent risk needs careful management and risk mitigation strategies.

-

Security Risks: Like any digital asset, stablecoins are susceptible to security breaches and hacking. Banks need robust security protocols to protect their assets and customer funds.

-

Integration with Existing Systems: Integrating stablecoin technology with legacy banking systems can be complex and costly, requiring significant technological investments and expertise.

Pilot Programs and Future Outlook:

Several banks are already conducting pilot programs to explore the use of stablecoins. These initiatives are providing valuable insights into the practical applications and challenges of integrating this technology into existing banking infrastructure. The outcome of these pilots will likely shape the future trajectory of stablecoin adoption within the banking sector.

Conclusion:

The exploration of stablecoins by banks represents a significant step towards bridging the gap between traditional finance and the burgeoning world of digital assets. While challenges remain, the potential benefits of enhanced liquidity, reduced costs, and access to new deposit sources are too significant for banks to ignore. The coming years will likely witness a gradual but significant increase in the use of stablecoins within the financial system, reshaping the landscape of banking as we know it. The key to successful adoption will be navigating the regulatory complexities and prioritizing security to build trust and confidence in this innovative technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Banks Explore Stablecoins: Expanding Liquidity And Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

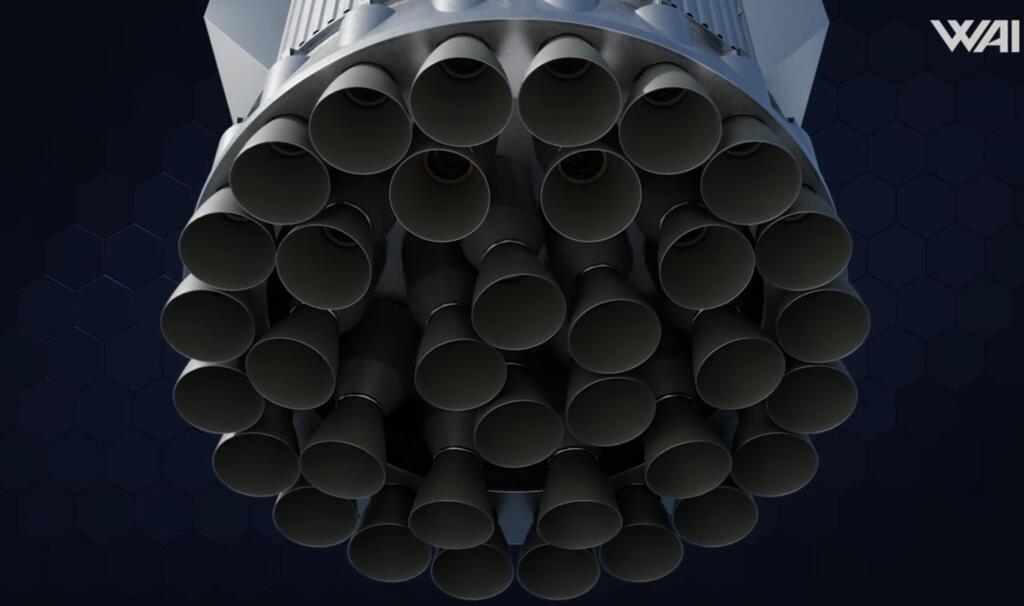

Space X Starships Enhanced Power A Closer Look At The 35 Raptor 3 Engines

Apr 29, 2025

Space X Starships Enhanced Power A Closer Look At The 35 Raptor 3 Engines

Apr 29, 2025 -

Jammu And Kashmirs Yudhvir Charak The Next Ipl Sensation

Apr 29, 2025

Jammu And Kashmirs Yudhvir Charak The Next Ipl Sensation

Apr 29, 2025 -

Singapore Ge 2025 A Roundup Of Day 6 Campaign Activities

Apr 29, 2025

Singapore Ge 2025 A Roundup Of Day 6 Campaign Activities

Apr 29, 2025 -

Fire At Wfcu Centre Forces Evacuation Voting Moved

Apr 29, 2025

Fire At Wfcu Centre Forces Evacuation Voting Moved

Apr 29, 2025 -

Made In China Navy Boats Australian Defense Department Responds After Tornado Incident

Apr 29, 2025

Made In China Navy Boats Australian Defense Department Responds After Tornado Incident

Apr 29, 2025

Latest Posts

-

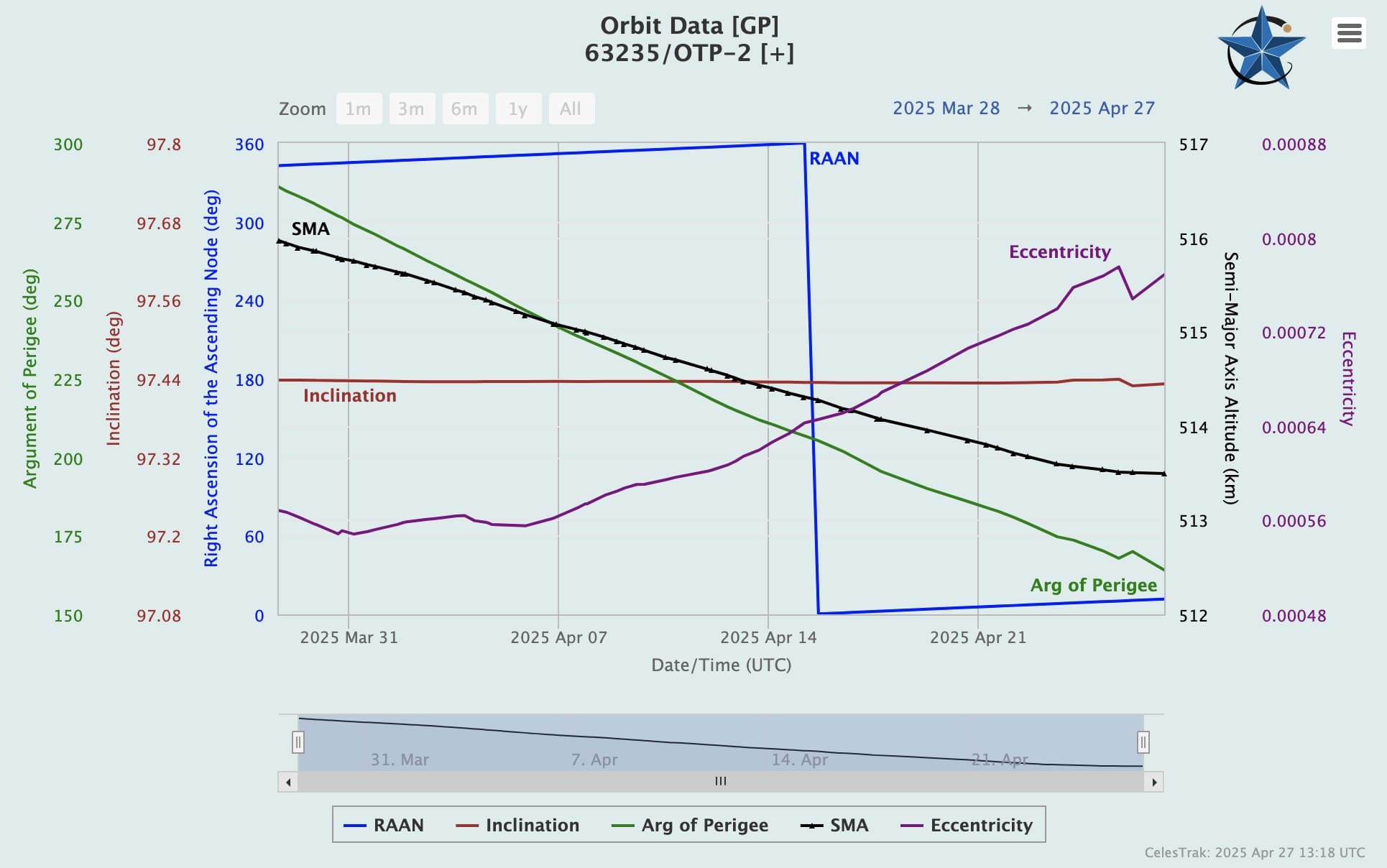

Propellantless Satellite Drive Otp 2 Analyzing Orbital Degradation

Apr 30, 2025

Propellantless Satellite Drive Otp 2 Analyzing Orbital Degradation

Apr 30, 2025 -

Shocked Myles Lewis Skelly On Arsenal Fans Behavior Following Man City Win

Apr 30, 2025

Shocked Myles Lewis Skelly On Arsenal Fans Behavior Following Man City Win

Apr 30, 2025 -

Thunderbolts Post Credit Scene Leak And Critic Reactions Following Premiere

Apr 30, 2025

Thunderbolts Post Credit Scene Leak And Critic Reactions Following Premiere

Apr 30, 2025 -

Woo Commerce Users Under Attack Phishing Campaign Distributes Malware Via Fake Patch

Apr 30, 2025

Woo Commerce Users Under Attack Phishing Campaign Distributes Malware Via Fake Patch

Apr 30, 2025 -

Dwayne The Rock Johnsons 40 Million Project A New Look And Unexpected Partner

Apr 30, 2025

Dwayne The Rock Johnsons 40 Million Project A New Look And Unexpected Partner

Apr 30, 2025