Banks: Leveraging Stablecoins To Boost Liquidity And Attract Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Banks: Leveraging Stablecoins to Boost Liquidity and Attract Deposits

The financial landscape is shifting, and banks are increasingly looking to stablecoins to enhance liquidity and attract new deposits. This innovative approach offers a potential solution to age-old banking challenges, presenting both opportunities and risks for institutions willing to embrace this emerging technology. But what exactly are stablecoins, and how are they transforming the banking sector?

What are Stablecoins and Why are Banks Interested?

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. Unlike volatile cryptocurrencies like Bitcoin, stablecoins offer price stability, making them attractive for various financial applications. For banks, the appeal lies in several key areas:

- Enhanced Liquidity: Stablecoins can act as a readily available source of liquidity, allowing banks to meet unexpected demands and manage their balance sheets more efficiently. This is particularly crucial during periods of market uncertainty.

- Increased Deposit Attraction: Offering stablecoin-based deposit accounts could attract a new generation of tech-savvy customers, especially those familiar with cryptocurrency and seeking the stability of a fiat-pegged asset.

- Lower Transaction Costs: Compared to traditional payment systems, stablecoin transactions can be faster and cheaper, reducing operational costs for banks.

- Improved Cross-Border Payments: Stablecoins can streamline international payments, eliminating delays and reducing associated fees. This is a significant advantage for banks operating globally.

Challenges and Risks Associated with Stablecoin Adoption

While the potential benefits are significant, banks must carefully consider the risks involved before integrating stablecoins into their operations:

- Regulatory Uncertainty: The regulatory landscape surrounding stablecoins is still evolving, creating uncertainty for banks navigating compliance requirements. Clear regulatory frameworks are crucial for widespread adoption.

- Security Concerns: As with any digital asset, stablecoins are vulnerable to hacking and security breaches. Banks need robust security measures to protect customer assets.

- Counterparty Risk: The stability of stablecoins often depends on the underlying assets backing them. Banks need to carefully assess the creditworthiness of the issuer to mitigate counterparty risk.

- Reputational Risk: Any negative event associated with a stablecoin, such as a de-pegging or security breach, could damage a bank's reputation.

Leading the Charge: Banks Exploring Stablecoin Integration

Several forward-thinking banks are already exploring ways to incorporate stablecoins into their offerings. These institutions recognize the potential for competitive advantage and are actively investing in the necessary infrastructure and expertise. This early adoption signifies a broader trend towards the integration of blockchain technology within traditional finance.

The Future of Stablecoins in Banking

The use of stablecoins in banking is still in its early stages, but the potential for transforming the financial landscape is undeniable. As regulatory clarity improves and security concerns are addressed, we can expect to see wider adoption of stablecoins by banks, leading to greater efficiency, increased customer engagement, and enhanced financial services. The key lies in a balanced approach, carefully weighing the benefits against the risks to ensure a responsible and sustainable integration of this innovative technology. The future of banking may well be built on a foundation of stablecoins, offering a more efficient and accessible financial ecosystem.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Banks: Leveraging Stablecoins To Boost Liquidity And Attract Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tennis Atp Madrid Gabriel Diallo S Impose Et Rejoint Les 16es De Finale

May 01, 2025

Tennis Atp Madrid Gabriel Diallo S Impose Et Rejoint Les 16es De Finale

May 01, 2025 -

No Messi Comparisons Says Inters Martinez Regarding Yamal

May 01, 2025

No Messi Comparisons Says Inters Martinez Regarding Yamal

May 01, 2025 -

Wsl Showdown Aston Villas Victory Over Arsenal Sets Up Thrilling Chelsea Title Race

May 01, 2025

Wsl Showdown Aston Villas Victory Over Arsenal Sets Up Thrilling Chelsea Title Race

May 01, 2025 -

Decisoes De Investimento Da Berkshire Buffett Transfere Controle Total Para Greg Abel

May 01, 2025

Decisoes De Investimento Da Berkshire Buffett Transfere Controle Total Para Greg Abel

May 01, 2025 -

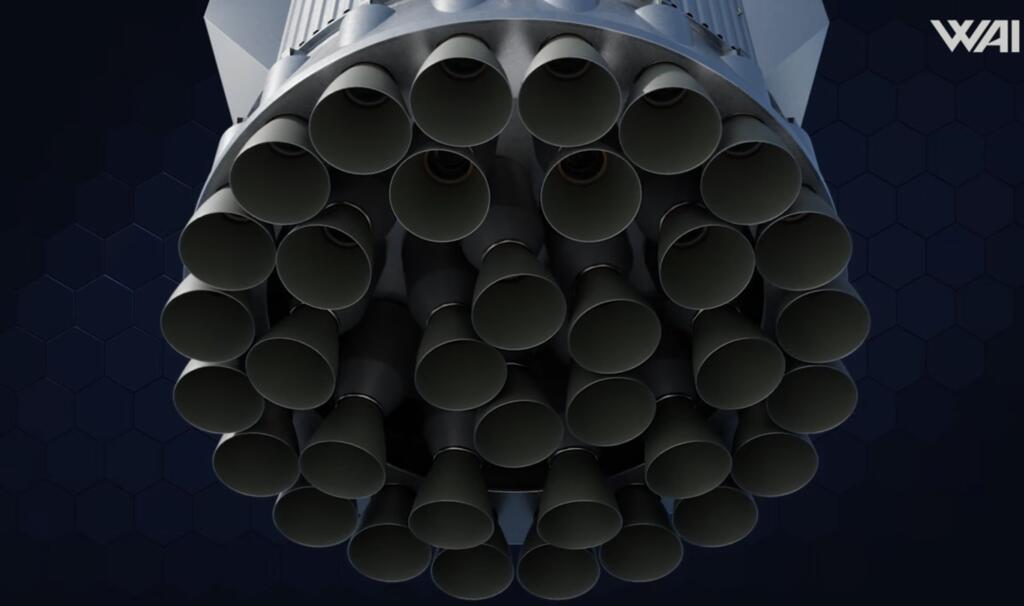

Next Gen Space X Starship 35 Raptor 3 Engines Boost Power And Capabilities

May 01, 2025

Next Gen Space X Starship 35 Raptor 3 Engines Boost Power And Capabilities

May 01, 2025