Banks' Strategic Use Of Stablecoins: Expanding Liquidity And Deposits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Banks' Strategic Embrace of Stablecoins: A New Era of Liquidity and Deposits?

The traditional banking landscape is undergoing a seismic shift, with the strategic integration of stablecoins emerging as a key catalyst for innovation. For years, banks have grappled with maintaining optimal liquidity and attracting deposits in a competitive market. Now, stablecoins – digital currencies pegged to a stable asset like the US dollar – are presenting a compelling solution, offering banks a pathway to enhanced liquidity management and potentially, a surge in deposits. But this burgeoning relationship is complex, fraught with regulatory uncertainty and technological challenges.

Expanding Liquidity: A Key Advantage of Stablecoin Integration

One of the most significant advantages of incorporating stablecoins into banking operations is the potential for improved liquidity management. Traditional liquidity management relies heavily on holding reserves in government bonds or central bank accounts. However, these assets can be less liquid than desired, especially during periods of market stress. Stablecoins, on the other hand, offer a more readily accessible source of liquidity. Their inherent stability and rapid transaction speeds allow banks to quickly convert them into fiat currency or use them for interbank transactions, significantly mitigating liquidity risks. This is particularly attractive in volatile market conditions where immediate access to capital is crucial.

Attracting Deposits: A New Frontier for Customer Acquisition

The integration of stablecoins also presents a unique opportunity for banks to attract new deposits, particularly from tech-savvy customers and businesses operating in the digital economy. Offering stablecoin-denominated accounts or facilitating transactions using stablecoins can significantly enhance a bank's appeal to a younger demographic more comfortable with digital assets. This could lead to a diversification of the deposit base, reducing reliance on traditional deposit channels and potentially lowering the cost of funding.

- Increased Efficiency: Stablecoin transactions are faster and cheaper than traditional wire transfers, leading to increased efficiency in banking operations.

- Enhanced Accessibility: Stablecoins can improve access to financial services, particularly in underserved communities or emerging markets with limited traditional banking infrastructure.

- Innovation Opportunities: The integration of stablecoins opens doors for the development of innovative financial products and services, such as decentralized finance (DeFi) applications within a regulated banking environment.

Regulatory Hurdles and Technological Challenges

Despite the potential benefits, the adoption of stablecoins by banks faces significant regulatory hurdles and technological challenges. The regulatory landscape surrounding stablecoins is still evolving, with varying interpretations and approaches across different jurisdictions. This uncertainty creates a barrier to widespread adoption, as banks need clear regulatory guidelines to navigate the risks associated with stablecoin integration.

Furthermore, integrating stablecoin technology into existing banking systems requires significant technological investment and expertise. Banks must ensure the security and integrity of their systems to prevent fraud and maintain customer trust. The interoperability of different stablecoin platforms is another challenge, as banks need seamless integration across various systems.

The Future of Stablecoins in Banking: A Cautiously Optimistic Outlook

The strategic use of stablecoins by banks is poised to reshape the financial landscape. While regulatory uncertainty and technological challenges remain, the potential benefits – enhanced liquidity, increased deposits, and improved efficiency – are too significant to ignore. As regulatory frameworks mature and technological advancements continue, we can expect to see increased adoption of stablecoins by banks, leading to a more efficient, inclusive, and innovative financial system. The future is likely to see a blend of traditional banking practices and innovative digital solutions, with stablecoins playing a crucial role in bridging the gap. The key will be navigating the regulatory complexities and ensuring robust security measures are in place to fully realize the potential of this transformative technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Banks' Strategic Use Of Stablecoins: Expanding Liquidity And Deposits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Recall Alert Spotlight Removes Popular Kids Item Due To Safety Concerns

May 05, 2025

Recall Alert Spotlight Removes Popular Kids Item Due To Safety Concerns

May 05, 2025 -

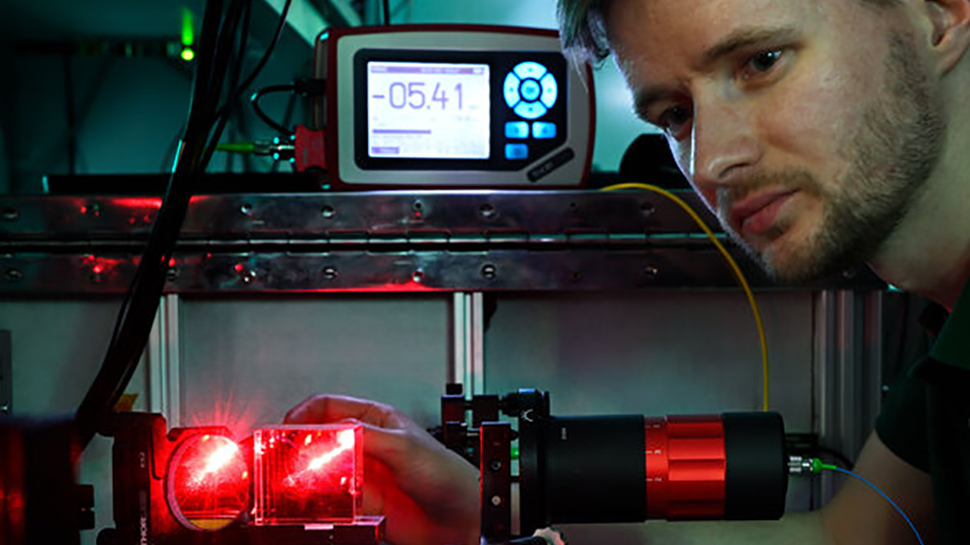

Next Generation Wi Fi Infrared Light Enables Unparalleled Data Transmission Capacity

May 05, 2025

Next Generation Wi Fi Infrared Light Enables Unparalleled Data Transmission Capacity

May 05, 2025 -

Juventus Stumbles In Bologna 1 1 Draw Extends Serie A Frustration

May 05, 2025

Juventus Stumbles In Bologna 1 1 Draw Extends Serie A Frustration

May 05, 2025 -

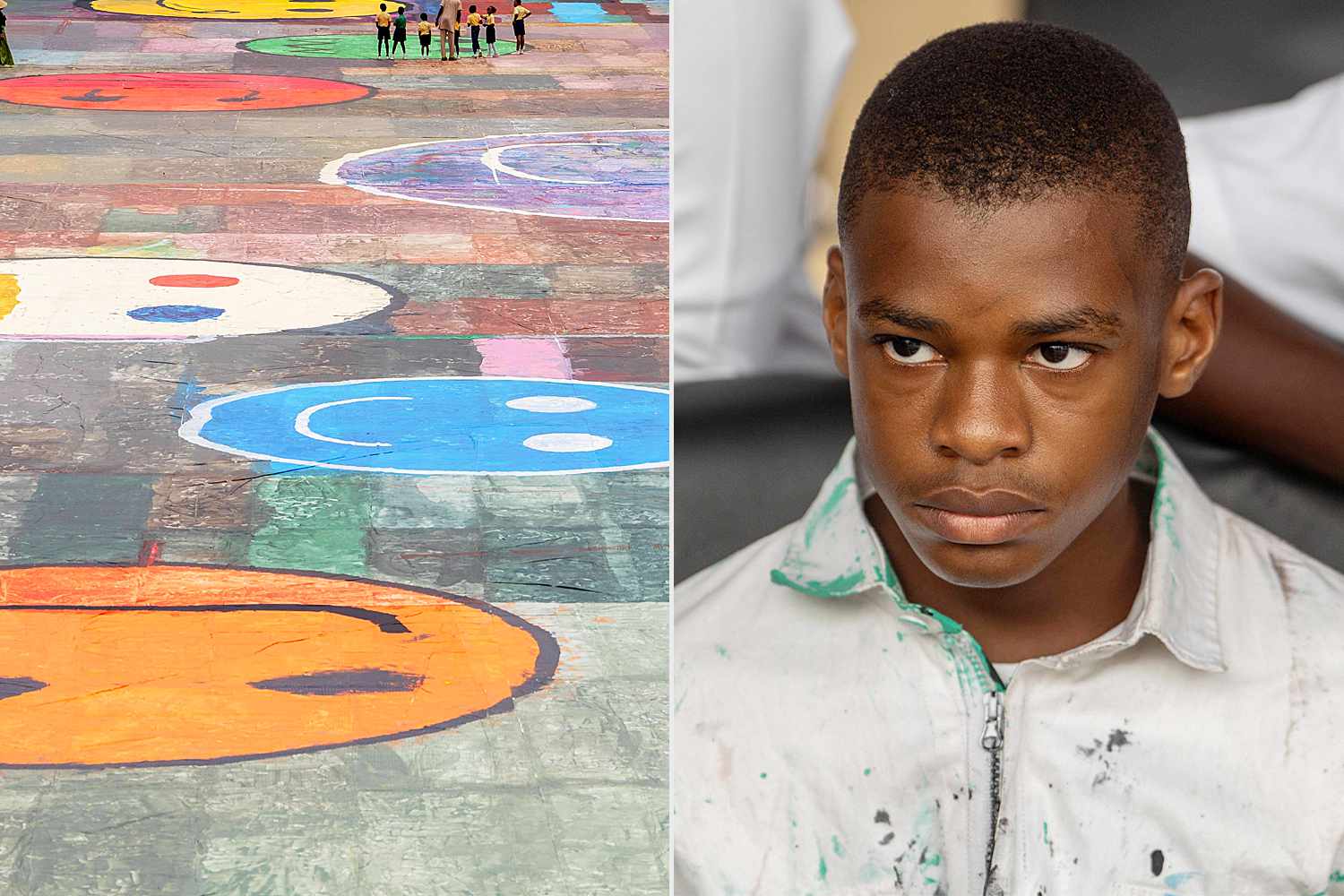

World Record Broken 15 Year Old With Autism Paints Massive Canvas

May 05, 2025

World Record Broken 15 Year Old With Autism Paints Massive Canvas

May 05, 2025 -

Cameron Smothermans Ufc Strategy New Coach New Approach

May 05, 2025

Cameron Smothermans Ufc Strategy New Coach New Approach

May 05, 2025