BCH Price Action: Assessing The Recent Volatility And Implied Breakout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BCH Price Action: Assessing the Recent Volatility and Implied Breakout

Bitcoin Cash (BCH) has experienced a period of significant price volatility recently, leaving investors wondering what the future holds. This article delves into the recent price action, analyzing the factors contributing to the swings and exploring the potential for a decisive breakout. Understanding this volatility is crucial for anyone invested in or considering investing in BCH.

The Rollercoaster Ride: Recent BCH Price Movements

Over the past [Insert timeframe, e.g., month], BCH has shown considerable price fluctuation. [Insert specific price data points with sources cited, e.g., "From a low of $X on [Date], the price surged to a high of $Y on [Date], before retracting to approximately $Z."]. This volatility is not uncommon for cryptocurrencies, but the magnitude of these recent swings has caught many investors' attention. Several factors contribute to this unpredictable behavior.

Factors Influencing BCH Price Volatility:

- Market Sentiment: The overall cryptocurrency market sentiment plays a significant role. Positive news across the broader crypto space often lifts BCH, while negative news or regulatory uncertainty can trigger sell-offs.

- Technological Developments: BCH's ongoing development and upgrades directly impact its perceived value. Announcements regarding protocol improvements, scaling solutions, or new features can influence investor confidence and price. [Mention specific recent developments and their impact, linking to official sources if possible].

- Adoption and Usage: Increased adoption by merchants and businesses, along with growing on-chain activity, can drive demand and boost the price. Conversely, a decline in usage can lead to price drops. [Include data on transaction volume or merchant adoption if available].

- Competition: BCH competes with other cryptocurrencies for market share. The performance of rival cryptocurrencies can indirectly influence BCH's price, as investors may shift their assets based on comparative advantages.

- Macroeconomic Factors: Global economic conditions, inflation rates, and interest rate adjustments also affect investor risk appetite. These macroeconomic factors can lead to broad sell-offs across the cryptocurrency market, impacting BCH.

Is a Breakout Imminent? Analyzing the Technicals

Technical analysis suggests the potential for a significant breakout. [Insert details about specific technical indicators, such as support/resistance levels, moving averages, RSI, etc. Use charts if possible, and always cite the source of the chart]. The recent price action may indicate a period of consolidation before a decisive move to either the upside or downside.

- Support and Resistance Levels: [Clearly state important support and resistance levels with their significance]. A break above the resistance level at $X could signal a bullish trend, while a fall below the support at $Y might indicate further downside.

- Moving Averages: [Explain the relationship between BCH price and various moving averages, such as 50-day and 200-day MA]. A bullish crossover could indicate an upcoming price surge.

- Relative Strength Index (RSI): [Explain the RSI reading and its implications for BCH’s momentum]. An RSI above 70 suggests overbought conditions, while an RSI below 30 suggests oversold conditions.

Conclusion: Navigating the Uncertainty

The recent volatility in BCH's price highlights the inherent risks associated with cryptocurrency investment. While a breakout is possible, it's crucial to approach this with caution. Thorough research, diversification, and a well-defined risk management strategy are essential for navigating the uncertainties of the market. Investors should closely monitor market trends, technical indicators, and fundamental developments to make informed decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries significant risk, and you could lose money. Always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BCH Price Action: Assessing The Recent Volatility And Implied Breakout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Second Gta 6 Trailer Hidden Clue Prompts Pre Order Cancellations

May 23, 2025

Second Gta 6 Trailer Hidden Clue Prompts Pre Order Cancellations

May 23, 2025 -

Celebrity Sightings Timothee Chalamet Ben Stiller And The Knicks Game

May 23, 2025

Celebrity Sightings Timothee Chalamet Ben Stiller And The Knicks Game

May 23, 2025 -

New Bbc Christmas Animation The Scarecrows Wedding Cast Revealed

May 23, 2025

New Bbc Christmas Animation The Scarecrows Wedding Cast Revealed

May 23, 2025 -

Shai Gilgeous Alexanders Mvp Award A Public Thank You To His Wife

May 23, 2025

Shai Gilgeous Alexanders Mvp Award A Public Thank You To His Wife

May 23, 2025 -

Exploring The Latest In Pc Tech At Computex 2025

May 23, 2025

Exploring The Latest In Pc Tech At Computex 2025

May 23, 2025

Latest Posts

-

Intense Action And Thrills Early Ballerina Reviews

May 23, 2025

Intense Action And Thrills Early Ballerina Reviews

May 23, 2025 -

Teslas Robotaxi Ambitions One Million Vehicles In The Us By 2026

May 23, 2025

Teslas Robotaxi Ambitions One Million Vehicles In The Us By 2026

May 23, 2025 -

Heavy Traffic Jams Anticipated At Woodlands Tuas During June School Holidays Ica Announcement

May 23, 2025

Heavy Traffic Jams Anticipated At Woodlands Tuas During June School Holidays Ica Announcement

May 23, 2025 -

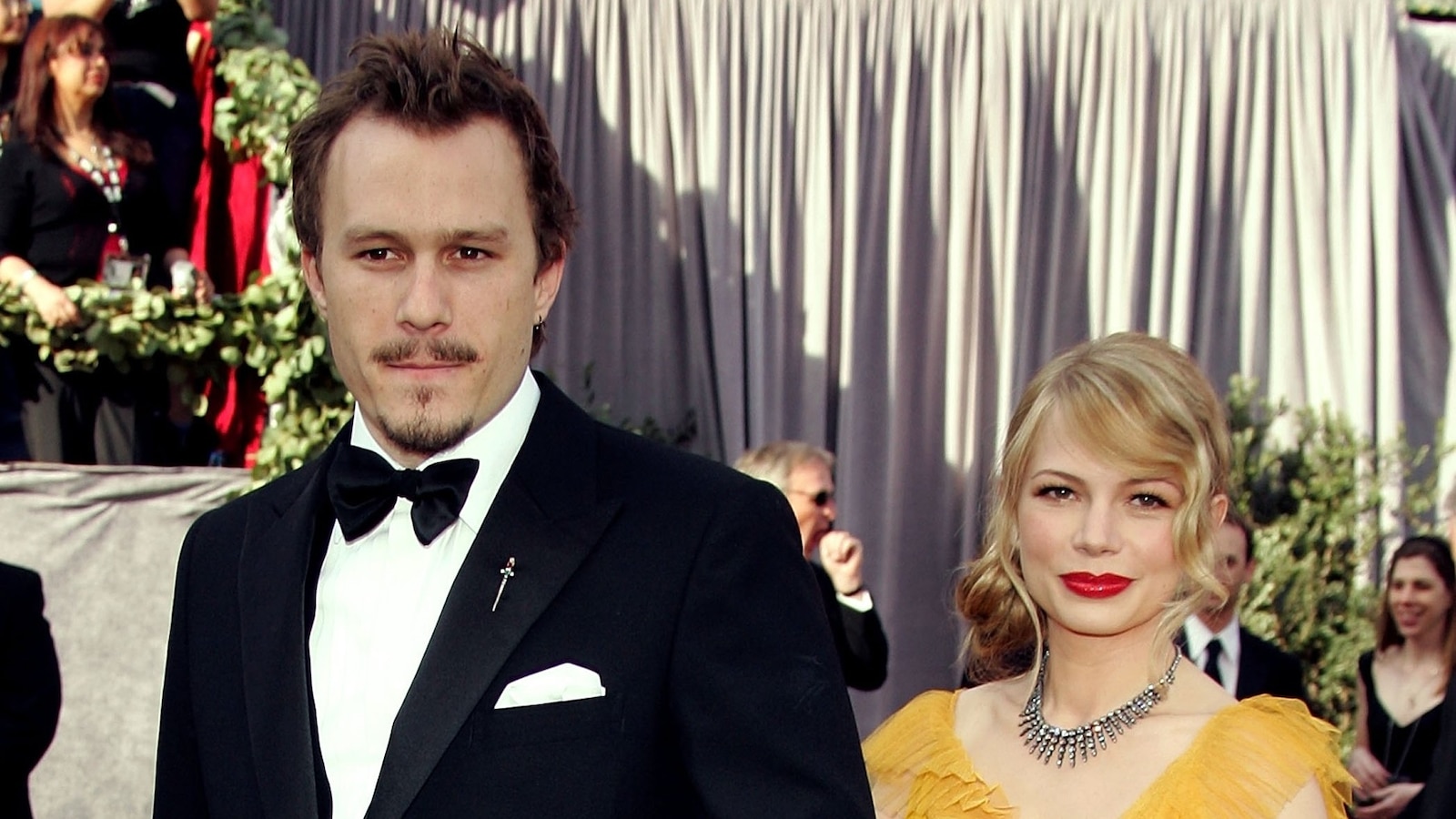

Michelle Williams A Heartfelt Reflection On Heath Ledger And Their Daughter Matilda

May 23, 2025

Michelle Williams A Heartfelt Reflection On Heath Ledger And Their Daughter Matilda

May 23, 2025 -

Silverstone Moto Gp Sat Nav Issues Cause Concern For Fans

May 23, 2025

Silverstone Moto Gp Sat Nav Issues Cause Concern For Fans

May 23, 2025