Bear Market Alert: Dow Futures Collapse Amidst Trump Tariff Fallout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bear Market Alert: Dow Futures Collapse Amidst Trump Tariff Fallout

Markets plunged into chaos this morning as Dow futures experienced a dramatic collapse, fueling widespread fears of a looming bear market. The steep decline, exceeding [Insert Percentage]% in pre-market trading, is directly attributed to the escalating fallout from President Trump's latest tariff announcements targeting [Specify targeted goods/countries]. This unprecedented market volatility has sent shockwaves through global financial markets, leaving investors scrambling to assess the potential long-term consequences.

The sudden downturn marks a significant escalation in the ongoing trade war, raising concerns about a potential global recession. The sharp drop in Dow futures underscores the market's extreme sensitivity to trade uncertainties and the growing apprehension regarding the economic implications of escalating protectionist policies.

Understanding the Market Panic: Key Factors

Several factors contributed to today's market meltdown:

- Increased Tariff Threats: President Trump's latest announcement to impose [Specify the type and percentage] tariffs on [Specify targeted goods/countries] significantly amplified existing trade tensions. This move has heightened fears of retaliatory measures from other nations, leading to a domino effect of negative economic consequences.

- Investor Sentiment: Already fragile investor confidence has been shattered by the unpredictable nature of the trade war. The lack of clarity regarding the long-term implications of these tariffs has created a climate of uncertainty, prompting investors to seek safety in less volatile assets.

- Global Supply Chain Disruptions: The escalating trade conflict threatens to disrupt global supply chains, increasing production costs and potentially leading to shortages of essential goods. This uncertainty further dampens investor sentiment and contributes to the market's decline.

- Currency Fluctuations: The weakening of the [Specify Currency] against the US dollar is further exacerbating the situation, adding to the negative impact on multinational corporations and global trade.

What This Means for Investors

The current market volatility presents a significant challenge for investors. Experts advise caution and a thorough review of investment portfolios. Some strategies to consider include:

- Diversification: A well-diversified portfolio can help mitigate risks associated with market downturns. Consider spreading investments across different asset classes, sectors, and geographies.

- Risk Assessment: Carefully reassess your risk tolerance and adjust your investment strategy accordingly. Consider shifting towards more defensive assets like government bonds.

- Long-Term Perspective: Maintain a long-term investment strategy and avoid making impulsive decisions based on short-term market fluctuations. Remember that market corrections are a natural part of the economic cycle.

Looking Ahead: Potential Scenarios

The future remains uncertain, with several potential scenarios playing out:

- Negotiated Settlement: A negotiated settlement between the involved parties could lead to a rapid market rebound. However, the likelihood of this outcome remains unclear given the current political climate.

- Prolonged Trade War: A prolonged trade war could lead to a deeper and more sustained market correction, potentially triggering a full-blown recession.

- Market Stabilization: The market could eventually stabilize, but a period of increased volatility is likely to persist until greater clarity emerges regarding the future trajectory of the trade war.

Disclaimer: This article provides general information and commentary only and does not constitute financial advice. Consult a qualified financial advisor before making any investment decisions. The information provided is based on current market conditions and is subject to change.

Keywords: Bear market, Dow futures, Trump tariffs, trade war, market crash, investor sentiment, global economy, recession, financial markets, investment strategy, risk management, economic uncertainty, global supply chain.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bear Market Alert: Dow Futures Collapse Amidst Trump Tariff Fallout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shocking Upset First Major Surprise At The 2025 Monte Carlo Masters

Apr 08, 2025

Shocking Upset First Major Surprise At The 2025 Monte Carlo Masters

Apr 08, 2025 -

Revealed The Nominees For The Icc Mens Player Of The Month March 2025

Apr 08, 2025

Revealed The Nominees For The Icc Mens Player Of The Month March 2025

Apr 08, 2025 -

Xrp Market Crash 65 Million In Liquidations Signal Potential Price Correction

Apr 08, 2025

Xrp Market Crash 65 Million In Liquidations Signal Potential Price Correction

Apr 08, 2025 -

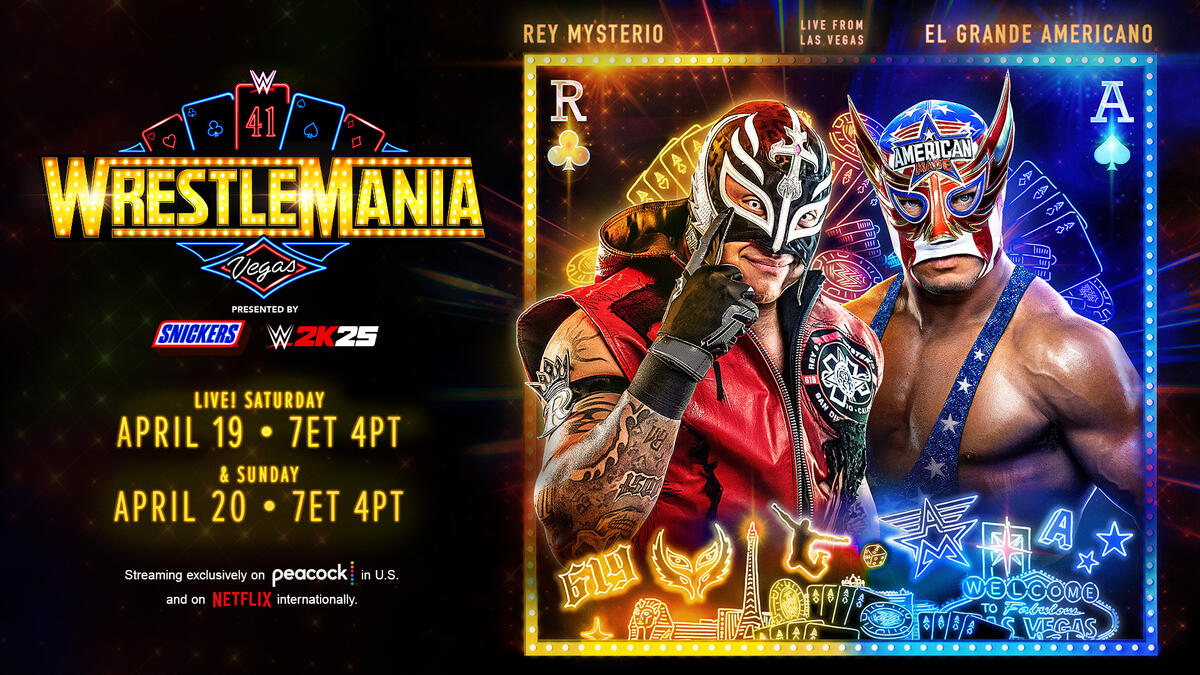

High Flying Action Rey Mysterio Takes On El Grande Americano

Apr 08, 2025

High Flying Action Rey Mysterio Takes On El Grande Americano

Apr 08, 2025 -

Bulldogs Football Major Coaching Change Announced

Apr 08, 2025

Bulldogs Football Major Coaching Change Announced

Apr 08, 2025