Bearish Report Sends Oil Prices Lower: Crude Inventories Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bearish Report Sends Oil Prices Lower: Crude Inventories Rise

Oil prices tumbled today after a surprise surge in US crude oil inventories cast a shadow over the market's already fragile optimism. The unexpected increase, far exceeding analyst expectations, fueled concerns about weakening global demand and sent benchmark crude futures plummeting. This bearish report comes at a critical time for the energy sector, raising questions about the trajectory of oil prices in the coming months.

Record High Inventories: A Sign of Weakening Demand?

The Energy Information Administration (EIA) released its weekly report this morning, revealing a significant build-up in US crude oil inventories. The reported increase of [Insert Actual Number] barrels – significantly higher than the anticipated [Insert Analyst Prediction] – shocked the market. This substantial jump in inventories suggests a potential slowdown in global oil demand, a troubling sign for producers already grappling with economic uncertainty and geopolitical tensions. Analysts are now scrambling to reassess their forecasts, with many downgrading their price projections for the near term.

Impact on Global Oil Markets:

The impact of this bearish report reverberated across global oil markets. Brent crude, the international benchmark, experienced a sharp decline, falling by [Insert Percentage]% to [Insert Price]. Similarly, West Texas Intermediate (WTI), the US benchmark, dropped by [Insert Percentage]% to [Insert Price]. This price slump has immediate consequences for oil-producing nations, energy companies, and consumers alike.

Factors Contributing to the Inventory Surge:

Several factors are likely contributing to the unexpected increase in crude oil inventories. These include:

- Increased Refinery Maintenance: Scheduled refinery maintenance in several key regions may have temporarily reduced the demand for crude oil.

- Slowdown in Global Economic Growth: Concerns about a potential global recession are impacting demand forecasts, leading to lower oil consumption.

- Geopolitical Uncertainty: While geopolitical events can often drive up oil prices, the current situation presents a complex picture, with some factors potentially dampening demand. [Elaborate briefly on a specific geopolitical factor, if relevant and factually supported].

What This Means for the Future of Oil Prices:

The immediate future of oil prices remains uncertain. While some analysts believe this dip is temporary, others foresee a prolonged period of lower prices. Several key factors will determine the market's trajectory in the coming weeks and months, including:

- Global economic data: Economic indicators will play a critical role in shaping demand forecasts.

- OPEC+ decisions: The Organization of the Petroleum Exporting Countries and its allies (OPEC+) will have a significant influence, as their production policies impact global supply.

- Geopolitical developments: Unpredictable geopolitical events could easily disrupt the market equilibrium.

Conclusion:

The release of the EIA's unexpectedly high inventory report sent shockwaves through the oil market, triggering a significant price drop. The situation highlights the volatility of the energy sector and emphasizes the interconnectedness of global economics, geopolitics, and oil demand. While the short-term outlook appears bearish, the long-term trajectory of oil prices remains dependent on a complex interplay of factors, making it crucial to monitor market developments closely. Further analysis and reports will be needed to fully assess the lasting impact of this unexpected inventory surge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bearish Report Sends Oil Prices Lower: Crude Inventories Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Government Report Shows Crude Surplus Pressuring Oil Prices

May 22, 2025

Government Report Shows Crude Surplus Pressuring Oil Prices

May 22, 2025 -

Ripple Security Alert Surge In Deepfake And Fake Airdrop Scams

May 22, 2025

Ripple Security Alert Surge In Deepfake And Fake Airdrop Scams

May 22, 2025 -

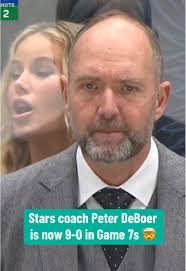

Peter De Boer Strategies Successes And Challenges In Professional Hockey

May 22, 2025

Peter De Boer Strategies Successes And Challenges In Professional Hockey

May 22, 2025 -

Marina Fogle Exposes Parenting Deception The Truth About Her Marriage

May 22, 2025

Marina Fogle Exposes Parenting Deception The Truth About Her Marriage

May 22, 2025 -

Knicks Vs Pacers Game 1 Haliburtons Last Second Shot Seals Ot Victory

May 22, 2025

Knicks Vs Pacers Game 1 Haliburtons Last Second Shot Seals Ot Victory

May 22, 2025