Bearish US Government Data Triggers Oil Price Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bearish US Government Data Triggers Oil Price Dip

US crude oil prices experienced a sharp decline following the release of unexpectedly high US government inventory data, fueling concerns about weakening global demand. The report, published by the Energy Information Administration (EIA), revealed a significant build-up in crude oil stocks, exceeding market expectations and sending shockwaves through the energy markets. This unexpected surge in inventories overshadowed recent OPEC+ production cuts and dampened investor optimism.

The oil market, already grappling with economic uncertainty and potential recession fears, reacted swiftly to the bearish news. The price of West Texas Intermediate (WTI) crude, the US benchmark, plummeted [insert percentage]% to [insert price per barrel], while Brent crude, the international benchmark, also saw a significant drop. This dramatic price swing highlights the market's sensitivity to supply and demand dynamics and the significant influence of US government data releases on global oil prices.

Unexpected Inventory Surge Fuels Concerns

The EIA report showed a build-up of [insert number] million barrels in crude oil inventories for the week ending [insert date], significantly higher than the anticipated increase of [insert number] million barrels. This unexpected surge points towards weaker-than-expected demand, raising concerns about the health of the global economy and its impact on future oil consumption. Analysts had predicted a decline in inventories, given the recent OPEC+ production cuts aimed at stabilizing the market. The discrepancy between expectations and reality fueled the sell-off.

OPEC+ Cuts Overshadowed by Weak Demand Signals

The recent decision by OPEC+ to significantly reduce oil production had initially boosted prices, leading to expectations of a tighter market. However, the unexpectedly high inventory numbers suggest that this production cut may not be enough to offset the slowdown in global demand. The data suggests that even with reduced supply, the market is struggling to absorb the existing volumes of crude oil, indicating a potentially prolonged period of price weakness.

Impact on Consumers and the Energy Sector

The oil price dip is likely to offer some temporary relief to consumers facing high energy costs. Lower oil prices translate to potentially cheaper gasoline and heating fuel, which could provide a much-needed respite from inflation. However, the impact on the energy sector is more complex. Energy companies may see reduced profits, potentially leading to slower investment in new exploration and production projects. This could, in the long term, impact future supply and potentially lead to price volatility.

Looking Ahead: Market Uncertainty Remains

The oil market remains highly volatile and susceptible to various factors, including geopolitical events, economic data releases, and changes in investor sentiment. While the recent price dip provides some short-term relief, the long-term outlook remains uncertain. Analysts are closely monitoring economic indicators and global demand trends to gauge the potential for future price fluctuations. Further government data releases and OPEC+ actions will play a critical role in shaping the direction of oil prices in the coming weeks and months. The situation remains fluid, and investors should brace for continued uncertainty.

Keywords: Oil price, crude oil, WTI, Brent crude, EIA, Energy Information Administration, OPEC+, oil inventory, global demand, energy market, oil price dip, bearish, US government data, recession, inflation, energy sector, commodity prices, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bearish US Government Data Triggers Oil Price Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tiffany Hayes Of The Connecticut Sun Helped Off Court Following Head Injury

May 22, 2025

Tiffany Hayes Of The Connecticut Sun Helped Off Court Following Head Injury

May 22, 2025 -

Familiar Victory For Minnesota Lynx 2 0 Start In Los Angeles

May 22, 2025

Familiar Victory For Minnesota Lynx 2 0 Start In Los Angeles

May 22, 2025 -

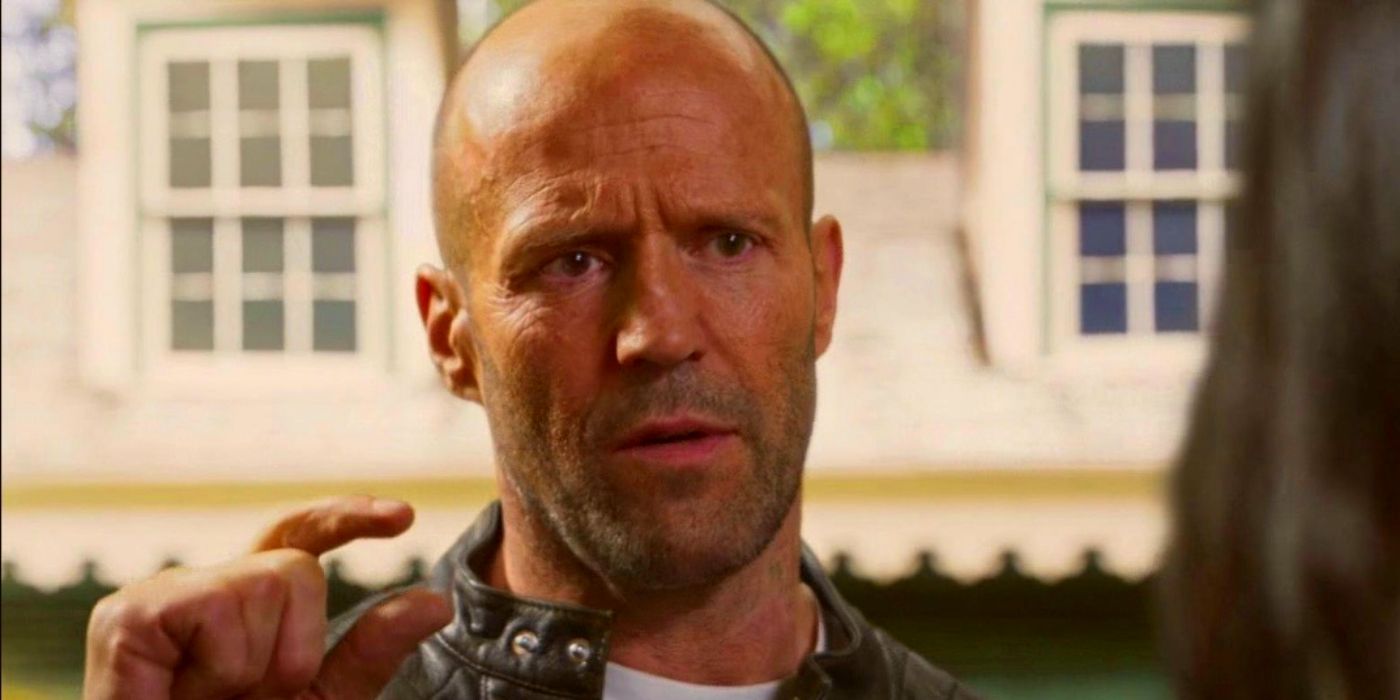

Low Rotten Tomatoes Score Doesnt Stop Jason Statham And Megan Fox Thrillers Streaming Popularity

May 22, 2025

Low Rotten Tomatoes Score Doesnt Stop Jason Statham And Megan Fox Thrillers Streaming Popularity

May 22, 2025 -

Why Nikola Jokics All Around Game Deserves The 2024 Nba Mvp Trophy

May 22, 2025

Why Nikola Jokics All Around Game Deserves The 2024 Nba Mvp Trophy

May 22, 2025 -

Menos Apple Para Buffett Una Reduccion Del 13 En Su Inversion Y Las Razones

May 22, 2025

Menos Apple Para Buffett Una Reduccion Del 13 En Su Inversion Y Las Razones

May 22, 2025