Before It's Too Late: Make Two Roth IRA Contributions In 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Before It's Too Late: Maximize Your Retirement with Two 2024 Roth IRA Contributions

The clock is ticking! Don't miss out on a powerful opportunity to boost your retirement savings. For 2024, you can make two Roth IRA contributions – one for the current year and one for the prior year. This strategic move could significantly enhance your long-term financial security. But you need to act fast. The deadline is rapidly approaching.

This article will break down exactly how to take advantage of this double contribution opportunity, highlighting the benefits and crucial deadlines you need to be aware of.

What's the Deal with Two Roth IRA Contributions?

The IRS allows taxpayers to contribute to a Roth IRA for the current tax year and, under certain circumstances, to make a contribution for the previous tax year. This means that in 2024, you can contribute for both 2023 and 2024. This is especially beneficial if you missed the contribution deadline for 2023 or if your income increased significantly in 2024, allowing you to contribute more.

Who Can Benefit from This?

This opportunity is available to those who meet the income requirements for Roth IRA contributions and who haven't already maxed out their contribution limits for either 2023 or 2024.

Here's a quick breakdown:

- 2024 Contribution Limit: The maximum contribution for 2024 is $6,500, with an additional $1,000 catch-up contribution allowed for those age 50 and over.

- 2023 Contribution Limit: The maximum contribution for 2023 was also $6,500, with an additional $1,000 catch-up contribution for those 50 and over.

Important Considerations:

- Income Limits: Remember that there are income limitations for Roth IRA contributions. If your modified adjusted gross income (MAGI) exceeds the specified limits, you may not be eligible to contribute to a Roth IRA. Check the IRS website for the most up-to-date income thresholds.

- Tax Filing Status: Your filing status (single, married filing jointly, etc.) will also impact your eligibility.

- Filing Taxes: You must have filed your 2023 taxes to be eligible to contribute for that year.

Why Contribute to a Roth IRA?

Roth IRAs offer significant advantages:

- Tax-Free Withdrawals: Qualifying withdrawals in retirement are completely tax-free.

- Growth Tax-Free: Your investments grow tax-deferred, meaning you won't pay taxes on the gains until withdrawal.

- Flexibility: You can withdraw contributions at any time without penalty.

Act Now: The Deadline is Approaching!

The deadline for contributing to your Roth IRA for both 2023 and 2024 is April 15, 2025. Don't wait until the last minute. Start planning your contributions today to maximize your retirement savings.

Key Takeaways:

- You can contribute to your Roth IRA for both 2023 and 2024 in 2024.

- Check the IRS website for income limits and contribution deadlines.

- Contributing to a Roth IRA offers significant tax advantages.

- Don't delay! The deadline is April 15, 2025.

This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions. Remember to always verify information with official IRS sources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Before It's Too Late: Make Two Roth IRA Contributions In 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Garde A Vue Pour Gregory Doucet Maire De Lyon Details De L Enquete Sur Les Charges De Mission

Apr 10, 2025

Garde A Vue Pour Gregory Doucet Maire De Lyon Details De L Enquete Sur Les Charges De Mission

Apr 10, 2025 -

Ultherapy Welcomes Salma Hayek Pinault As Prime Ambassador

Apr 10, 2025

Ultherapy Welcomes Salma Hayek Pinault As Prime Ambassador

Apr 10, 2025 -

Antisipasi Bencana Bpbd Bantul Tingkatkan Kewaspadaan Cuaca Ekstrem

Apr 10, 2025

Antisipasi Bencana Bpbd Bantul Tingkatkan Kewaspadaan Cuaca Ekstrem

Apr 10, 2025 -

Kecelakaan Maut Jenggala Kai Layangkan Gugatan Hukum Dan Tuntutan Ganti Rugi

Apr 10, 2025

Kecelakaan Maut Jenggala Kai Layangkan Gugatan Hukum Dan Tuntutan Ganti Rugi

Apr 10, 2025 -

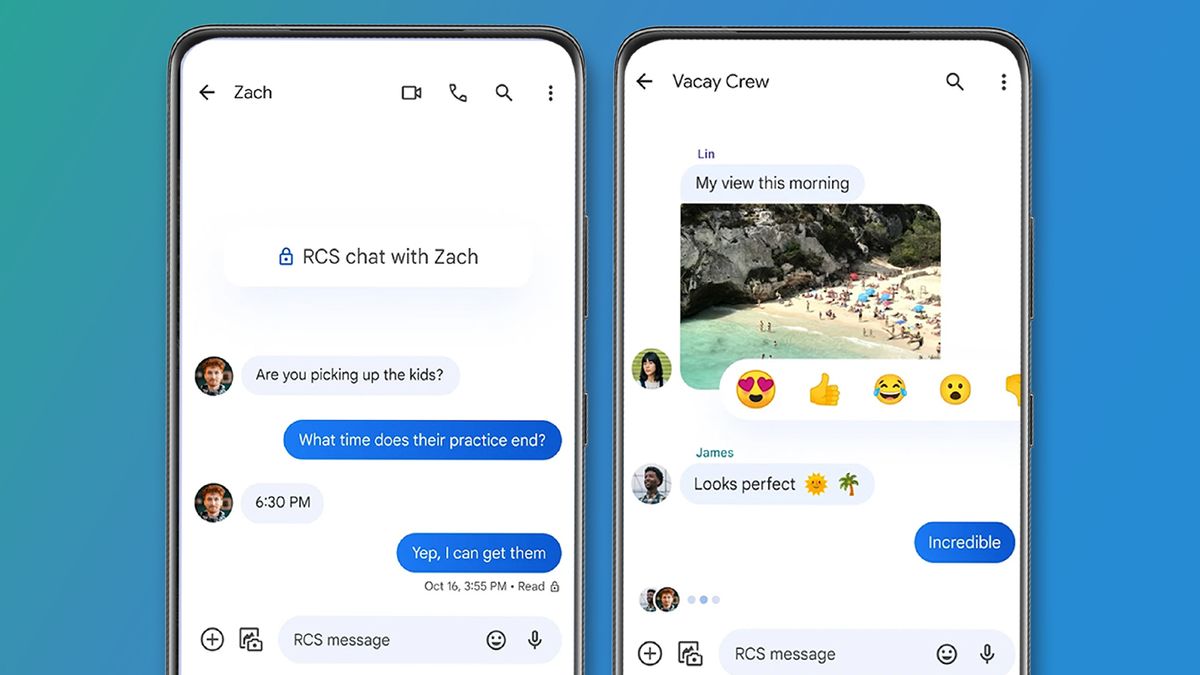

Is It A Bug Or A Feature Google Explains Emoji Reactions In Messages Beta

Apr 10, 2025

Is It A Bug Or A Feature Google Explains Emoji Reactions In Messages Beta

Apr 10, 2025