Behind Closed Doors: Top US Banks Plot A Joint Stablecoin Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Behind Closed Doors: Top US Banks Plot a Joint Stablecoin Strategy

The race to establish a dominant US stablecoin heats up as major banking giants secretly collaborate on a unified approach.

The financial world is buzzing with whispers of a clandestine meeting – a gathering of titans in the US banking industry secretly strategizing a joint approach to launching a stablecoin. While details remain scarce, the potential implications are seismic, promising to reshape the landscape of digital finance and potentially challenge the dominance of existing players like Tether and USD Coin.

This secretive collaboration, involving some of the nation's largest banks, marks a significant shift. Previously, individual institutions explored stablecoin ventures independently, often facing regulatory hurdles and market uncertainty. This coordinated effort suggests a concerted push to create a stablecoin with greater stability, trust, and regulatory compliance.

Why the Joint Venture? A Look at the Benefits:

The move towards a unified stablecoin strategy offers several key advantages:

- Enhanced Regulatory Compliance: A joint effort allows for a more streamlined approach to navigating complex regulatory landscapes. By pooling resources and expertise, these banks can collectively lobby for favorable legislation and proactively address potential compliance issues.

- Increased Trust and Stability: A stablecoin backed by a consortium of major banks would inherently carry greater credibility and trust than one backed by a single entity. This collective backing would reduce counterparty risk and enhance the overall stability of the digital currency.

- Economies of Scale: A shared infrastructure and development process significantly reduces costs associated with launching and maintaining a stablecoin. This collaborative approach allows for efficient resource allocation and potentially faster market penetration.

- Wider Adoption: A stablecoin backed by a powerful consortium of banks could encourage wider adoption among both consumers and businesses, accelerating the integration of digital currencies into mainstream finance.

The Stakes are High: A Potential Game Changer

The success of this joint venture could fundamentally alter the US financial system. A domestically-issued, bank-backed stablecoin could:

- Boost financial inclusion: Provide access to financial services for underbanked populations.

- Streamline cross-border payments: Facilitate faster and cheaper international transactions.

- Drive innovation in DeFi: Fuel the growth of decentralized finance (DeFi) applications within a more regulated and trusted environment.

However, challenges remain. Regulatory scrutiny will be intense, and overcoming concerns about market manipulation and systemic risk will be crucial for the initiative's success. Competition from existing stablecoins and potential regulatory hurdles could also impact the project's timeline and ultimate outcome.

What's Next? The Future of Banking and Stablecoins

The secrecy surrounding this initiative raises questions about the banks' long-term vision and strategic goals. As details emerge, the financial world will be watching closely. The success or failure of this joint stablecoin venture could significantly influence the future trajectory of digital finance in the United States and beyond, potentially setting the stage for a new era of banking and financial transactions. Further updates on this developing story will be reported as they become available. Stay tuned for more insights into this groundbreaking collaboration.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Behind Closed Doors: Top US Banks Plot A Joint Stablecoin Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

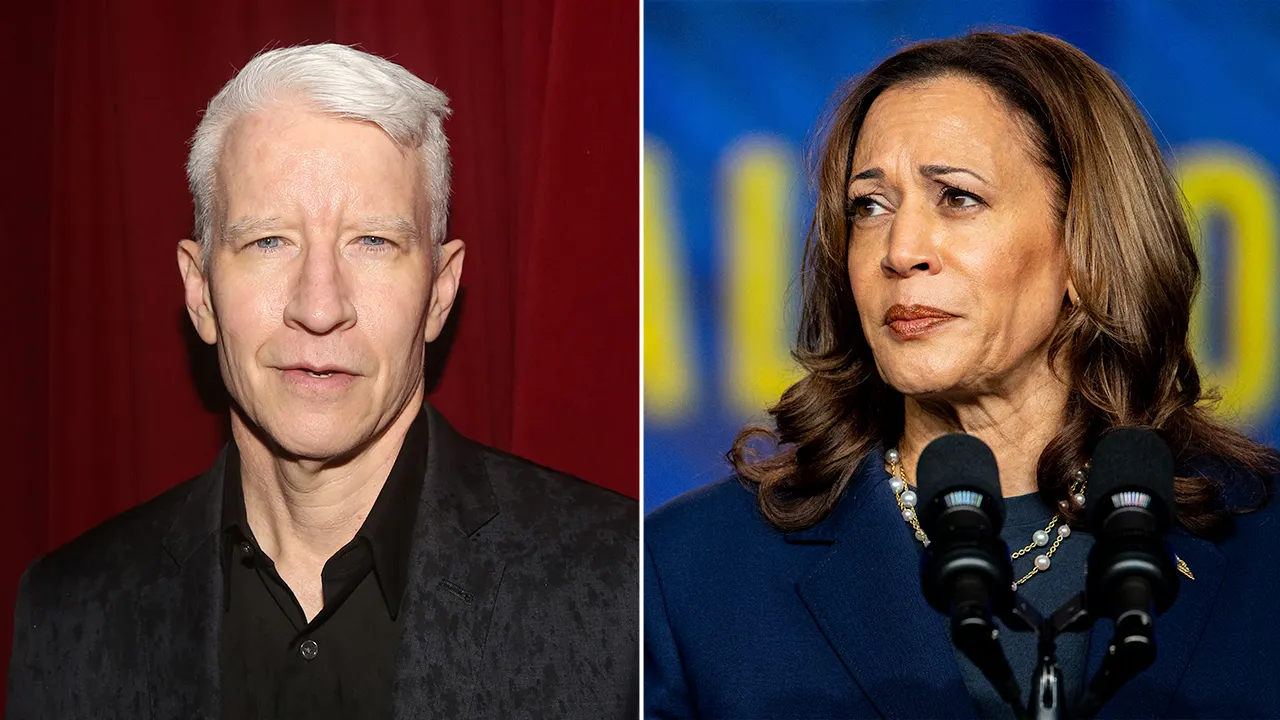

Book Reveals Kamala Harriss Angry Reaction To Anderson Cooper Interview After Biden Debate

May 24, 2025

Book Reveals Kamala Harriss Angry Reaction To Anderson Cooper Interview After Biden Debate

May 24, 2025 -

Groundbreaking Ssd Feature Complete Data Overwrite Cycle

May 24, 2025

Groundbreaking Ssd Feature Complete Data Overwrite Cycle

May 24, 2025 -

Shai Gilgeous Alexanders Dad Reacts To Sons Historic Mvp Win

May 24, 2025

Shai Gilgeous Alexanders Dad Reacts To Sons Historic Mvp Win

May 24, 2025 -

100 M Trading Volume For Haedal Haedal On Binance Listing News

May 24, 2025

100 M Trading Volume For Haedal Haedal On Binance Listing News

May 24, 2025 -

The Cartographic Conflict How Early Mars Maps Fueled Planetary Interest

May 24, 2025

The Cartographic Conflict How Early Mars Maps Fueled Planetary Interest

May 24, 2025