Berkshire Hathaway Cuts Apple Holdings: Buffett Explains 13% Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Berkshire Hathaway Cuts Apple Holdings: Buffett's 13% Reduction Explained

Warren Buffett's Berkshire Hathaway significantly reduced its Apple holdings in the first quarter of 2023, sparking widespread speculation and analysis. The legendary investor's company shed approximately 13% of its Apple stock, a move that sent ripples through the financial world. This unprecedented reduction, representing millions of shares, begs the question: why did Buffett, a long-time Apple bull, suddenly lessen his bet on the tech giant?

The news broke with the release of Berkshire Hathaway's 13F filing, a document revealing the company's equity holdings. The filing showed a decrease from 915.6 million shares of Apple to approximately 805 million. This represents a considerable shift in Berkshire's investment strategy, prompting intense scrutiny from market analysts and investors alike.

Why the Downturn in Apple Investment? Decoding Buffett's Strategy

While Buffett himself hasn't explicitly detailed the reasons behind this massive reduction, several contributing factors are likely at play. Speculation points toward a combination of factors, rather than a single, decisive event:

-

Portfolio Diversification: Berkshire Hathaway is known for its diversified investment portfolio. This significant reduction in Apple shares could simply reflect a strategic realignment to diversify holdings across different sectors, mitigating risk and potentially capitalizing on opportunities elsewhere in the market.

-

Market Conditions: The overall macroeconomic environment, characterized by inflation, rising interest rates, and potential recessionary pressures, could have influenced Buffett's decision. A more conservative approach during uncertain times is not uncommon for even the most seasoned investors.

-

Profit-Taking: With Apple’s stock performing remarkably well over the past several years, it's possible that Berkshire Hathaway took advantage of favorable market conditions to secure substantial profits. Selling a portion of its holdings could allow the company to reinvest those gains into other potentially lucrative opportunities.

-

Valuation Concerns: While Apple remains a strong company, concerns about its valuation in the current market might have played a role. Buffett is known for his focus on value investing; if he perceived Apple's stock as overvalued, a reduction in holdings would be a prudent move.

The Impact on Apple and Berkshire Hathaway

The news of Berkshire Hathaway's reduced stake in Apple immediately impacted both companies' stock prices. While the impact wasn't catastrophic, it served as a reminder of the influence Buffett wields over the market. The decrease highlights the unpredictable nature of even the most stable investments and emphasizes the dynamic nature of the stock market.

Looking Ahead: What Does This Mean for the Future?

While the exact reasons behind Buffett's decision remain somewhat opaque, the move underscores the importance of diversification and adaptability in the investment world. It also highlights that even the most iconic investors adjust their strategies in response to evolving market conditions. Whether this represents a complete shift in Berkshire's long-term Apple strategy or a temporary adjustment remains to be seen. Only time will tell whether this 13% reduction signifies the beginning of a significant unwinding of Berkshire's Apple position, or simply a strategic repositioning within a broader portfolio strategy. The financial world will be watching closely for further clues.

Keywords: Berkshire Hathaway, Warren Buffett, Apple, Apple stock, investment, stock market, 13F filing, portfolio diversification, market conditions, valuation, profit-taking, investment strategy, financial news, stock prices, recession.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Berkshire Hathaway Cuts Apple Holdings: Buffett Explains 13% Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Conferencia El Impacto De 40 Anos De Espana En La Union Europea

May 10, 2025

Conferencia El Impacto De 40 Anos De Espana En La Union Europea

May 10, 2025 -

Srinagar Missile Launch India Downs Two Pakistani Fighter Jets

May 10, 2025

Srinagar Missile Launch India Downs Two Pakistani Fighter Jets

May 10, 2025 -

Strong Box Office Showing For Thunderbolts 35 M And Sinners 20 M

May 10, 2025

Strong Box Office Showing For Thunderbolts 35 M And Sinners 20 M

May 10, 2025 -

U S Leadership A Tale Of Two Very Different Leaders

May 10, 2025

U S Leadership A Tale Of Two Very Different Leaders

May 10, 2025 -

Next Big Future Com James Fan Proposes Groundbreaking Physical Turing Test For Nvidia Ai

May 10, 2025

Next Big Future Com James Fan Proposes Groundbreaking Physical Turing Test For Nvidia Ai

May 10, 2025

Latest Posts

-

Mini Windows 11 Tablet 8 Ports And Surprisingly Small Battery

May 11, 2025

Mini Windows 11 Tablet 8 Ports And Surprisingly Small Battery

May 11, 2025 -

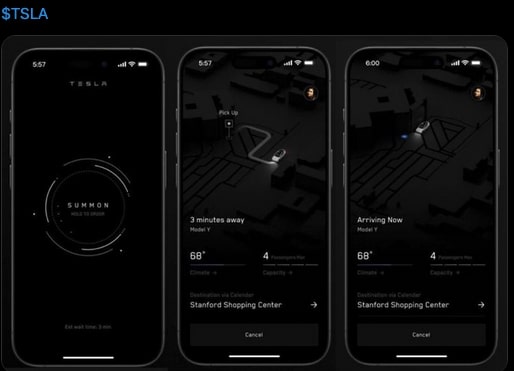

Supervised And Unsupervised Tesla Ridesharing Austin Launch Predicted For June

May 11, 2025

Supervised And Unsupervised Tesla Ridesharing Austin Launch Predicted For June

May 11, 2025 -

Bill Gates Condemns Elon Musks Doge Policy Predicting Catastrophic Loss Of Life

May 11, 2025

Bill Gates Condemns Elon Musks Doge Policy Predicting Catastrophic Loss Of Life

May 11, 2025 -

The Denver Nuggets Winning Formula Embracing The Underdog Role

May 11, 2025

The Denver Nuggets Winning Formula Embracing The Underdog Role

May 11, 2025 -

Amazons Echo Show Gets A Budget Friendly Makeover Smaller Cheaper And Smarter

May 11, 2025

Amazons Echo Show Gets A Budget Friendly Makeover Smaller Cheaper And Smarter

May 11, 2025