Bessent's Assessment: A Return To Calm In The Bond Market?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bessent's Assessment: A Return to Calm in the Bond Market? Or Just the Eye of the Storm?

The bond market, a crucial barometer of global economic health, has recently shown signs of stabilizing after a period of intense volatility. This shift has prompted many analysts to question whether we're witnessing a genuine return to calm, or merely a temporary lull before another storm. The insightful assessment from renowned financial expert, Dr. Eleanor Bessent, offers a nuanced perspective on this critical juncture.

Dr. Bessent, whose decades of experience analyzing fixed-income markets have cemented her reputation, suggests that while recent market behavior indicates a degree of stabilization, caution remains paramount. "The recent decline in volatility isn't necessarily indicative of a long-term trend," she cautions. "Several factors are contributing to this apparent calm, and a deeper analysis is needed before we can declare a lasting return to normalcy."

What's Driving the Perceived Calm in the Bond Market?

Several key factors have contributed to the recent relative tranquility in the bond market, according to Dr. Bessent's analysis:

-

Central Bank Intervention: The coordinated actions of major central banks, particularly in managing interest rate hikes, have played a significant role in easing market anxieties. The measured approach, focusing on gradual adjustments rather than drastic shifts, has helped to prevent sudden market shocks.

-

Easing Inflationary Pressures: While inflation remains a concern, recent data suggests a potential softening in inflationary pressures in several key economies. This easing of inflation concerns has lessened the pressure on bond yields, contributing to greater stability.

-

Improved Risk Appetite: A slight improvement in investor sentiment, fueled by positive corporate earnings reports and stabilizing geopolitical situations in certain regions, has encouraged a return to riskier assets, including bonds.

The Clouds on the Horizon: Potential Risks Remain

Despite these positive developments, Dr. Bessent highlights several significant risks that could quickly disrupt the current market calm:

-

Persistent Inflation: The potential for inflation to remain stubbornly high, even with recent positive indicators, poses a significant threat. Sustained high inflation could force central banks to implement more aggressive interest rate hikes, triggering further bond market volatility.

-

Geopolitical Uncertainty: Ongoing geopolitical tensions remain a source of significant uncertainty. Unforeseen events could trigger a fresh wave of risk aversion, leading to a sharp sell-off in the bond market.

-

Recessionary Fears: The persistent threat of a global recession continues to loom large. A significant economic downturn would likely trigger a flight to safety, potentially leading to increased demand for government bonds and impacting yields.

Bessent's Conclusion: Vigilance is Key

Dr. Bessent concludes that while the recent stabilization in the bond market is a welcome development, it's far too early to declare victory. "The current calm could easily be disrupted by a number of factors," she emphasizes. "Investors should remain vigilant, carefully monitor economic indicators, and maintain a diversified portfolio to mitigate potential risks." Her advice highlights the need for a cautious approach, urging investors to avoid complacency and to remain prepared for potential market shifts. The bond market's future remains uncertain, and ongoing monitoring is crucial for navigating this complex landscape. The "calm" may be temporary, and investors should be prepared for the possibility of further volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bessent's Assessment: A Return To Calm In The Bond Market?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Your Complete Horoscope Wednesday April 9th 2025

Apr 10, 2025

Your Complete Horoscope Wednesday April 9th 2025

Apr 10, 2025 -

Central Asian Nations Jointly Bid For 2031 Afc Cup

Apr 10, 2025

Central Asian Nations Jointly Bid For 2031 Afc Cup

Apr 10, 2025 -

Microsoft Employee Protest Leads To Termination Accusations Of War Profiteering

Apr 10, 2025

Microsoft Employee Protest Leads To Termination Accusations Of War Profiteering

Apr 10, 2025 -

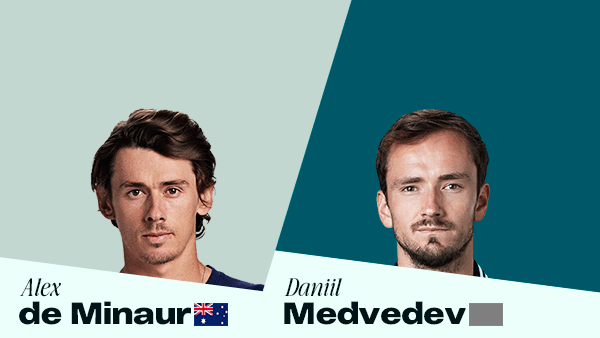

Monte Carlo Masters Medvedev Vs De Minaur Tv Schedule Predictions And Odds

Apr 10, 2025

Monte Carlo Masters Medvedev Vs De Minaur Tv Schedule Predictions And Odds

Apr 10, 2025 -

Daredevil Born Agains Punisher Appearance Promises Fan Frenzy

Apr 10, 2025

Daredevil Born Agains Punisher Appearance Promises Fan Frenzy

Apr 10, 2025