Beyond Fossil Fuels: Oil And Gas Firms' Strategic Bitcoin Mining Plays

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beyond Fossil Fuels? Oil and Gas Firms' Strategic Bitcoin Mining Plays

The energy sector is undergoing a seismic shift. While the transition to renewable energy sources is accelerating, some oil and gas giants aren't simply waiting for the inevitable. Instead, they're strategically leveraging their existing infrastructure and expertise to become major players in a surprisingly complementary field: Bitcoin mining. This move, while seemingly paradoxical, offers compelling economic and strategic advantages, sparking debate about the future of energy and cryptocurrency.

The Allure of Bitcoin Mining for Oil and Gas Companies:

Several factors are driving this unexpected convergence. Oil and gas companies possess considerable assets that are perfectly suited to Bitcoin mining's energy-intensive requirements:

- Excess Energy Capacity: Many oil and gas operations generate surplus energy, often flared or wasted. Bitcoin mining provides a lucrative way to monetize this excess, boosting profitability and reducing environmental impact (by reducing flaring).

- Established Infrastructure: These companies already have the infrastructure – power grids, pipelines, and cooling systems – necessary for large-scale mining operations. This reduces setup costs and speeds up deployment significantly.

- Geographic Advantages: Many oil and gas operations are located in regions with low electricity costs, making them ideal locations for energy-intensive Bitcoin mining.

- Diversification Strategy: The volatile nature of the oil and gas market pushes companies to seek diversification. Bitcoin mining represents a potentially high-return, albeit risky, investment in a rapidly growing sector.

Key Players and Their Strategies:

Several prominent oil and gas companies are already making significant strides in the Bitcoin mining space. While many are keeping their strategies close to their chests, public announcements and industry reports highlight a growing trend:

- Marathon Digital Holdings: This company is a prime example, illustrating how traditional energy companies are transitioning to become major Bitcoin mining players. They leverage low-cost energy sources and invest heavily in advanced mining hardware to maximize their returns.

- Other Notable Players: Although many firms haven't publicly announced large-scale Bitcoin mining ventures, industry insiders suggest a growing interest, with several companies exploring pilot projects and potential partnerships.

Environmental Concerns and the "Green Bitcoin" Debate:

The environmental impact of Bitcoin mining remains a significant concern. However, oil and gas companies argue that utilizing excess energy to power Bitcoin mining is more sustainable than flaring or wasting that energy. This aligns with the growing interest in "green Bitcoin," which focuses on powering mining operations with renewable energy sources. The debate is complex and ongoing, with arguments on both sides needing further scrutiny.

The Future of Energy and Cryptocurrency: A Symbiotic Relationship?

The convergence of the oil and gas industry and Bitcoin mining presents a fascinating case study in strategic adaptation and technological innovation. While the long-term implications remain uncertain, the current trajectory suggests a growing symbiotic relationship. Oil and gas companies can leverage their existing infrastructure to become significant players in the cryptocurrency space, potentially boosting profitability and contributing to a more sustainable energy future by reducing wasted energy. However, the environmental impact of this partnership requires continuous monitoring and responsible development. This evolving relationship will continue to shape the future of both the energy sector and the cryptocurrency market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beyond Fossil Fuels: Oil And Gas Firms' Strategic Bitcoin Mining Plays. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing Celtics Team Selection For The Tayside Game

Apr 27, 2025

Analyzing Celtics Team Selection For The Tayside Game

Apr 27, 2025 -

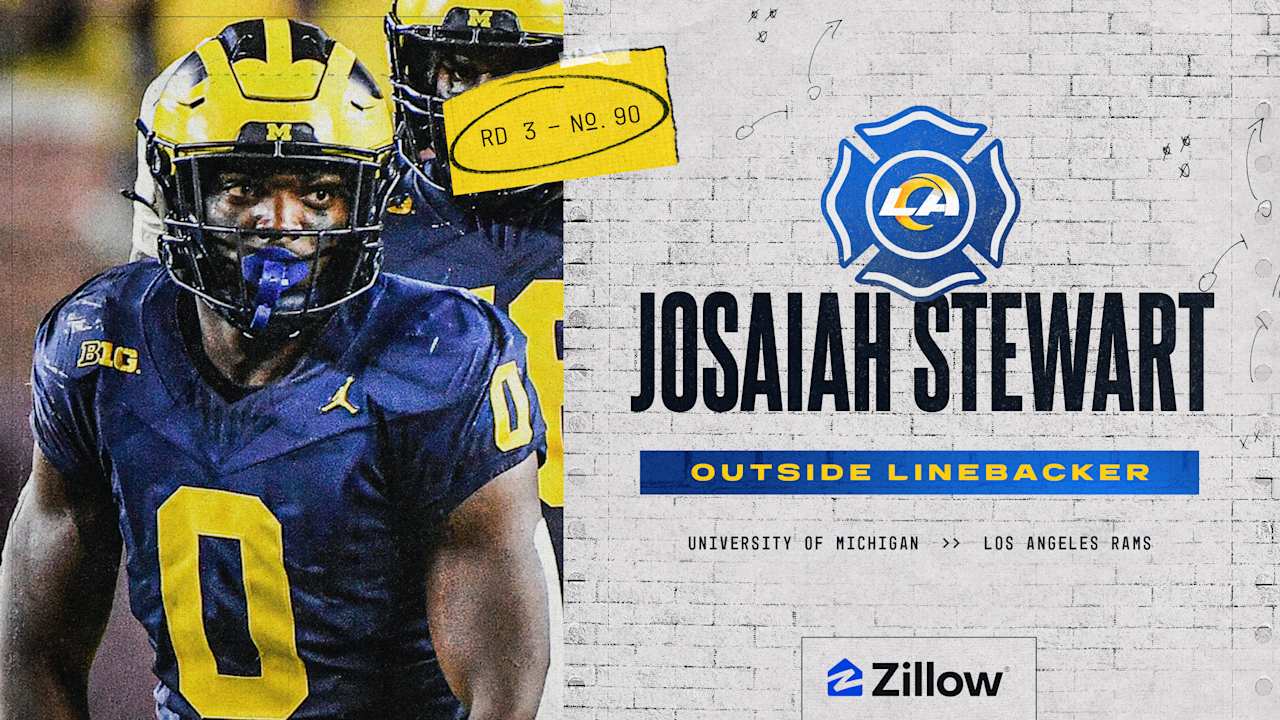

Los Angeles Rams Select Josaiah Stewart In Round 3 Of 2025 Nfl Draft

Apr 27, 2025

Los Angeles Rams Select Josaiah Stewart In Round 3 Of 2025 Nfl Draft

Apr 27, 2025 -

Is Cole Palmers Goalless Run At Chelsea A Mental Issue Maresca Weighs In

Apr 27, 2025

Is Cole Palmers Goalless Run At Chelsea A Mental Issue Maresca Weighs In

Apr 27, 2025 -

Conquer The Nyt Strands Sunday April 27th Spangram Guide

Apr 27, 2025

Conquer The Nyt Strands Sunday April 27th Spangram Guide

Apr 27, 2025 -

Milo Plushies Celebrate Singaporean Food Icons Limited Edition Release

Apr 27, 2025

Milo Plushies Celebrate Singaporean Food Icons Limited Edition Release

Apr 27, 2025