Beyond The Hype: Analyzing Tesla's AI Chip Strategy And Its Impact On Profits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beyond the Hype: Analyzing Tesla's AI Chip Strategy and its Impact on Profits

Tesla's relentless pursuit of autonomous driving has catapulted its AI chip strategy into the spotlight. While the promise of full self-driving (FSD) capabilities fuels investor excitement, a closer look reveals a complex interplay of technological innovation, manufacturing challenges, and financial implications. This article delves beyond the hype to analyze Tesla's AI chip strategy and its impact on the company's bottom line.

Tesla's In-House AI Chip Advantage: The Dojo Supercomputer and FSD Chip

Tesla's departure from relying solely on off-the-shelf chips represents a bold move. The development of its custom-designed FSD chip, specifically optimized for neural network processing, allows for greater control over performance, efficiency, and cost. This in-house approach is further amplified by the ambitious Dojo supercomputer project. Dojo, a massive training cluster leveraging custom-built chips, aims to drastically accelerate the development and refinement of Tesla's AI algorithms for autonomous driving.

This vertical integration offers several potential advantages:

- Improved Performance: Custom chips are tailored to the specific needs of Tesla's AI algorithms, leading to potentially faster processing speeds and enhanced performance in real-world driving scenarios.

- Cost Optimization: While the initial R&D investment is significant, long-term cost savings could be achieved through economies of scale and reduced reliance on third-party suppliers.

- Data Security and Intellectual Property Protection: Owning the entire AI stack, from hardware to software, grants Tesla greater control over its sensitive data and intellectual property.

Challenges and Risks in Tesla's AI Chip Strategy

Despite the potential benefits, Tesla's AI chip strategy faces significant hurdles:

- High R&D Costs: Developing and manufacturing custom chips is capital-intensive. The substantial upfront investment in Dojo and the FSD chip requires significant financial resources and could strain profitability in the short term.

- Manufacturing Complexity: Producing advanced AI chips requires highly specialized manufacturing facilities and expertise. Yield rates and production bottlenecks could impact the availability and cost of these chips.

- Competition: Other automakers and tech giants are investing heavily in AI and autonomous driving technologies, creating a fiercely competitive landscape. Tesla needs to maintain a technological edge to stay ahead.

- Regulatory Hurdles: The development and deployment of autonomous driving systems face numerous regulatory challenges and safety concerns, potentially delaying widespread adoption and impacting market penetration.

The Impact on Tesla's Profits: A Balancing Act

The ultimate success of Tesla's AI chip strategy hinges on its ability to deliver on the promise of full self-driving. While the FSD software and hardware represent a significant potential revenue stream, the associated costs and risks pose challenges to profitability.

The current FSD beta program generates revenue, but the transition to a fully autonomous system requires extensive testing, validation, and refinement, delaying widespread commercialization. Furthermore, the regulatory environment and public perception of autonomous driving technology can significantly affect market adoption and, consequently, Tesla's financial performance.

Conclusion: A Long-Term Vision with Short-Term Uncertainties

Tesla's AI chip strategy is a high-stakes gamble with the potential for significant long-term rewards. The company's vertical integration efforts, while ambitious and potentially transformative, require careful management of costs, technological challenges, and regulatory hurdles. While the short-term impact on profits remains uncertain, the long-term implications for Tesla's competitiveness in the rapidly evolving autonomous driving market are undeniable. The ongoing development and success of Dojo and the FSD chip will be crucial in determining whether Tesla's bold bet pays off.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beyond The Hype: Analyzing Tesla's AI Chip Strategy And Its Impact On Profits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Four Day Sweep Is This The End For Baseballs Worst Team

May 20, 2025

Four Day Sweep Is This The End For Baseballs Worst Team

May 20, 2025 -

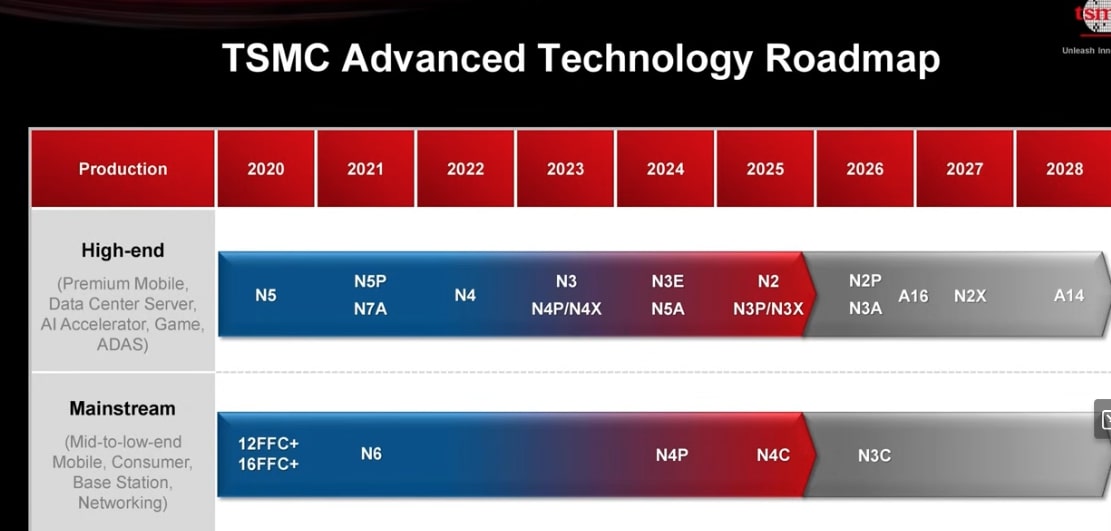

Tsmc 2025 Symposium A Deep Dive Into The Semiconductor Roadmap To 2028

May 20, 2025

Tsmc 2025 Symposium A Deep Dive Into The Semiconductor Roadmap To 2028

May 20, 2025 -

Mars Mapmakers A History Of Cartographic Conflict And Martian Allure

May 20, 2025

Mars Mapmakers A History Of Cartographic Conflict And Martian Allure

May 20, 2025 -

Four Game Sweep On The Horizon Can Team Name Finally Overcome The Leagues Worst

May 20, 2025

Four Game Sweep On The Horizon Can Team Name Finally Overcome The Leagues Worst

May 20, 2025 -

End Of The Line For Boeing 737 800s In Singapore Airlines Fleet

May 20, 2025

End Of The Line For Boeing 737 800s In Singapore Airlines Fleet

May 20, 2025