BigBear.ai And C3.ai Stock Comparison: Risk, Reward, And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BigBear.ai vs. C3.ai: A Stock Comparison for Investors

The AI software market is booming, attracting investors eager to capitalize on its explosive growth. Two prominent players, BigBear.ai (BBAI) and C3.ai (AI), both offer compelling propositions but present distinctly different risk and reward profiles. This comparison delves into the strengths and weaknesses of each, providing a comprehensive overview for investors considering adding either to their portfolios.

BigBear.ai (BBAI): Focus on National Security and Mission-Critical Applications

BigBear.ai specializes in providing mission-critical data analytics and AI solutions, primarily to government and defense clients. This niche focus presents both opportunities and challenges.

Strengths:

- Strong Government Contracts: BBAI boasts a substantial pipeline of contracts with various government agencies, ensuring a relatively stable revenue stream. This makes it less susceptible to the volatile swings impacting companies relying heavily on commercial markets.

- National Security Focus: The increasing emphasis on national security and cybersecurity globally positions BBAI favorably for continued growth. Government spending in these areas is projected to increase significantly in the coming years.

- Proprietary Technology: BigBear.ai's technology portfolio includes advanced analytics and AI capabilities, offering a competitive edge in its niche market.

Weaknesses:

- High Dependence on Government Contracts: While providing stability, this heavy reliance limits diversification and exposes BBAI to potential budget cuts or shifts in government priorities.

- Lower Public Profile: Compared to C3.ai, BigBear.ai enjoys less widespread brand recognition, potentially hindering its ability to attract wider investor interest and commercial clients.

- Higher Risk Tolerance Required: Investment in BBAI demands a higher risk tolerance given its concentration in a sector sensitive to geopolitical factors and government funding cycles.

C3.ai (AI): Enterprise AI Solutions for a Broader Market

C3.ai offers an enterprise-grade AI platform targeting a broader range of industries and applications. This broader approach offers significant scalability but also exposes it to increased competition.

Strengths:

- Wider Market Reach: C3.ai's platform caters to a diverse clientele across various sectors, reducing dependence on any single market segment. This diversification mitigates some of the risks associated with a niche focus.

- Established Brand Recognition: C3.ai benefits from higher brand awareness and a stronger reputation within the enterprise AI space, attracting a wider pool of potential customers and investors.

- Scalable Platform: The company's platform allows for easy adaptation and deployment across multiple industries, fostering rapid growth potential.

Weaknesses:

- Intense Competition: The enterprise AI market is extremely competitive, with established tech giants and numerous startups vying for market share. Maintaining a competitive edge requires continuous innovation and significant investment.

- Profitability Concerns: C3.ai has yet to achieve consistent profitability, raising concerns about its long-term financial sustainability. Investors need to carefully assess its path to profitability.

- Market Volatility: As a growth stock in a rapidly evolving sector, C3.ai's stock price is subject to significant volatility, presenting substantial risk for investors with a lower risk tolerance.

Future Outlook and Investment Considerations:

Both BigBear.ai and C3.ai present compelling investment opportunities, but the optimal choice depends heavily on individual investor risk profiles and investment goals.

-

BigBear.ai: Suitable for investors with a higher risk tolerance seeking exposure to the rapidly growing national security and defense technology sectors. Long-term growth potential is substantial but subject to government policy and budgetary fluctuations.

-

C3.ai: More suitable for investors comfortable with higher market volatility but seeking exposure to a broader, faster-growing market segment. The path to profitability needs careful monitoring, and the competitive landscape requires ongoing analysis.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. The information provided is based on publicly available data and may change.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BigBear.ai And C3.ai Stock Comparison: Risk, Reward, And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Could Antony And Osimhen Join Manchester United Transfer Update

May 02, 2025

Could Antony And Osimhen Join Manchester United Transfer Update

May 02, 2025 -

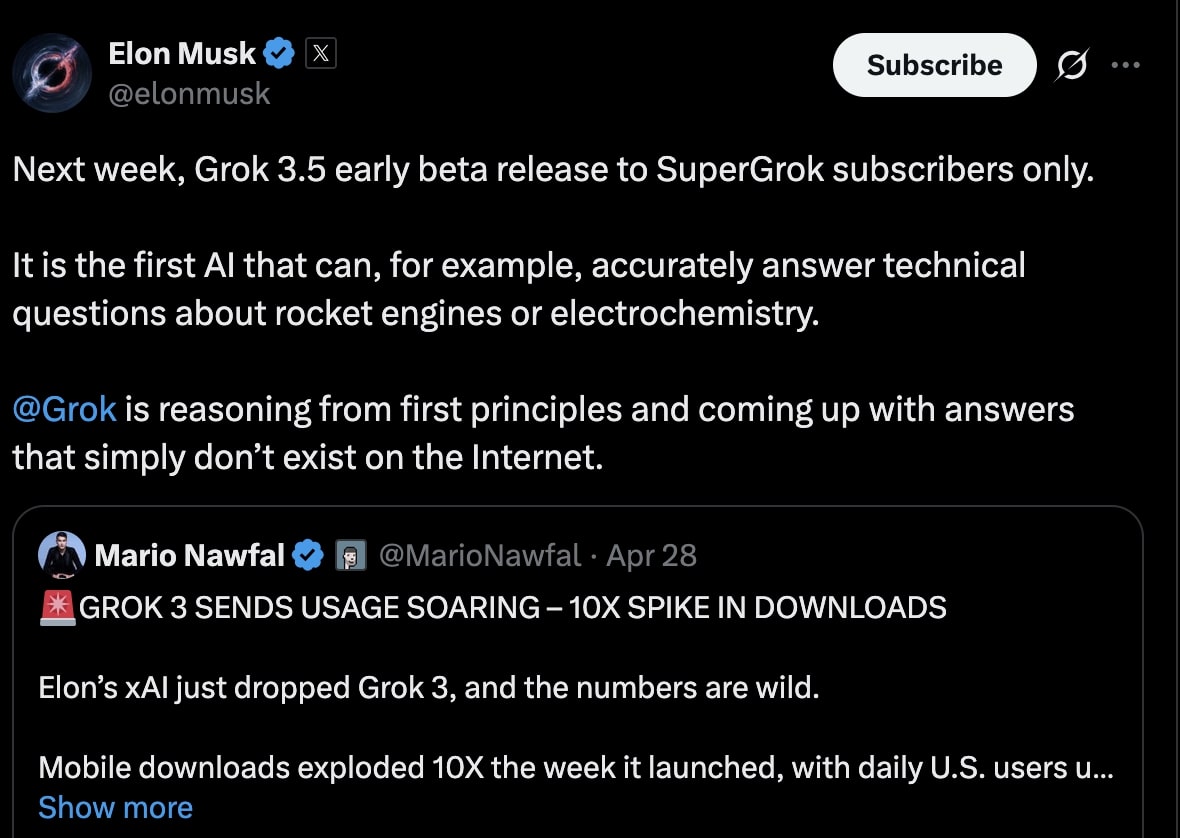

Super Grok Upgrade X Ais Grok 3 5 Released Next Week

May 02, 2025

Super Grok Upgrade X Ais Grok 3 5 Released Next Week

May 02, 2025 -

Upset At Quail Hollow Michael Block Punching Ticket To Pga Championship

May 02, 2025

Upset At Quail Hollow Michael Block Punching Ticket To Pga Championship

May 02, 2025 -

Pga Club Pro Championship Collet Secures Victory 20 Advance To Major

May 02, 2025

Pga Club Pro Championship Collet Secures Victory 20 Advance To Major

May 02, 2025 -

Coalitions Nuclear Power Push Two Plants Targeted For Mid 2030s Operation

May 02, 2025

Coalitions Nuclear Power Push Two Plants Targeted For Mid 2030s Operation

May 02, 2025