BigBear.ai (BBAI) Stock: A Q1 Earnings Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BigBear.ai (BBAI) Stock: A Q1 Earnings Investment Analysis

BigBear.ai (BBAI) stock recently reported its Q1 2024 earnings, sending ripples through the investment community. This report delves into a comprehensive investment analysis of BBAI, examining the Q1 results, future growth prospects, and potential risks for investors considering adding this tech stock to their portfolio.

Q1 Earnings: A Mixed Bag for BigBear.ai

BigBear.ai's Q1 earnings revealed a mixed performance. While the company showcased progress in key areas, certain aspects fell short of analyst expectations. Revenue growth, while positive, was slower than anticipated, primarily attributed to [cite specific reason from the earnings report, e.g., delays in contract awards or shifting market dynamics]. However, the company highlighted strong performance in [cite specific area of strength, e.g., a particular sector or product line], signaling potential for future growth. This nuanced performance underscores the need for a thorough analysis before making any investment decisions.

Key Highlights from the Q1 Earnings Report:

- Revenue: [Insert specific revenue figures and year-over-year growth percentage]. While positive, this growth lagged behind some market predictions.

- Earnings per Share (EPS): [Insert EPS figures and compare to previous quarters and analyst expectations]. The EPS results further emphasize the mixed nature of the Q1 performance.

- Contract Wins: [Discuss significant contract wins and their potential impact on future revenue streams]. Highlighting these wins is crucial for assessing future growth potential.

- Guidance: [Analyze the company's guidance for the remaining quarters of 2024. This is a crucial element for projecting future performance and making informed investment decisions]. This section should highlight both positive and negative aspects of the provided guidance.

Growth Prospects and Future Potential:

Despite the mixed Q1 results, BigBear.ai remains positioned within a rapidly expanding market. The increasing demand for AI-driven solutions across various sectors, including defense, intelligence, and commercial applications, presents significant growth opportunities. The company's focus on [mention key technological areas of focus, e.g., artificial intelligence, machine learning, data analytics] positions it well to capitalize on these trends. However, success hinges on the company's ability to effectively execute its strategic plans and navigate the competitive landscape.

Risks and Considerations for Investors:

Investing in BBAI stock carries inherent risks. The company operates in a highly competitive market, and success is not guaranteed. Key risks include:

- Competition: Intense competition from established players and emerging startups could impact market share and profitability.

- Technology Risk: The rapid evolution of AI technology requires continuous innovation and adaptation, which presents a significant challenge.

- Execution Risk: Failure to effectively execute its strategic plans could hinder revenue growth and profitability.

- Market Volatility: The overall market conditions could impact the stock price irrespective of the company's performance.

Investment Conclusion:

BigBear.ai's Q1 earnings presented a mixed picture, showcasing both progress and challenges. While the company's long-term potential within the burgeoning AI market is undeniable, investors should carefully weigh the potential risks before committing capital. A thorough due diligence process, considering the factors outlined above, is crucial for making an informed investment decision. Consult with a financial advisor before making any investment decisions related to BBAI or any other stock. This analysis is for informational purposes only and does not constitute financial advice.

Keywords: BigBear.ai, BBAI, Stock, Q1 Earnings, Investment Analysis, AI, Artificial Intelligence, Machine Learning, Data Analytics, Technology Stock, Revenue Growth, Earnings per Share, EPS, Stock Market, Investment, Risk, Growth Prospects, Competitive Landscape, Financial Analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BigBear.ai (BBAI) Stock: A Q1 Earnings Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reddit Stock Market Rally 16 Jump On Positive Sales And Outlook

May 02, 2025

Reddit Stock Market Rally 16 Jump On Positive Sales And Outlook

May 02, 2025 -

Wifes Death At Festival Heartbreak For Hallmark Star Noel Johansen

May 02, 2025

Wifes Death At Festival Heartbreak For Hallmark Star Noel Johansen

May 02, 2025 -

Diretta Live Betis Siviglia Fiorentina Semifinale Andata Conference League

May 02, 2025

Diretta Live Betis Siviglia Fiorentina Semifinale Andata Conference League

May 02, 2025 -

Desastre No Rio Grande Do Sul 75 Vitimas Falta D Agua E Luz Para Mais De Um Milhao De Pessoas

May 02, 2025

Desastre No Rio Grande Do Sul 75 Vitimas Falta D Agua E Luz Para Mais De Um Milhao De Pessoas

May 02, 2025 -

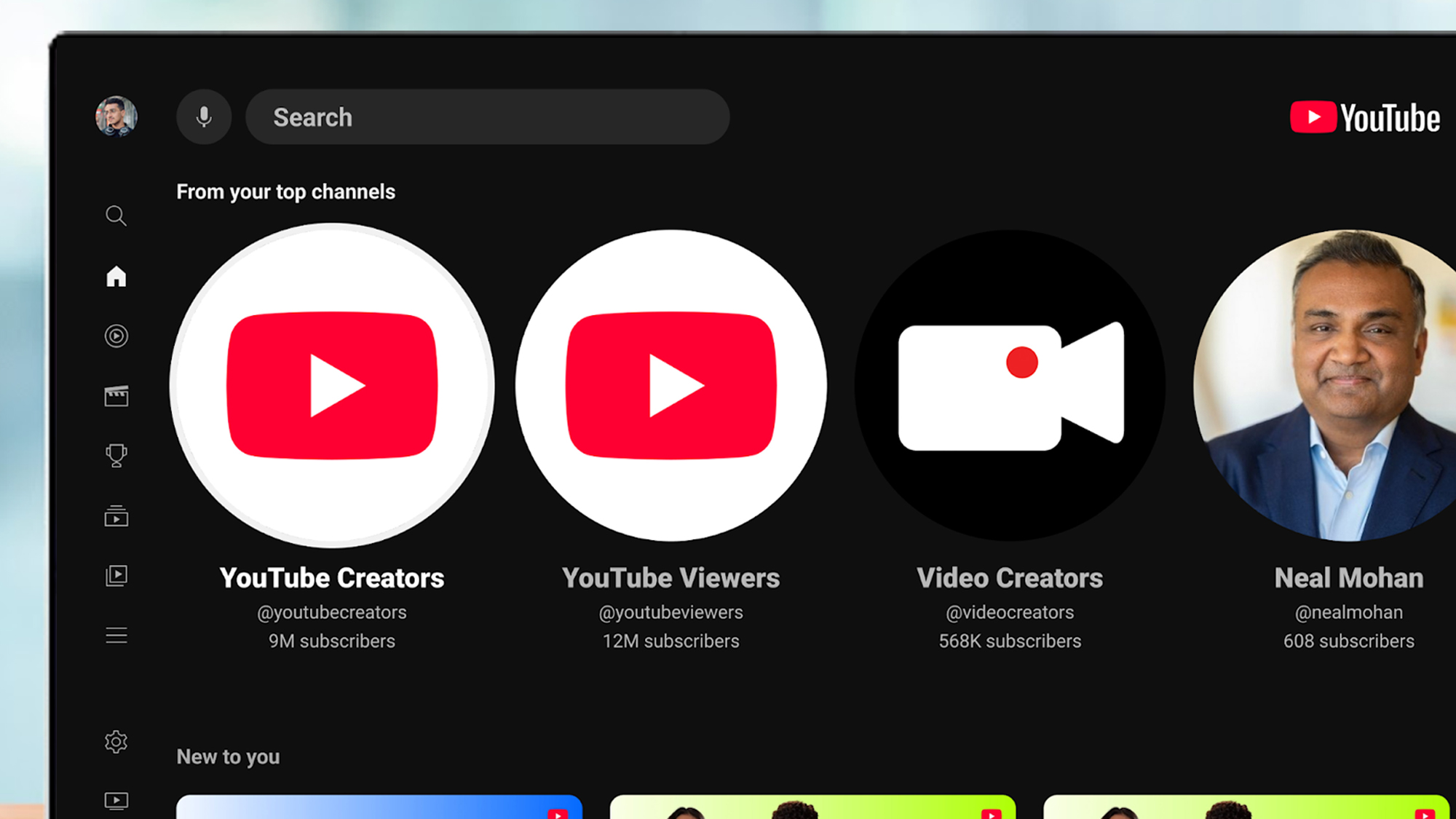

9 Game Changing Updates To The You Tube Tv App

May 02, 2025

9 Game Changing Updates To The You Tube Tv App

May 02, 2025