Billionaire Investors Pile Into BlackRock ETF: 110% Growth Forecast Sparks Interest

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire Investors Pile into BlackRock ETF: 110% Growth Forecast Sparks Frenzy

BlackRock's iShares Global Clean Energy ETF (ICLN) is experiencing a surge in investment, fueled by a bold 110% growth forecast and attracting the attention of high-profile billionaire investors. This unprecedented influx of capital highlights a growing confidence in the renewable energy sector and its potential for explosive growth in the coming years.

The clean energy sector has long been viewed as a promising investment, but recent market shifts and a renewed focus on environmental sustainability have catapulted it into the spotlight. This isn't just about altruism; the potential for substantial returns is undeniable, attracting even the savviest of investors. The 110% growth forecast, while ambitious, is based on projections of significant global investment in renewable energy infrastructure and the increasing adoption of sustainable practices across various industries.

What's Driving the Billionaire Interest in ICLN?

Several factors contribute to the current wave of investment in the iShares Global Clean Energy ETF:

- Aggressive Growth Projections: The 110% growth forecast, issued by a reputable financial analysis firm (Source needed – replace with actual source if available), is a major driver. This bold prediction, while carrying inherent risk, is enough to entice high-risk, high-reward investors.

- Government Policy and Incentives: Governments worldwide are increasingly implementing policies and offering substantial financial incentives to promote renewable energy adoption. These incentives reduce the risk associated with clean energy investments, making them more appealing to a wider range of investors.

- Technological Advancements: Continuous advancements in renewable energy technologies are driving down costs and improving efficiency. This makes renewable energy sources more competitive with traditional fossil fuels, further boosting investor confidence.

- ESG Investing Trends: Environmental, Social, and Governance (ESG) investing is gaining significant traction. Investors are increasingly incorporating ESG factors into their investment decisions, leading to a surge in demand for ethically responsible investments like clean energy ETFs.

- Climate Change Concerns: The growing awareness of the urgency of climate change is pushing investors to seek opportunities in sectors actively addressing this global challenge. Investing in clean energy is viewed as both a financial opportunity and a contribution to a more sustainable future.

Is ICLN the Right Investment for You?

While the potential returns are alluring, it's crucial to remember that investing in any ETF, especially one focused on a rapidly evolving sector like clean energy, carries significant risk. The 110% growth forecast is just a projection, and actual returns may vary significantly. Before investing in ICLN or any other ETF, it’s vital to:

- Conduct Thorough Research: Understand the underlying assets of the ETF and the potential risks involved.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification is key to mitigating risk.

- Consult a Financial Advisor: Seek professional advice before making any significant investment decisions.

The Future of Clean Energy Investment

The massive influx of billionaire investment into BlackRock's ICLN signals a significant shift in the investment landscape. The clean energy sector is poised for substantial growth, driven by technological advancements, supportive government policies, and growing investor interest. While risk remains inherent in any investment, the potential rewards for those who strategically position themselves within this burgeoning market are significant. The future looks bright for clean energy, and for those bold enough to invest, the potential returns could be equally illuminating.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire Investors Pile Into BlackRock ETF: 110% Growth Forecast Sparks Interest. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

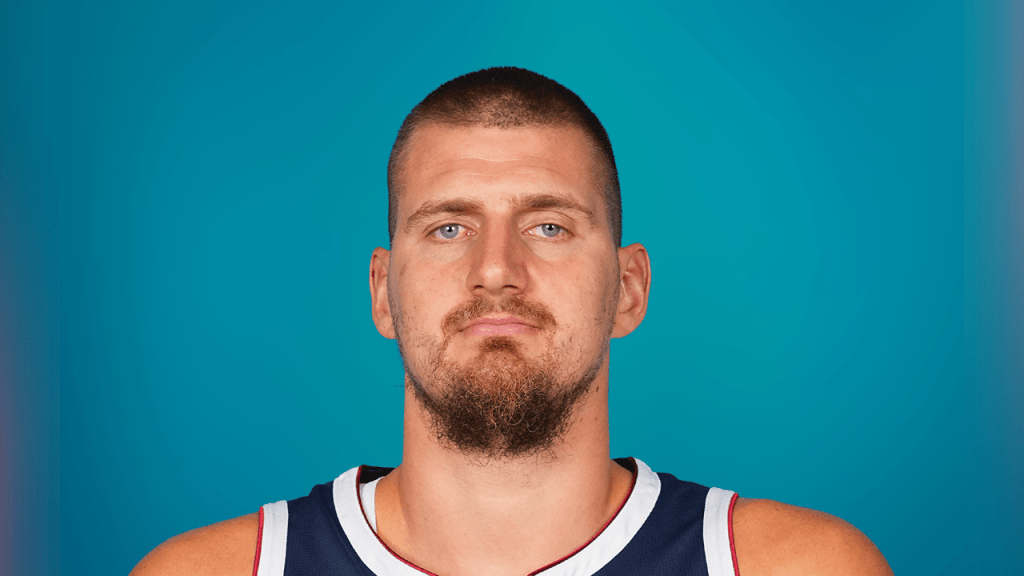

Jokics Amusing Response To Free Throw Criticism From Opposing Fans

May 08, 2025

Jokics Amusing Response To Free Throw Criticism From Opposing Fans

May 08, 2025 -

Black Rock Etf A 110 Potential Return Attracting Billionaire Investors

May 08, 2025

Black Rock Etf A 110 Potential Return Attracting Billionaire Investors

May 08, 2025 -

Choosing The Right Ai Superchip Cerebras Wse 3 Or Nvidia B200 A Comprehensive Guide

May 08, 2025

Choosing The Right Ai Superchip Cerebras Wse 3 Or Nvidia B200 A Comprehensive Guide

May 08, 2025 -

Xdc Network Xdc Price Dip Bullish Outlook Remains Strong

May 08, 2025

Xdc Network Xdc Price Dip Bullish Outlook Remains Strong

May 08, 2025 -

Leaked 35 Unit Amd Epyc 4005 Mini Pc Racks From Major Us Vendor

May 08, 2025

Leaked 35 Unit Amd Epyc 4005 Mini Pc Racks From Major Us Vendor

May 08, 2025

Latest Posts

-

New Perth Nrl Team How Will It Function Key Facts And Insights

May 09, 2025

New Perth Nrl Team How Will It Function Key Facts And Insights

May 09, 2025 -

Nhl Playoffs Round 1 Game 7 Wrap Up Stars Victory And Live Chat Discussion

May 09, 2025

Nhl Playoffs Round 1 Game 7 Wrap Up Stars Victory And Live Chat Discussion

May 09, 2025 -

Dicas Para Conseguir Casas De Temporada Na Praia E Campo Sem Comprar

May 09, 2025

Dicas Para Conseguir Casas De Temporada Na Praia E Campo Sem Comprar

May 09, 2025 -

Jaylin Williams Rising Star Forward For The Okc Thunder

May 09, 2025

Jaylin Williams Rising Star Forward For The Okc Thunder

May 09, 2025 -

Josh Hartnett On Fight Or Flight Thrilling Stunts After A Decade Long Break

May 09, 2025

Josh Hartnett On Fight Or Flight Thrilling Stunts After A Decade Long Break

May 09, 2025