Billions Flow Into Crypto Assets: Week Three Of Continuous Investment Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billions Flow Into Crypto Assets: Week Three of Continuous Investment Growth

Crypto markets are experiencing a resurgence, with billions of dollars pouring into various digital assets for the third consecutive week. This sustained influx of investment signals a potential shift in market sentiment, defying recent predictions of a prolonged bear market. Experts are analyzing the contributing factors behind this significant upswing, prompting renewed interest and discussion within the cryptocurrency community.

This surge isn't just limited to Bitcoin; altcoins are also seeing substantial gains, indicating a broader market recovery rather than a localized phenomenon. The renewed optimism is leading to increased trading volumes and a renewed focus on long-term investment strategies.

What's Driving This Crypto Investment Boom?

Several factors are likely contributing to this sustained investment growth:

-

Regulatory Clarity (in some regions): More defined regulatory frameworks in certain jurisdictions are providing investors with increased confidence and reducing uncertainty. This stability is encouraging institutional and retail investors alike to enter or expand their crypto holdings.

-

Institutional Adoption: Large financial institutions are increasingly incorporating crypto assets into their portfolios, reflecting a growing acceptance of cryptocurrencies as a viable asset class. This institutional backing lends credibility and stability to the market.

-

Technological Advancements: Ongoing developments in blockchain technology, such as Layer-2 scaling solutions and improved DeFi protocols, are enhancing the efficiency and usability of cryptocurrencies, attracting new users and investors.

-

Macroeconomic Factors: Global economic uncertainty and inflation are pushing investors to seek alternative assets, with cryptocurrencies increasingly viewed as a hedge against inflation and traditional market volatility.

-

Positive Market Sentiment: The overall positive sentiment surrounding the crypto market is a self-fulfilling prophecy. As more investors enter, the market gains momentum, attracting even more capital.

Which Crypto Assets Are Seeing the Biggest Gains?

While Bitcoin remains the dominant cryptocurrency, other altcoins are experiencing significant growth. Ethereum, for instance, has seen substantial gains, fueled by the increasing popularity of its DeFi ecosystem and the anticipation of further network upgrades. Several smaller-cap altcoins have also experienced impressive growth, though investors should proceed with caution due to the inherent volatility of these assets. Thorough due diligence is crucial before investing in any cryptocurrency.

Looking Ahead: Sustainability and Volatility

While the current trend is positive, it's crucial to remember that the cryptocurrency market remains highly volatile. The sustained growth of the past three weeks doesn't guarantee continued upward momentum. External factors, regulatory changes, and market sentiment can all significantly impact prices.

Experts caution against impulsive investment decisions driven solely by short-term price fluctuations. A long-term investment strategy with a focus on diversification and risk management is essential for navigating the complexities of the crypto market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you could lose some or all of your investment. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billions Flow Into Crypto Assets: Week Three Of Continuous Investment Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game 7 Adjustments Kerr Seeks Winning Lineup Combination Against Rockets

May 07, 2025

Game 7 Adjustments Kerr Seeks Winning Lineup Combination Against Rockets

May 07, 2025 -

Mercury Vs Aces Your Guide To Live Wnba Game Streaming And Tv Coverage

May 07, 2025

Mercury Vs Aces Your Guide To Live Wnba Game Streaming And Tv Coverage

May 07, 2025 -

Nba Playoffs Warriors Face Setback As Curry Suffers Hamstring Injury

May 07, 2025

Nba Playoffs Warriors Face Setback As Curry Suffers Hamstring Injury

May 07, 2025 -

Cnn Faces Condemnation For Interviewing Notorious Sinaloa Cartel Figure

May 07, 2025

Cnn Faces Condemnation For Interviewing Notorious Sinaloa Cartel Figure

May 07, 2025 -

David Fifita Titans Star Considers Offers From Competing Nrl Teams

May 07, 2025

David Fifita Titans Star Considers Offers From Competing Nrl Teams

May 07, 2025

Latest Posts

-

Australia Election News Rudd Vs Trump On Bluey Tax Bandts Melbourne Seat In Jeopardy

May 08, 2025

Australia Election News Rudd Vs Trump On Bluey Tax Bandts Melbourne Seat In Jeopardy

May 08, 2025 -

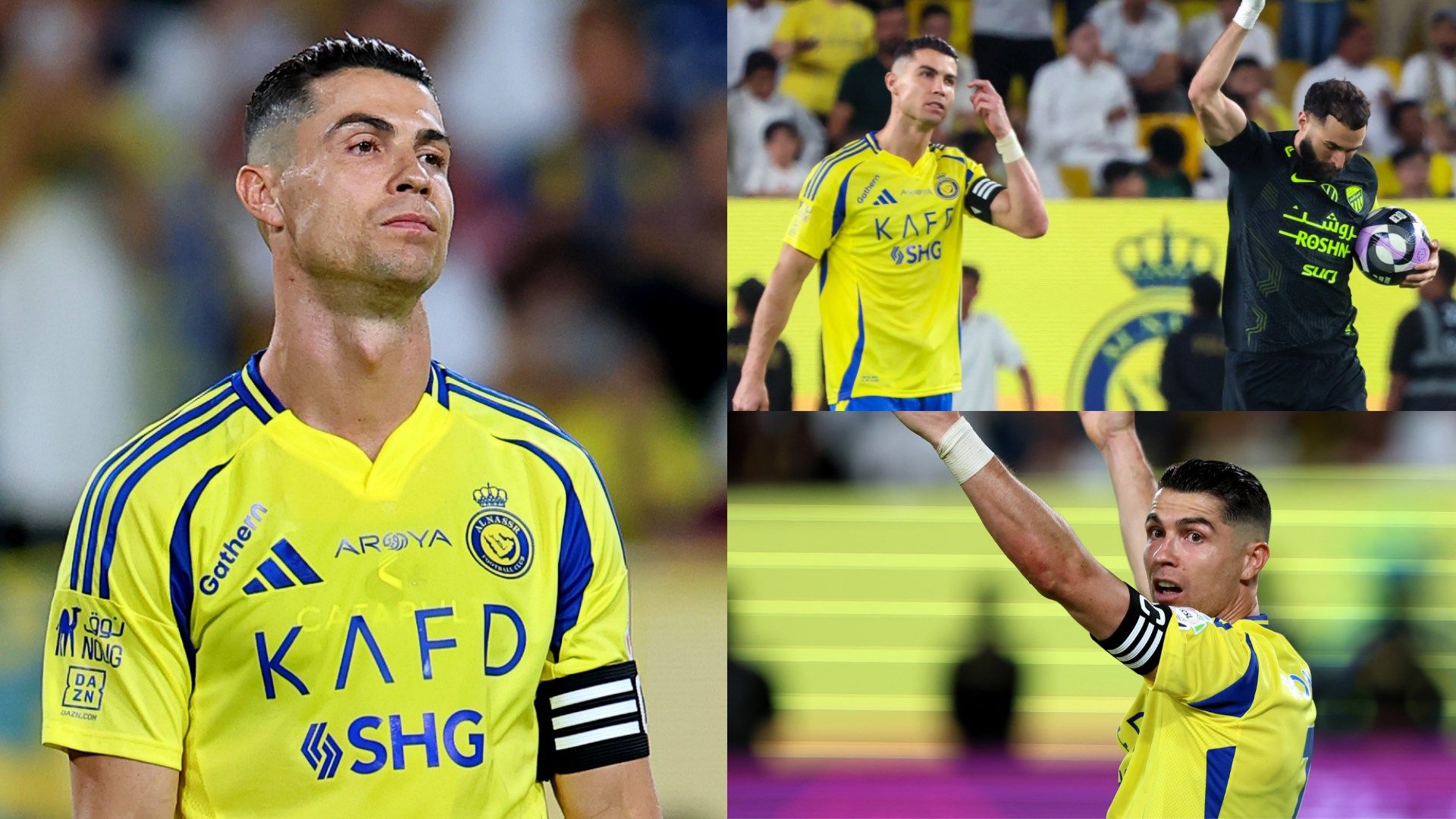

Two Goal Lead Vanishes Al Nassr And Ronaldo Fall To Al Ittihad In Saudi Pro League

May 08, 2025

Two Goal Lead Vanishes Al Nassr And Ronaldo Fall To Al Ittihad In Saudi Pro League

May 08, 2025 -

Breaking News Guilty Verdicts In High Profile Indigenous Teen Murder

May 08, 2025

Breaking News Guilty Verdicts In High Profile Indigenous Teen Murder

May 08, 2025 -

Red Planet Revelation Mapping Mars And Its Impact On Scientific Understanding

May 08, 2025

Red Planet Revelation Mapping Mars And Its Impact On Scientific Understanding

May 08, 2025 -

Details Emerge The Specifics Of Bryants Back Pain Treatment

May 08, 2025

Details Emerge The Specifics Of Bryants Back Pain Treatment

May 08, 2025