Bitcoin And Ethereum ETF Withdrawals Soar In April, Exceeding March

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin and Ethereum ETF Withdrawals Soar in April, Exceeding March's Record Highs

Investor Sentiment Shifts as Crypto Market Shows Signs of Uncertainty

April 2024 witnessed a dramatic surge in Bitcoin and Ethereum exchange-traded fund (ETF) withdrawals, significantly surpassing the already high levels recorded in March. This unprecedented outflow of capital signals a potential shift in investor sentiment and raises questions about the future trajectory of the cryptocurrency market. Industry analysts are scrambling to understand the driving forces behind this sudden exodus, with several key factors emerging as potential culprits.

Record-Breaking Withdrawals: A Deeper Dive

Data from leading financial analytics firms reveals a staggering increase in ETF withdrawals for both Bitcoin and Ethereum during April. While precise figures vary slightly depending on the data source, the consensus points to a substantial jump compared to March, which itself saw record-high outflows. This suggests a growing unease among investors, potentially fueled by a confluence of factors.

Macroeconomic Headwinds and Regulatory Uncertainty

One of the most significant contributors to the increased withdrawals is likely the ongoing macroeconomic uncertainty. Rising inflation, interest rate hikes, and concerns about a potential recession are impacting investor confidence across all asset classes, including cryptocurrencies. The regulatory landscape also remains a key concern. The lack of clear, consistent global regulations surrounding cryptocurrencies continues to create uncertainty and risk aversion among investors. This ambiguity is prompting some to reduce their exposure to the market.

Price Volatility and Market Sentiment

The inherent volatility of the cryptocurrency market plays a significant role. While Bitcoin and Ethereum have shown periods of growth, they are also prone to sharp price drops. Negative market sentiment, often fueled by media coverage of regulatory crackdowns or security breaches, can trigger panic selling and contribute to increased withdrawals from ETFs. April saw several instances of price fluctuations, likely exacerbating existing anxieties.

Alternative Investment Opportunities

The emergence of attractive alternative investment opportunities also plays a role. With traditional markets showing some signs of stability, investors may be reallocating funds to assets perceived as less risky. This shift in allocation could be contributing to the outflow from Bitcoin and Ethereum ETFs.

What Lies Ahead for Bitcoin and Ethereum ETFs?

The significant withdrawals in April paint a complex picture. While it's difficult to predict the future with certainty, the current trend suggests a period of consolidation and potential caution within the cryptocurrency market. The macroeconomic environment, regulatory developments, and investor sentiment will all play crucial roles in shaping the future trajectory of Bitcoin and Ethereum ETF investments.

Key Takeaways:

- Record Outflows: April saw unprecedented withdrawals from Bitcoin and Ethereum ETFs, exceeding March's levels.

- Macroeconomic Uncertainty: Inflation, interest rates, and recession fears are impacting investor confidence.

- Regulatory Concerns: Lack of clear global regulations contributes to uncertainty and risk aversion.

- Market Volatility: Price fluctuations and negative sentiment trigger panic selling.

- Alternative Investments: Investors may be shifting funds to perceived lower-risk assets.

The coming months will be critical in determining whether this represents a temporary correction or a more significant shift in the long-term outlook for Bitcoin and Ethereum ETFs. Investors are advised to monitor market developments closely and make informed decisions based on their own risk tolerance and investment strategies. The cryptocurrency market remains dynamic and unpredictable, requiring careful consideration and due diligence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin And Ethereum ETF Withdrawals Soar In April, Exceeding March. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Film The Outpost Sinopsis Dan Perjuangan Pahlawan Di Benteng Terpencil

Apr 12, 2025

Film The Outpost Sinopsis Dan Perjuangan Pahlawan Di Benteng Terpencil

Apr 12, 2025 -

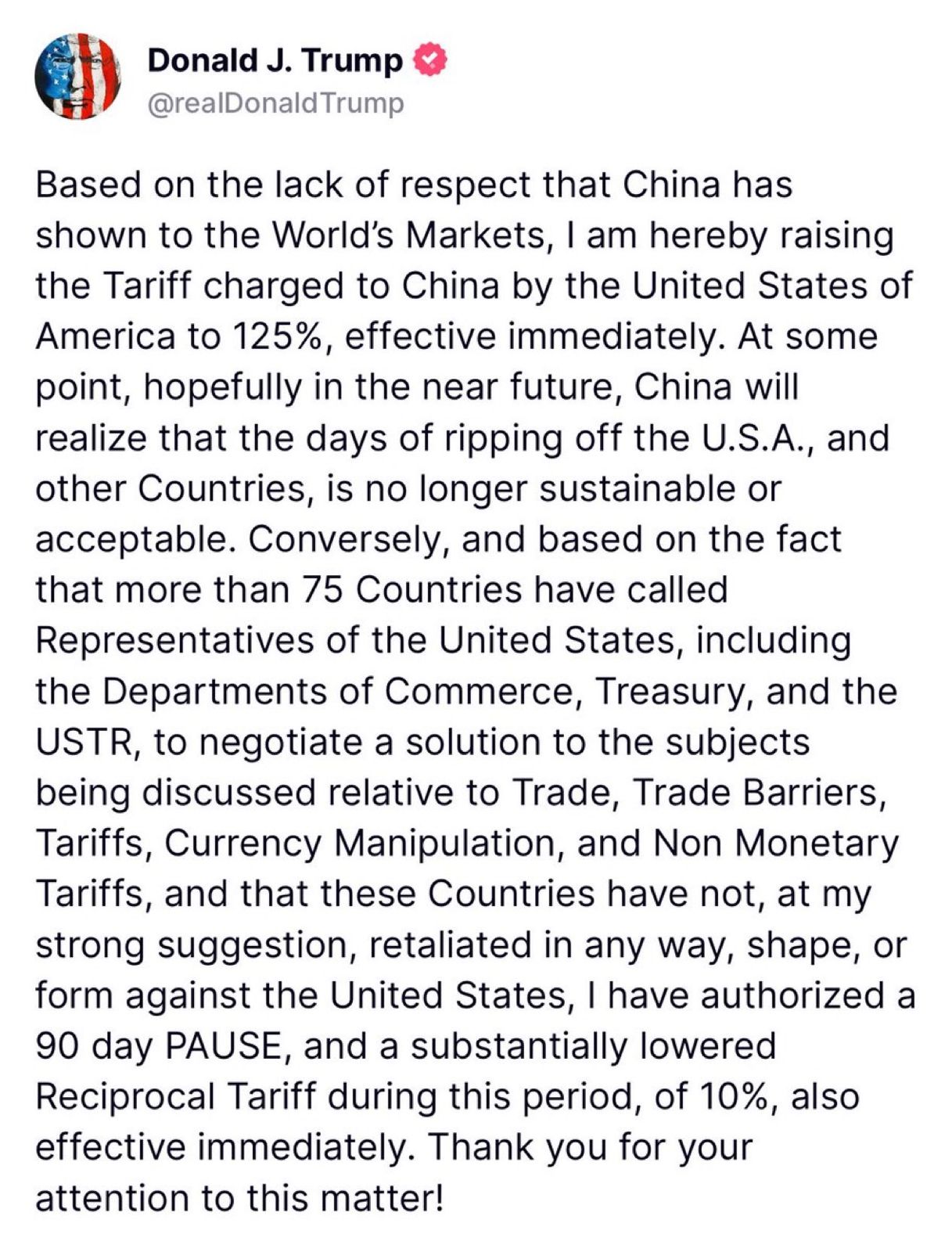

Global Trade Update 90 Day Tariff Delay Chinas Exclusion And Future Trade Prospects

Apr 12, 2025

Global Trade Update 90 Day Tariff Delay Chinas Exclusion And Future Trade Prospects

Apr 12, 2025 -

Rinku Singh Jaiswal Sudharsan Ex Pakistan Players Opinion On Indias Future In T20

Apr 12, 2025

Rinku Singh Jaiswal Sudharsan Ex Pakistan Players Opinion On Indias Future In T20

Apr 12, 2025 -

3 Oyuncu Galatasaray Karsilasmasini Kaciriyor Thomas Reis Dogruluyor

Apr 12, 2025

3 Oyuncu Galatasaray Karsilasmasini Kaciriyor Thomas Reis Dogruluyor

Apr 12, 2025 -

Canli Skor Samsunspor Galatasaray Maci Sueper Lig De Gerilim Tirmaniyor

Apr 12, 2025

Canli Skor Samsunspor Galatasaray Maci Sueper Lig De Gerilim Tirmaniyor

Apr 12, 2025