Bitcoin & Ethereum Facing A Supply Crunch: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin & Ethereum Facing a Supply Crunch: What it Means for Investors

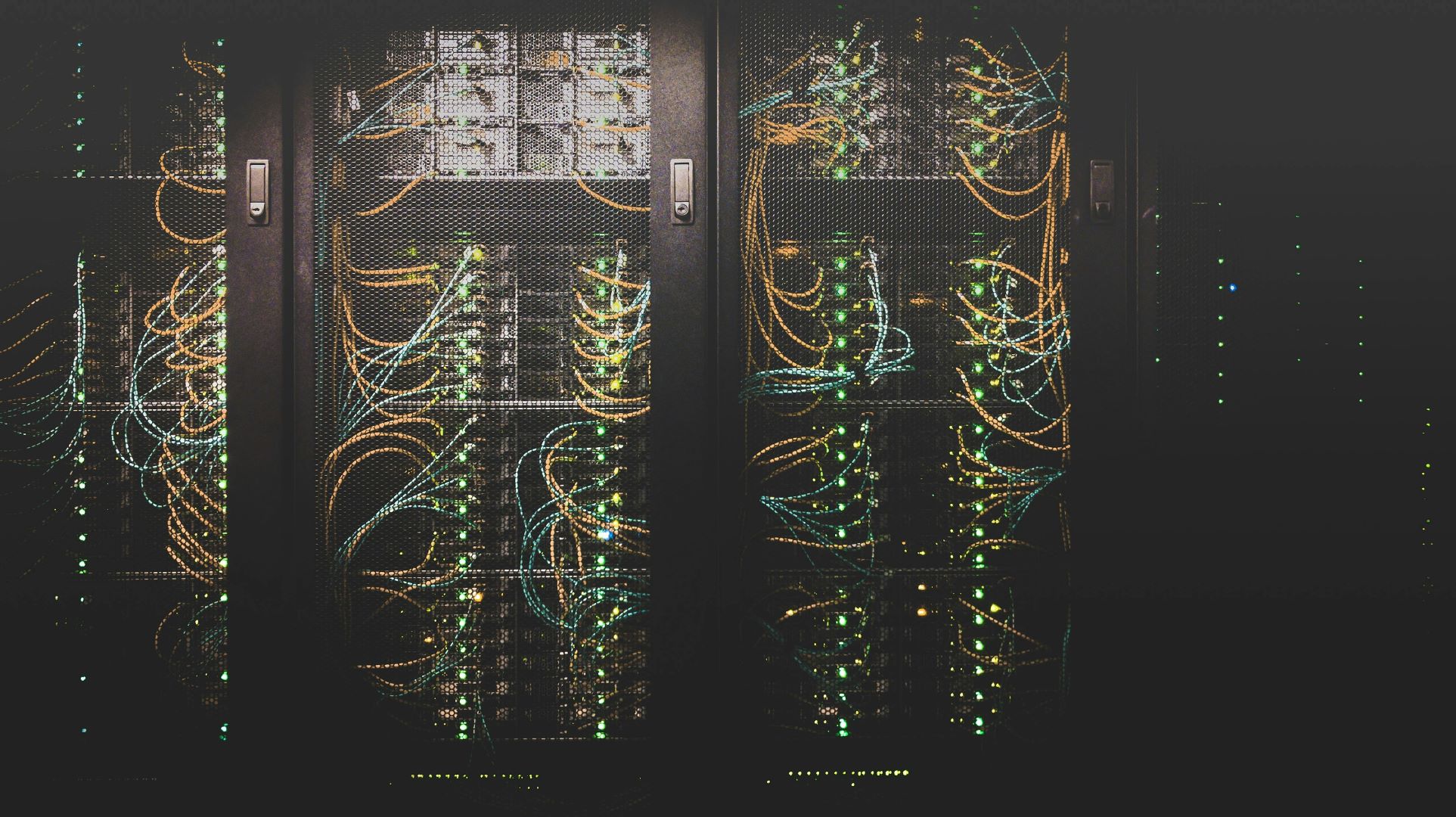

The cryptocurrency market is buzzing with excitement (and some trepidation) as both Bitcoin and Ethereum grapple with dwindling supplies. This isn't just a minor fluctuation; experts believe this supply crunch could significantly impact the price and future trajectory of these leading cryptocurrencies. But what exactly does it mean for investors? Let's delve into the details.

Understanding the Supply Crunch

The scarcity of Bitcoin and Ethereum stems from their inherent design. Both operate on a pre-defined, capped supply model. Bitcoin, with its 21 million coin limit, is nearing its maximum supply. While the exact date of the final Bitcoin being mined is still some years away, the rate at which new coins enter circulation is steadily decreasing. This "halving" mechanism, built into Bitcoin's code, reduces the reward for miners, creating a naturally deflationary pressure.

Ethereum, while not capped in the same way as Bitcoin, is undergoing a significant shift with its transition to a proof-of-stake (PoS) consensus mechanism. This move drastically reduces the rate of ETH issuance, effectively shrinking the circulating supply increase. The "burn mechanism," where ETH is destroyed during transactions, further exacerbates this scarcity.

The Impact on Price:

This reduced supply, coupled with persistent demand, is a classic recipe for price appreciation. Basic economics dictates that when demand remains high while supply decreases, prices inevitably rise. We've already seen periods of significant price increases for both Bitcoin and Ethereum, partially attributed to this tightening supply.

However, it's crucial to avoid simplistic interpretations. Price is influenced by numerous factors beyond just supply, including:

- Regulatory Landscape: Government regulations and policies significantly impact investor sentiment and market volatility.

- Market Sentiment: Overall market conditions, news events, and investor confidence play a crucial role.

- Technological Advancements: Innovations and developments within the blockchain ecosystem can drive price fluctuations.

- Adoption Rate: Wider adoption by businesses and individuals influences demand.

What it Means for Investors:

The supply crunch presents both opportunities and challenges for investors.

Opportunities:

- Long-Term Growth Potential: Many analysts believe the scarcity of Bitcoin and Ethereum makes them attractive long-term investments.

- Increased Value Proposition: The reduced supply strengthens their position as store-of-value assets, similar to gold.

- Potential for Higher Returns: While risky, the potential for significant price appreciation remains.

Challenges:

- Volatility: The cryptocurrency market is notoriously volatile, and price swings can be dramatic.

- Regulatory Uncertainty: The regulatory environment is constantly evolving, creating uncertainty for investors.

- Market Manipulation: The possibility of market manipulation, particularly in smaller cryptocurrencies, remains a concern.

Investing Wisely:

Before investing in Bitcoin or Ethereum (or any cryptocurrency), it's crucial to:

- Conduct Thorough Research: Understand the risks and rewards involved.

- Diversify Your Portfolio: Don't put all your eggs in one basket.

- Only Invest What You Can Afford to Lose: Cryptocurrency investments are inherently risky.

- Consult a Financial Advisor: Seek professional advice before making significant investment decisions.

The supply crunch facing Bitcoin and Ethereum is a significant development with potentially far-reaching consequences. While the scarcity creates a compelling case for long-term investment, investors must remain vigilant, understanding the inherent risks and the complex interplay of factors influencing cryptocurrency prices. The future remains uncertain, but the decreasing supply of these digital assets is undoubtedly shaping the narrative.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin & Ethereum Facing A Supply Crunch: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Minister Faishal Ibrahim Safeguarding Singapores Unity Against Divisive Rhetoric

May 26, 2025

Minister Faishal Ibrahim Safeguarding Singapores Unity Against Divisive Rhetoric

May 26, 2025 -

Maintaining Harmony Faishal Ibrahim On Combating Divisive Speech In Singapore

May 26, 2025

Maintaining Harmony Faishal Ibrahim On Combating Divisive Speech In Singapore

May 26, 2025 -

Ai Videos Energy Footprint A Surprising Revelation

May 26, 2025

Ai Videos Energy Footprint A Surprising Revelation

May 26, 2025 -

Pete Doherty Reveals Shocking Health Scare Led To Remarkable Transformation

May 26, 2025

Pete Doherty Reveals Shocking Health Scare Led To Remarkable Transformation

May 26, 2025 -

Viral Post Claims Tej Pratap In Relationship Politician Blames Facebook Hack

May 26, 2025

Viral Post Claims Tej Pratap In Relationship Politician Blames Facebook Hack

May 26, 2025