Bitcoin And Ethereum: The Supply Shock Has Arrived

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin and Ethereum: The Supply Shock Has Arrived

The cryptocurrency market is bracing for a significant shift as Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, experience a dramatic reduction in newly minted coins. This "supply shock," predicted by many analysts, is now a reality, potentially impacting price volatility and long-term market trends. What does this mean for investors and the future of these digital assets? Let's delve into the details.

H2: Understanding the Supply Shock

Both Bitcoin and Ethereum operate on a predetermined supply schedule. Bitcoin's total supply is capped at 21 million coins, with a halving mechanism reducing the rate of new coin creation roughly every four years. The recent halving in April 2020, and the upcoming halvings in the future, directly contribute to this dwindling supply. Ethereum, while not having a fixed total supply like Bitcoin, is undergoing a significant transition with the implementation of Ethereum 2.0 (also known as the Serenity upgrade). This upgrade shifts from a proof-of-work to a proof-of-stake consensus mechanism, drastically reducing the rate of ETH issuance.

H2: Impact on Market Prices

The reduced supply of both Bitcoin and Ethereum is expected to create upward pressure on prices, especially if demand remains strong or increases. Basic economics dictates that when supply decreases and demand stays constant or rises, prices tend to increase. This is the core principle behind the predicted price surge. However, other market factors, including regulatory changes, macroeconomic conditions, and overall investor sentiment, will also play a crucial role in determining the actual price movement.

H3: Bitcoin's Halving Effect:

The Bitcoin halving events have historically been followed by significant price increases in the months and years following the event. While past performance is not indicative of future results, the halving mechanism is a predictable event that has already influenced market behavior. This predictability contributes to the anticipation surrounding this supply shock.

H3: Ethereum's 2.0 Transition:

Ethereum's transition to proof-of-stake is a more complex factor. While reducing inflation, the transition itself has introduced some uncertainty into the market. Successfully completing the transition without major technical issues is crucial for maintaining investor confidence and avoiding negative price impacts. The reduced emission rate is a key part of the planned deflationary nature of the ETH supply.

H2: Risks and Considerations

It's crucial to remember that a supply shock doesn't guarantee immediate price appreciation. Several factors could counter this effect:

- Reduced Demand: A decrease in investor interest or a broader market downturn could offset the impact of reduced supply.

- Regulatory Uncertainty: Government regulations and legal challenges remain a significant risk for the cryptocurrency market as a whole.

- Market Manipulation: The possibility of market manipulation, particularly in less regulated markets, should always be considered.

H2: The Future of Bitcoin and Ethereum

The supply shock presents a significant turning point for both Bitcoin and Ethereum. While the long-term impact remains to be seen, the reduced supply is a powerful fundamental factor that could drive price appreciation. However, navigating the complexities of the cryptocurrency market requires careful analysis, risk management, and a clear understanding of the inherent volatility. Investors should conduct thorough research and consider their individual risk tolerance before making any investment decisions. The combination of reduced supply and growing institutional adoption positions both Bitcoin and Ethereum for potentially significant future growth. The coming months and years will be crucial in observing how the market reacts to this unprecedented supply shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin And Ethereum: The Supply Shock Has Arrived. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Avant Roland Garros Nadal Brise Le Silence Je N Ai Jamais Ete Un Esclave Du Tennis

May 25, 2025

Avant Roland Garros Nadal Brise Le Silence Je N Ai Jamais Ete Un Esclave Du Tennis

May 25, 2025 -

Conquer Nyt Spelling Bee Puzzle 446 Tips And Tricks For Success

May 25, 2025

Conquer Nyt Spelling Bee Puzzle 446 Tips And Tricks For Success

May 25, 2025 -

Serie A Winner Napoli Scott Mc Tominays Move To Man Utd Adds To Historic Season

May 25, 2025

Serie A Winner Napoli Scott Mc Tominays Move To Man Utd Adds To Historic Season

May 25, 2025 -

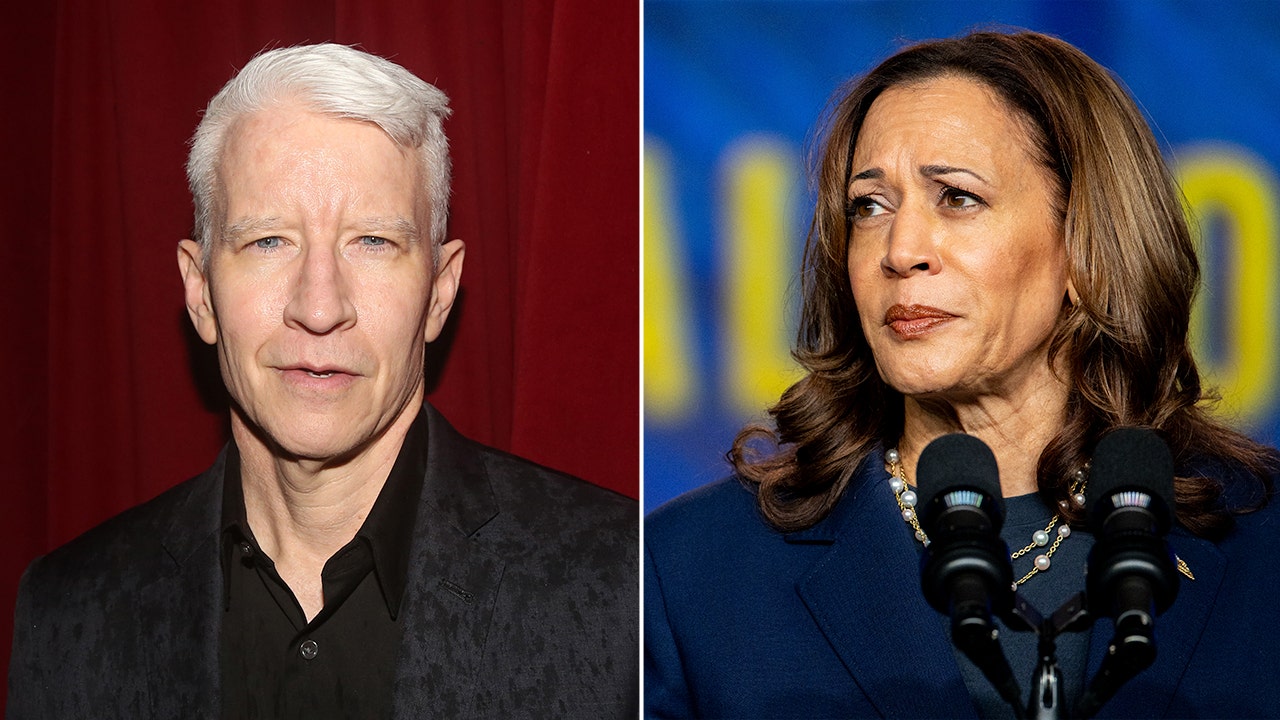

Book Exposes Tense Moments Kamala Harris And Anderson Cooper After 2020 Debate

May 25, 2025

Book Exposes Tense Moments Kamala Harris And Anderson Cooper After 2020 Debate

May 25, 2025 -

Baseball Teams Anti Aoc Video Sparks Wave Of Online Harassment And Death Threats

May 25, 2025

Baseball Teams Anti Aoc Video Sparks Wave Of Online Harassment And Death Threats

May 25, 2025

Latest Posts

-

French Open 2024 Opelkas Powerful Performance Against Hijikata

May 25, 2025

French Open 2024 Opelkas Powerful Performance Against Hijikata

May 25, 2025 -

Roland Garros 2025 Opelka Vs Hijikata Match Preview Betting Odds And Prediction

May 25, 2025

Roland Garros 2025 Opelka Vs Hijikata Match Preview Betting Odds And Prediction

May 25, 2025 -

From Poverty To Politics The Inspiring Story Of Ge 2025 Candidate Jeremy Tan

May 25, 2025

From Poverty To Politics The Inspiring Story Of Ge 2025 Candidate Jeremy Tan

May 25, 2025 -

Team News And Prediction Girona Vs Atletico Madrid La Liga Clash

May 25, 2025

Team News And Prediction Girona Vs Atletico Madrid La Liga Clash

May 25, 2025 -

Unexpected Energy Drain The High Cost Of Short Ai Videos

May 25, 2025

Unexpected Energy Drain The High Cost Of Short Ai Videos

May 25, 2025