Bitcoin As Legal Tender: A Case Study Of El Salvador And Its Relevance To The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin as Legal Tender: El Salvador's Experiment and its Implications for the US

El Salvador's bold move to adopt Bitcoin as legal tender in September 2021 sent shockwaves through the global financial landscape. While hailed by some as a revolutionary step towards financial inclusion and economic freedom, others criticized it as a reckless gamble with potentially devastating consequences. This case study examines El Salvador's experience, analyzing its successes and failures, and exploring its relevance to the ongoing debate about the role of cryptocurrencies in the United States.

The El Salvadorian Experiment: A Mixed Bag

The initial rollout of Bitcoin as legal tender in El Salvador was met with both enthusiasm and apprehension. The government’s ambitious goal was to boost financial inclusion, particularly for the unbanked population, and attract foreign investment. The government launched the "Chivo" wallet, aiming to simplify Bitcoin transactions.

However, the reality has been far more complex. The cryptocurrency's volatility led to significant losses for many Salvadorans, especially those who were forced to accept Bitcoin payments for goods and services. The lack of widespread Bitcoin literacy and the technical challenges associated with using the Chivo wallet further exacerbated the problems. Adoption rates, initially high due to government incentives, have since plummeted.

Challenges Faced by El Salvador:

- Volatility: Bitcoin's price fluctuations have directly impacted the Salvadoran economy, causing uncertainty and loss for businesses and individuals.

- Lack of Infrastructure: Inadequate internet access and technological literacy hampered the widespread adoption of Bitcoin.

- Security Concerns: Concerns about security breaches and scams related to Bitcoin transactions remain significant.

- Environmental Impact: Bitcoin's energy consumption is a significant environmental concern, particularly relevant for a developing nation.

- Transparency and Regulation: A lack of transparency and robust regulatory framework surrounding Bitcoin transactions raised concerns about illicit activities.

Lessons Learned and Relevance to the US:

El Salvador's experience offers valuable lessons for other countries considering similar policies, including the United States. While the experiment hasn't yielded the expected economic benefits, it highlights the crucial need for:

- Robust infrastructure: Widespread internet access and digital literacy are prerequisites for successful cryptocurrency adoption.

- Comprehensive education and awareness: Educating the public about the risks and benefits of cryptocurrencies is vital.

- Strong regulatory frameworks: Clear regulations are essential to protect consumers and prevent illicit activities.

- Gradual implementation: A phased approach to cryptocurrency adoption, allowing for adjustments and learning from experience, is crucial.

The US Context: A Cautious Approach

The US, unlike El Salvador, has a much more developed financial system and a higher level of technological literacy. However, the debate about incorporating cryptocurrencies into the US financial system is ongoing. While some see potential benefits in terms of innovation and financial inclusion, concerns about volatility, security, and regulation remain significant. The El Salvadorian experience serves as a cautionary tale, emphasizing the potential pitfalls of a hasty and ill-prepared adoption of Bitcoin as legal tender.

Looking Ahead:

The future of Bitcoin and other cryptocurrencies remains uncertain. However, El Salvador's experience provides invaluable insight into the challenges and complexities of integrating cryptocurrencies into a national economy. A measured, well-regulated approach, prioritizing consumer protection and financial stability, is essential for any country considering similar policies. The US, with its sophisticated financial infrastructure, must proceed with caution, learning from El Salvador's mistakes to avoid similar pitfalls. The focus should be on fostering innovation while mitigating the inherent risks associated with cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin As Legal Tender: A Case Study Of El Salvador And Its Relevance To The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Robinhoods Plea A Unified Federal Framework For Tokenized Real World Assets

May 23, 2025

Robinhoods Plea A Unified Federal Framework For Tokenized Real World Assets

May 23, 2025 -

Win R59 Million Tonights Lotto Results

May 23, 2025

Win R59 Million Tonights Lotto Results

May 23, 2025 -

Australian Competition And Consumer Commissions Warning To Elon Musks Starlink

May 23, 2025

Australian Competition And Consumer Commissions Warning To Elon Musks Starlink

May 23, 2025 -

Buy Now Pay Later With Klarna Tvs And Air Pods Financing Options

May 23, 2025

Buy Now Pay Later With Klarna Tvs And Air Pods Financing Options

May 23, 2025 -

Amber Alert 15 Year Old Girl Last Seen With Older Man In North Harris County

May 23, 2025

Amber Alert 15 Year Old Girl Last Seen With Older Man In North Harris County

May 23, 2025

Latest Posts

-

Trump Vs Harvard How The Legal Battle Impacts International Students

May 23, 2025

Trump Vs Harvard How The Legal Battle Impacts International Students

May 23, 2025 -

Budget Friendly Echo Show Amazons Bold Move Against Googles Smart Displays

May 23, 2025

Budget Friendly Echo Show Amazons Bold Move Against Googles Smart Displays

May 23, 2025 -

Enhanced Security Chrome Auto Replaces Compromised Passwords

May 23, 2025

Enhanced Security Chrome Auto Replaces Compromised Passwords

May 23, 2025 -

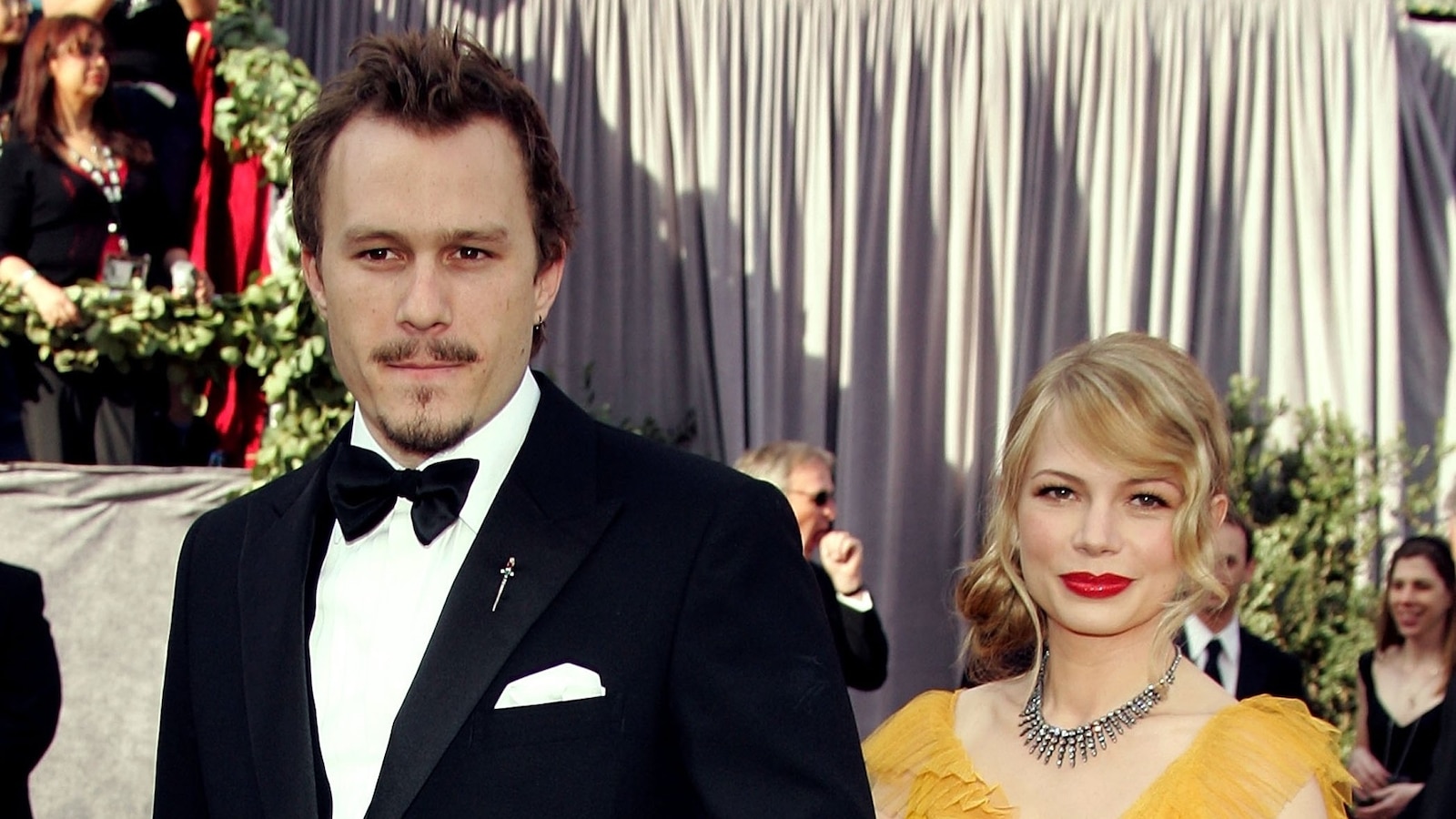

Heath Ledgers Legacy Michelle Williams Shares Emotional Memories Of Their Daughter

May 23, 2025

Heath Ledgers Legacy Michelle Williams Shares Emotional Memories Of Their Daughter

May 23, 2025 -

Protect Your Data Chromes Credential Manager Offers Automatic Password Updates

May 23, 2025

Protect Your Data Chromes Credential Manager Offers Automatic Password Updates

May 23, 2025