Bitcoin As Legal Tender: Comparing El Salvador's Adoption With The US Context

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin as Legal Tender: El Salvador's Experiment vs. the US Context

Bitcoin's rise as a potential alternative currency has sparked global debate, with El Salvador's bold move to adopt it as legal tender in September 2021 serving as a high-profile case study. However, the US context presents a vastly different landscape, highlighting the complexities and contrasting approaches to cryptocurrency regulation and adoption. This article compares and contrasts the two scenarios, examining the successes, failures, and implications for the future of Bitcoin's role in global finance.

El Salvador's Bitcoin Law: A Risky Gamble?

El Salvador's decision to make Bitcoin legal tender alongside the US dollar was met with both excitement and skepticism. Proponents argued it would boost financial inclusion, attract foreign investment, and modernize the economy. The government launched the Chivo digital wallet to facilitate Bitcoin transactions, offering incentives for adoption.

However, the implementation faced significant challenges. Volatility in Bitcoin's price led to substantial losses for many Salvadorans who were forced to use it for everyday transactions. Furthermore, lack of infrastructure and widespread digital literacy hampered widespread adoption, and the lack of transparency and potential for corruption surrounding the government's Bitcoin investments raised concerns. While the government claims success in certain areas like increased tourism and remittance inflows, independent analyses paint a more complex picture, highlighting considerable economic and social costs.

The US Stance: Cautious Regulation and Technological Innovation

The US approach to Bitcoin differs dramatically. While Bitcoin isn't legal tender, its use is largely tolerated, albeit within a framework of increasing regulatory scrutiny. The focus is on consumer protection and preventing illicit activities, rather than promoting Bitcoin as a mainstream currency. Several US states have embraced blockchain technology and cryptocurrencies through pilot programs and supportive legislation, but the federal government maintains a cautious stance, prioritizing the stability of the traditional financial system.

Key Differences: A Comparative Analysis

| Feature | El Salvador | United States |

|---|---|---|

| Legal Status | Legal tender alongside the US dollar | Not legal tender; regulated as a commodity |

| Government Role | Active promotion and investment | Primarily regulatory; cautious approach |

| Adoption Rate | Limited; significant challenges reported | Growing adoption, primarily for investment |

| Regulatory Focus | Less stringent; concerns about transparency | Stricter; focus on consumer protection and AML/CFT |

| Economic Impact | Debated; potential benefits and drawbacks | Primarily indirect, impacting fintech innovation |

The Future of Bitcoin: Global Perspectives

El Salvador's experiment, while controversial, provides valuable data on the practical challenges of widespread Bitcoin adoption. The US, on the other hand, represents a more measured approach, prioritizing regulatory oversight and financial stability. The contrasting strategies underscore the complexities involved in integrating Bitcoin into national economies, with no single "correct" path emerging.

The future of Bitcoin's role in the global economy hinges on several factors, including:

- Regulatory clarity: Consistent and transparent regulations are crucial for fostering trust and growth.

- Technological advancements: Improvements in scalability and security will be vital.

- Public perception and adoption: Increased understanding and acceptance among the general public are necessary for widespread use.

- Volatility management: Addressing Bitcoin's inherent price volatility remains a significant challenge.

Ultimately, the journey of Bitcoin as a mainstream currency is far from over. The ongoing experiences of countries like El Salvador and the regulatory evolution in the US will shape the future of this groundbreaking technology, impacting the global financial landscape in significant ways. Continued monitoring and analysis are crucial to understanding the evolving role of Bitcoin in the world economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin As Legal Tender: Comparing El Salvador's Adoption With The US Context. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chegg Announces Major Layoffs The Rise Of Ai In Education

May 15, 2025

Chegg Announces Major Layoffs The Rise Of Ai In Education

May 15, 2025 -

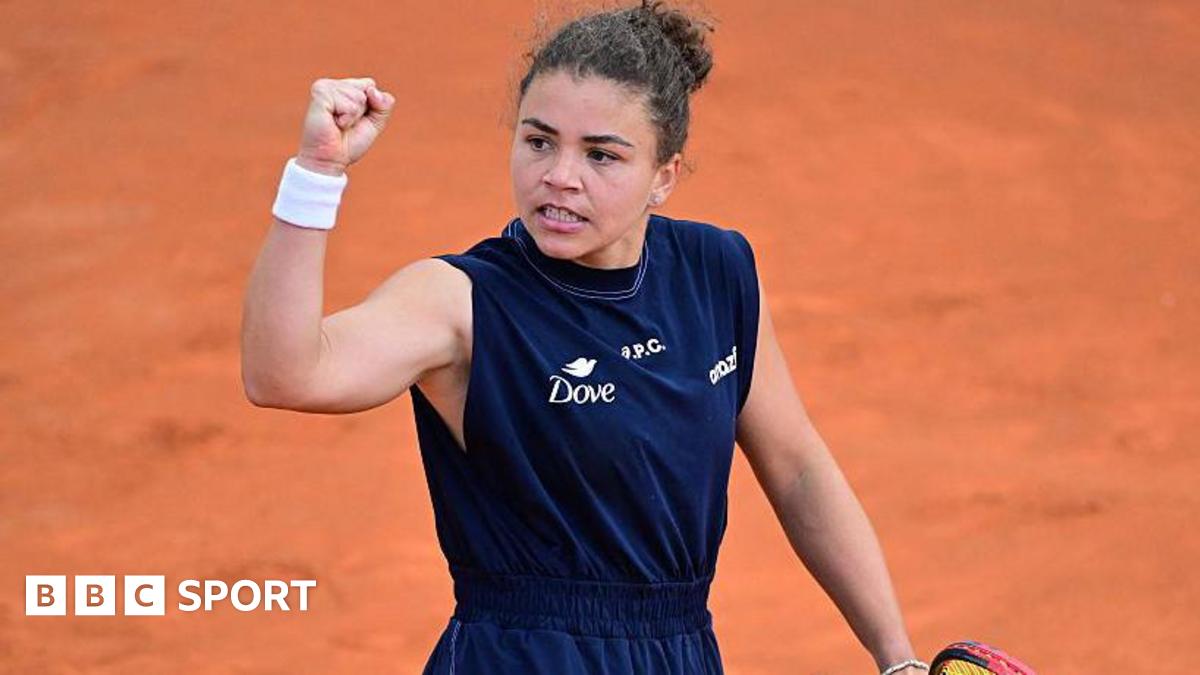

Italian Open 2024 Paolinis Resilience Secures Victory Over Shnaider

May 15, 2025

Italian Open 2024 Paolinis Resilience Secures Victory Over Shnaider

May 15, 2025 -

Analysis Pakistans Use Of Chinese J 10 C Fighter Jets And Missiles

May 15, 2025

Analysis Pakistans Use Of Chinese J 10 C Fighter Jets And Missiles

May 15, 2025 -

Oklahoma City Thunder Defeat Denver Nuggets In High Scoring Game 5 Sgas Impact

May 15, 2025

Oklahoma City Thunder Defeat Denver Nuggets In High Scoring Game 5 Sgas Impact

May 15, 2025 -

Giro D Italia Stage 5 Matera Awaits As Van Aert Eyes Another Triumph

May 15, 2025

Giro D Italia Stage 5 Matera Awaits As Van Aert Eyes Another Triumph

May 15, 2025

Latest Posts

-

The Jon Rahm Enigma Unpacking His Reserved Response After The Ryder Cup

May 15, 2025

The Jon Rahm Enigma Unpacking His Reserved Response After The Ryder Cup

May 15, 2025 -

New Zealander Ryan Fox Claims Pga Championship Spot At Myrtle Beach Classic

May 15, 2025

New Zealander Ryan Fox Claims Pga Championship Spot At Myrtle Beach Classic

May 15, 2025 -

Paolini Stearns Live Score Update Jasmine Saves Set Point Takes Break

May 15, 2025

Paolini Stearns Live Score Update Jasmine Saves Set Point Takes Break

May 15, 2025 -

Chris Brown Arrested R And B Singer Detained At Uk Hotel Following Nightclub Assault

May 15, 2025

Chris Brown Arrested R And B Singer Detained At Uk Hotel Following Nightclub Assault

May 15, 2025 -

Paolinis Semifinal Berth A Triumph At The Italian Open

May 15, 2025

Paolinis Semifinal Berth A Triumph At The Italian Open

May 15, 2025