Bitcoin Breaks $106,000 Barrier: A Deeper Look At Institutional Involvement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Breaks $106,000 Barrier: A Deeper Look at Institutional Involvement

Bitcoin's meteoric rise continues, smashing the $106,000 mark for the first time in history! This unprecedented surge has sent shockwaves through the crypto market, prompting analysts to delve deeper into the driving forces behind this remarkable rally. While retail investor enthusiasm undoubtedly plays a role, the increasing involvement of institutional investors is emerging as a key catalyst for this historic Bitcoin price breakthrough.

This monumental leap signifies more than just a price increase; it underscores Bitcoin's growing acceptance as a legitimate asset class among sophisticated financial players. But what exactly is fueling this institutional influx? Let's dissect the key factors contributing to this unprecedented market momentum.

H2: The Institutional Influx: More Than Just a Trend

For years, Bitcoin's volatility deterred many institutional investors. However, recent shifts in the financial landscape have dramatically altered this perception. Several crucial factors are driving this change:

-

Increased Regulatory Clarity: While regulatory frameworks surrounding cryptocurrencies remain complex and evolving, increasing clarity in jurisdictions like the US and parts of Europe is fostering a more comfortable environment for institutional participation. This reduced uncertainty encourages larger players to allocate assets to Bitcoin.

-

Sophisticated Investment Vehicles: The emergence of Bitcoin-related investment products, including exchange-traded funds (ETFs) and other institutional-grade investment vehicles, has significantly lowered the barrier to entry for large-scale investments. These products offer a more manageable and regulated approach to Bitcoin exposure.

-

Portfolio Diversification: In a period of economic uncertainty and historically low interest rates, many institutional investors are seeking alternative assets to diversify their portfolios and hedge against inflation. Bitcoin, with its decentralized nature and limited supply, is increasingly viewed as a suitable inflation hedge.

-

Growing Institutional Adoption: Major corporations, such as MicroStrategy and Tesla, have already made significant Bitcoin acquisitions, demonstrating a growing acceptance of Bitcoin as a strategic asset. This corporate endorsement carries substantial weight and encourages other institutional investors to follow suit.

H2: Analyzing the Price Surge: Short-Term Volatility vs. Long-Term Growth

While the recent price surge is exhilarating, it's crucial to maintain a balanced perspective. The cryptocurrency market remains inherently volatile, and short-term fluctuations are to be expected. However, the sustained upward trajectory, fueled by institutional involvement, suggests a more profound long-term trend.

Several analysts predict further growth, pointing to factors like:

-

Halving Events: The upcoming Bitcoin halving event, which reduces the rate of new Bitcoin creation, is expected to further limit supply and potentially push prices upward.

-

Global Adoption: Increased adoption of Bitcoin in emerging markets could also contribute to sustained price increases.

-

Technological Advancements: Continued development and improvements in Bitcoin's underlying technology will enhance its scalability and efficiency, attracting even more investors.

H2: Navigating the Future of Bitcoin: Cautious Optimism

The Bitcoin market is dynamic and unpredictable. While the current price surge is impressive, investors should approach the market with a degree of caution. Thorough due diligence and a well-defined investment strategy are paramount.

Key Takeaways:

- The recent Bitcoin price surge above $106,000 is largely attributed to increasing institutional investment.

- Regulatory clarity, sophisticated investment vehicles, and the need for portfolio diversification are driving this institutional involvement.

- While short-term volatility is expected, the long-term outlook for Bitcoin remains positive, driven by several factors including halving events and global adoption.

- Investors should proceed with caution and conduct thorough research before investing in Bitcoin.

This significant milestone in Bitcoin's history highlights its evolving role in the global financial system. The continued participation of institutional investors suggests a bright future for Bitcoin, but careful analysis and risk management remain crucial for navigating this exciting yet volatile market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Breaks $106,000 Barrier: A Deeper Look At Institutional Involvement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Peter De Boer Strategies Successes And Setbacks Of A Hockey Coach

May 22, 2025

Peter De Boer Strategies Successes And Setbacks Of A Hockey Coach

May 22, 2025 -

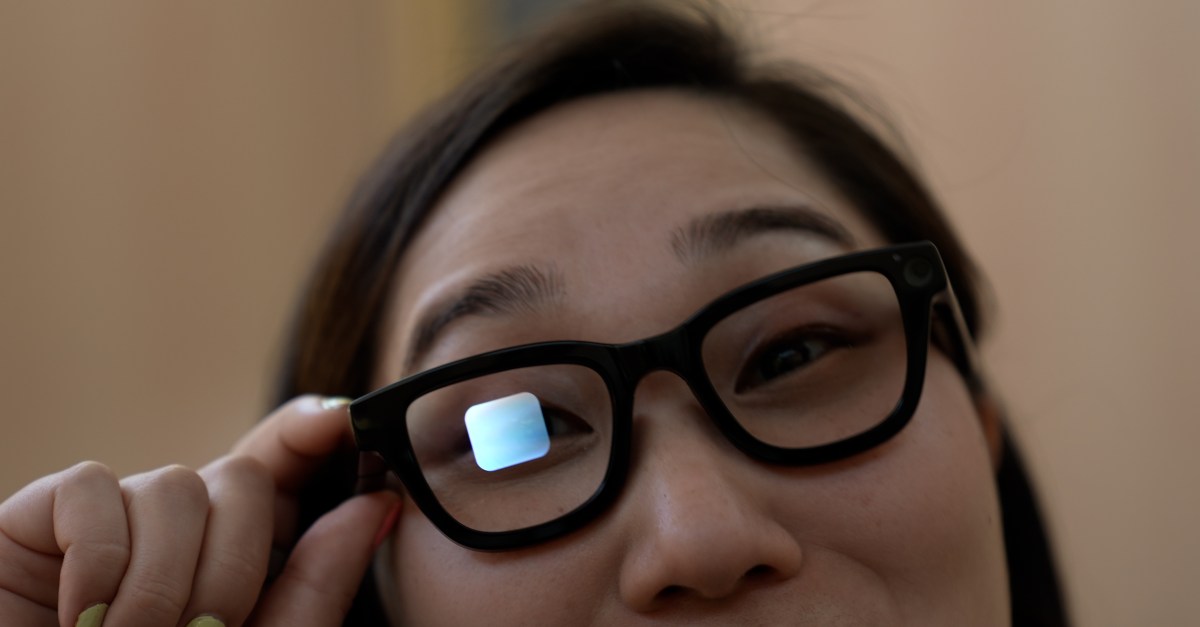

Googles Ai Smart Glasses Prototype Features Performance And Impressions

May 22, 2025

Googles Ai Smart Glasses Prototype Features Performance And Impressions

May 22, 2025 -

Collectors Rejoice Metal Mario Arrives In Hot Wheels

May 22, 2025

Collectors Rejoice Metal Mario Arrives In Hot Wheels

May 22, 2025 -

Stock Market Update Deep Losses For Dow S And P 500 And Nasdaq Bitcoin Sets Record

May 22, 2025

Stock Market Update Deep Losses For Dow S And P 500 And Nasdaq Bitcoin Sets Record

May 22, 2025 -

Tottenham Hotspur Triumphs Europa League Final Victory Over Manchester United

May 22, 2025

Tottenham Hotspur Triumphs Europa League Final Victory Over Manchester United

May 22, 2025