Bitcoin (BTC) Analysis: Bull Market Correction Or Reversal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin (BTC) Analysis: Bull Market Correction or Reversal?

Bitcoin's recent price action has left many investors wondering: is this a temporary correction within a bullish trend, or the start of a significant market reversal? The cryptocurrency's volatility is legendary, making accurate prediction challenging, but by analyzing key on-chain metrics and market sentiment, we can attempt to shed light on the situation.

The Current State of Play:

Bitcoin, after reaching its 2023 high, has experienced a noticeable pullback. This downturn has sparked debate amongst analysts, with opinions ranging from a healthy consolidation phase to the beginning of a prolonged bear market. Understanding the nuances of this situation requires a deep dive into various indicators.

Is it a Correction? Arguments for Continued Bullishness:

Several factors suggest this dip could simply be a correction within a larger bull market:

- On-chain metrics: Despite the price drop, some key on-chain indicators remain positive. For example, the number of active addresses and transaction volume haven't significantly decreased, suggesting sustained network activity and underlying demand. This contrasts with previous bear markets where these metrics plummeted.

- Long-term holders: Data shows that long-term Bitcoin holders (those holding BTC for extended periods) haven't been selling off en masse. This resilience points to a belief in Bitcoin's long-term potential, even amidst short-term price fluctuations. This hodling behavior is a bullish signal.

- Regulatory clarity (potential): While regulatory uncertainty remains a significant factor impacting crypto markets, positive developments in certain jurisdictions could boost investor confidence and trigger another price surge. Any positive news on this front could act as a catalyst for further growth.

Is it a Reversal? Reasons for Bearish Concern:

On the other hand, the recent decline also raises concerns about a potential market reversal:

- Macroeconomic factors: Global macroeconomic conditions, including inflation and interest rate hikes, continue to pose a significant threat to risk assets, including Bitcoin. A further deterioration of the global economy could negatively impact Bitcoin's price.

- Overbought conditions: Before the recent dip, Bitcoin's price had experienced a rapid ascent, potentially leading to overbought conditions. Corrections are a natural part of market cycles, and this pullback could simply be a healthy unwinding of those gains.

- Technical analysis: Technical indicators, such as moving averages and relative strength index (RSI), may suggest bearish momentum, depending on the timeframe analyzed. However, technical analysis is subjective and should be considered alongside other factors.

Conclusion: Navigating the Uncertainty

Determining whether this is a correction or reversal is inherently difficult. The cryptocurrency market is notoriously volatile and influenced by a complex interplay of factors. While some indicators point to continued bullishness, others raise concerns about a potential market downturn.

Investors should adopt a cautious approach, diversifying their portfolios and avoiding impulsive decisions based solely on short-term price movements. Thorough research, encompassing on-chain analysis, macroeconomic conditions, and technical indicators, is crucial for informed decision-making. The Bitcoin market remains dynamic, and continued monitoring of key indicators is paramount for navigating the potential shifts ahead. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin (BTC) Analysis: Bull Market Correction Or Reversal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Vegas Golden Knights Season Ends Failure To Score Costs Playoffs

May 17, 2025

Vegas Golden Knights Season Ends Failure To Score Costs Playoffs

May 17, 2025 -

An Exclusive Look At Queen Latifahs Life And Career The Biopic And Beyond

May 17, 2025

An Exclusive Look At Queen Latifahs Life And Career The Biopic And Beyond

May 17, 2025 -

Tesla Model Y Autonomous Driving 1 5 Mile Texas Test Results

May 17, 2025

Tesla Model Y Autonomous Driving 1 5 Mile Texas Test Results

May 17, 2025 -

Analyzing Teslas Ai Chip Development Challenges Advantages And Market Implications

May 17, 2025

Analyzing Teslas Ai Chip Development Challenges Advantages And Market Implications

May 17, 2025 -

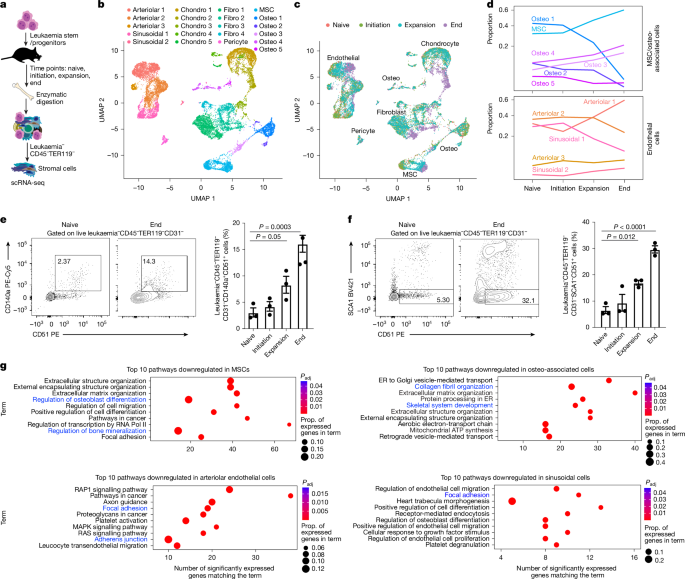

Leukaemogenesis Driven By Glycolysis The Crucial Role Of Taurine In The Tumor Microenvironment

May 17, 2025

Leukaemogenesis Driven By Glycolysis The Crucial Role Of Taurine In The Tumor Microenvironment

May 17, 2025