Bitcoin BTC Cycle Analysis: Charts Point To A Market Shift

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin BTC Cycle Analysis: Charts Point to a Market Shift

Bitcoin's price action is hinting at a potential market shift, according to recent cycle analyses. Traders and analysts are buzzing with speculation as charts reveal intriguing patterns suggesting a departure from recent trends. Could this be the start of a new bull run, or are we facing a period of consolidation before further price drops? Let's delve into the data and explore what the charts are telling us.

Understanding Bitcoin's Cyclical Nature:

Bitcoin, unlike traditional assets, operates on distinct cycles characterized by periods of intense growth (bull markets) followed by significant corrections (bear markets). Understanding these cycles is crucial for navigating the volatile cryptocurrency landscape. Analyzing historical price data, on-chain metrics, and market sentiment helps identify potential turning points and predict future price movements. This analysis incorporates various technical indicators like moving averages, Relative Strength Index (RSI), and the accumulation/distribution trend.

Key Indicators Suggesting a Potential Shift:

Several key indicators point towards a possible shift in the Bitcoin market:

-

Breaking Resistance Levels: Recent price action has shown Bitcoin breaking through significant resistance levels, suggesting a potential surge in buying pressure. This breakthrough could signal the start of a new upward trend. However, it's crucial to remember that breaking resistance doesn't guarantee sustained upward momentum.

-

On-Chain Metrics: On-chain data, including metrics like the MVRV Z-score and the exchange flow, are showing signs of accumulation, indicating that large holders (whales) are accumulating BTC, potentially setting the stage for a future price increase. This accumulation phase is often seen before a bull market begins.

-

Shifting Market Sentiment: While fear and uncertainty still linger among some investors, there's a growing sense of optimism within the Bitcoin community. Positive news surrounding Bitcoin adoption by institutional investors and the growing development of the Bitcoin ecosystem is fueling this sentiment shift.

However, Caution Remains Warranted:

While the indicators suggest a potential market shift, it's crucial to approach this with caution. The cryptocurrency market remains inherently volatile, and unforeseen events can significantly impact price movements.

-

Regulatory Uncertainty: Regulatory uncertainty in various jurisdictions continues to pose a risk to Bitcoin's price stability. Changes in regulatory frameworks can lead to significant price fluctuations.

-

Macroeconomic Factors: Global macroeconomic conditions, including inflation and interest rate hikes, can influence Bitcoin's price. These external factors often play a significant role in shaping the cryptocurrency market's trajectory.

-

Potential for Consolidation: Before any significant upward movement, Bitcoin might experience a period of consolidation, where the price fluctuates within a defined range before breaking out. This consolidation phase allows the market to absorb recent price movements and establish a new equilibrium before continuing its trend.

What's Next for Bitcoin?

The charts suggest a potential market shift, but whether this translates into a sustained bull run remains uncertain. A cautious approach is recommended, closely monitoring key indicators and remaining aware of the inherent volatility of the cryptocurrency market. Further analysis and observation of market behaviour are essential before drawing definitive conclusions. Continuous monitoring of on-chain data, technical analysis, and macroeconomic factors will be vital in determining the next phase of Bitcoin's price cycle. This is an exciting time for Bitcoin investors, and the coming months will likely provide greater clarity on the market's direction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin BTC Cycle Analysis: Charts Point To A Market Shift. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

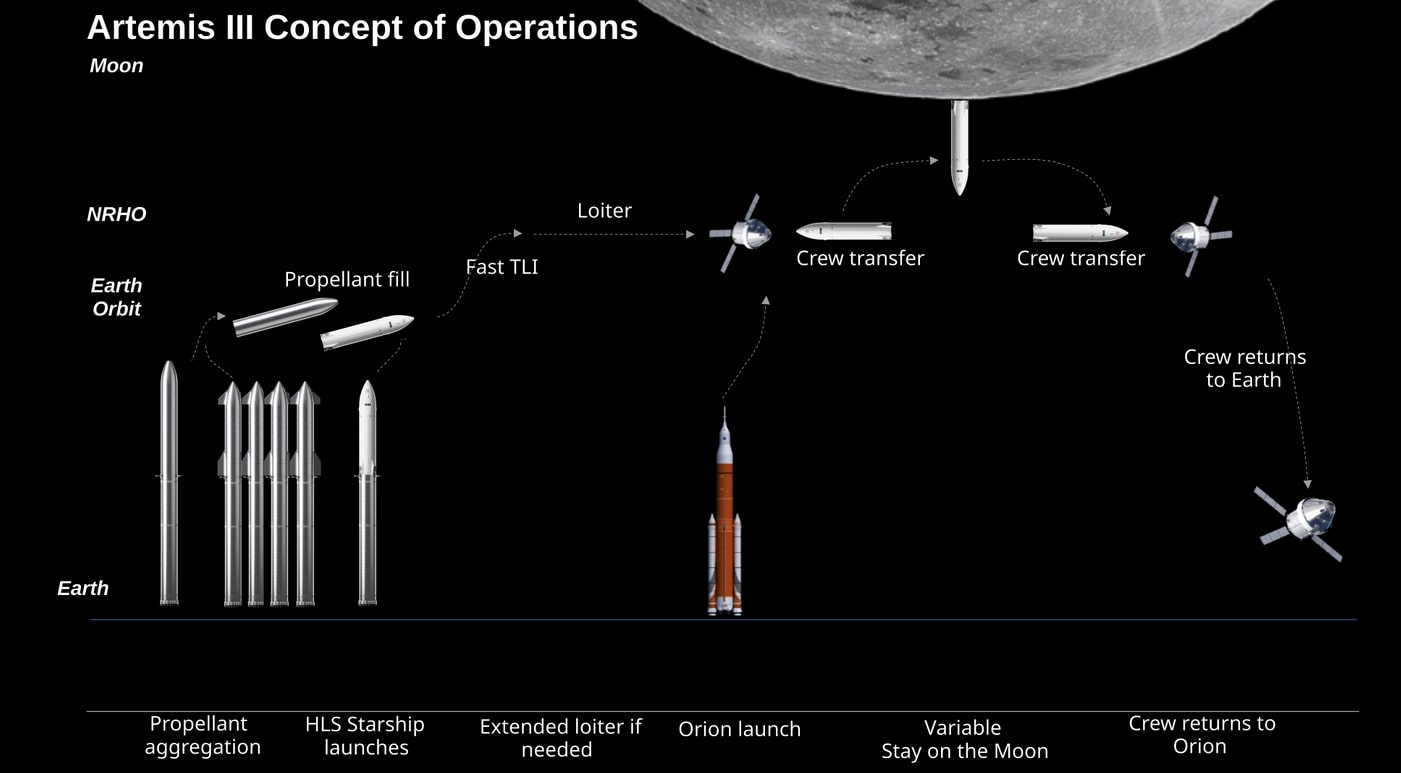

Nasas Budget Analyzing Overruns And Their Impact On Space Exploration

May 06, 2025

Nasas Budget Analyzing Overruns And Their Impact On Space Exploration

May 06, 2025 -

Despite Strong Ai Driven Revenue Forecast Palantir Stock Underwhelms Investors

May 06, 2025

Despite Strong Ai Driven Revenue Forecast Palantir Stock Underwhelms Investors

May 06, 2025 -

Met Gala 2025 The Truth Behind Ariana Grandes No Show

May 06, 2025

Met Gala 2025 The Truth Behind Ariana Grandes No Show

May 06, 2025 -

Diljit Dosanjhs Met Gala 2025 Look A Fusion Of Punjabi Heritage And Regal Style

May 06, 2025

Diljit Dosanjhs Met Gala 2025 Look A Fusion Of Punjabi Heritage And Regal Style

May 06, 2025 -

Playoffs Game 1 Celtics Holiday Cleared To Face Knicks

May 06, 2025

Playoffs Game 1 Celtics Holiday Cleared To Face Knicks

May 06, 2025

Latest Posts

-

Rockies Fall To Giants 3 9 In Mlb Gameday Action May 4 2025

May 06, 2025

Rockies Fall To Giants 3 9 In Mlb Gameday Action May 4 2025

May 06, 2025 -

Met Gala 2025 A Comprehensive Guide To Fashions Biggest Event

May 06, 2025

Met Gala 2025 A Comprehensive Guide To Fashions Biggest Event

May 06, 2025 -

Nuggets Vs Thunder Play By Play And Final Score May 6th 2025 Espn Australia

May 06, 2025

Nuggets Vs Thunder Play By Play And Final Score May 6th 2025 Espn Australia

May 06, 2025 -

Ministers Ong Ye Kung And Chee Hong Tat Issue Statement On Su Haijin

May 06, 2025

Ministers Ong Ye Kung And Chee Hong Tat Issue Statement On Su Haijin

May 06, 2025 -

250 Million Business Empire The Unlikely Success Of An Nba What If

May 06, 2025

250 Million Business Empire The Unlikely Success Of An Nba What If

May 06, 2025