Bitcoin (BTC) Cycle Analysis: Three Charts Pointing To A Potential Market Top

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin (BTC) Cycle Analysis: Three Charts Pointing to a Potential Market Top

Bitcoin's price has seen significant volatility in recent months, leaving many investors wondering if the current bull run is nearing its peak. While predicting the future of Bitcoin is notoriously difficult, a careful analysis of three key charts suggests a potential market top may be on the horizon. This analysis focuses on factors beyond simple price action, incorporating on-chain metrics and historical cycle comparisons to paint a more complete picture.

1. The Bitcoin Stock-to-Flow (S2F) Model: Divergence and Diminishing Returns

The popular Bitcoin Stock-to-Flow (S2F) model, while having enjoyed considerable success in predicting past price movements, is currently showing signs of divergence. This model, based on the scarcity of Bitcoin and its halving cycles, historically correlated strongly with price increases. However, recent price action has significantly outpaced the model's predictions. This divergence suggests that other market forces are at play, potentially indicating a weakening of the underlying bullish narrative supported by S2F.

- Key takeaway: While S2F remains a useful long-term indicator, its current divergence should be viewed as a cautionary sign. It suggests that the narrative driving the price upwards may be losing steam.

2. On-Chain Metrics: High Miner Profitability & Potential for Consolidation

Examining on-chain metrics provides a more granular understanding of market sentiment. Currently, miner profitability is exceptionally high, indicating a potentially unsustainable level of reward relative to the network's operating costs. This can be a precursor to a period of price consolidation or even correction, as miners may be incentivized to sell their holdings to lock in profits.

Furthermore, the recent increase in large Bitcoin transactions suggests increased activity amongst whales and institutional investors. While this could indicate further upward pressure, it also carries the potential for sudden large-scale selling if market sentiment shifts.

- Key takeaway: High miner profitability and increased large transaction volumes are double-edged swords. While bullish in the short-term, they highlight a risk of significant selling pressure in the event of a market downturn.

3. Historical Cycle Comparison: Echoes of Past Bull Runs

Comparing the current Bitcoin cycle with previous bull runs reveals striking similarities in terms of price action, market hype, and the emergence of speculative altcoins. Historical analysis shows that periods of extreme exuberance and rapid price increases are often followed by significant corrections. The current market displays many characteristics reminiscent of these past cycles, particularly the late stages of previous bull markets.

- Key takeaway: While history doesn't perfectly repeat itself, recognizing these cyclical patterns provides valuable context. The similarities between the present cycle and previous ones suggest a higher probability of a market correction in the near future.

Conclusion: A Cautious Outlook

While Bitcoin's long-term prospects remain promising, the confluence of these three factors—S2F model divergence, high miner profitability, and historical cycle analysis—suggests a potential market top. It's crucial for investors to exercise caution and manage risk appropriately. This isn't necessarily a prediction of an imminent crash, but a strong indication that the current bullish momentum may be waning. Investors should focus on risk management strategies and consider diversifying their portfolios. The cryptocurrency market remains volatile, and informed decision-making based on comprehensive analysis is paramount. Remember to always conduct thorough research and consult with financial advisors before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin (BTC) Cycle Analysis: Three Charts Pointing To A Potential Market Top. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Controversial Gary Glitter Lyric Prompts Oasis To Cut Song From Reunion Shows

May 06, 2025

Controversial Gary Glitter Lyric Prompts Oasis To Cut Song From Reunion Shows

May 06, 2025 -

Game 6 On The Line Jets Ehlers Pre Game Jersey Incident Sparks Worry

May 06, 2025

Game 6 On The Line Jets Ehlers Pre Game Jersey Incident Sparks Worry

May 06, 2025 -

Liguilla Esta Noche El Octavo Equipo Clasificado Pronosticos Y Analisis

May 06, 2025

Liguilla Esta Noche El Octavo Equipo Clasificado Pronosticos Y Analisis

May 06, 2025 -

Steve Kerr Golden State Ready For Rockets In Winner Take All Game 6

May 06, 2025

Steve Kerr Golden State Ready For Rockets In Winner Take All Game 6

May 06, 2025 -

Sunday Wordle Solution Nyt Wordle Answer And Hints For Game 1415 May 4th

May 06, 2025

Sunday Wordle Solution Nyt Wordle Answer And Hints For Game 1415 May 4th

May 06, 2025

Latest Posts

-

Giants Cubs Series Opens 3 Game Showdown Begins

May 06, 2025

Giants Cubs Series Opens 3 Game Showdown Begins

May 06, 2025 -

Gilgeous Alexander Thunder Face Defining Playoff Challenge Against Nuggets

May 06, 2025

Gilgeous Alexander Thunder Face Defining Playoff Challenge Against Nuggets

May 06, 2025 -

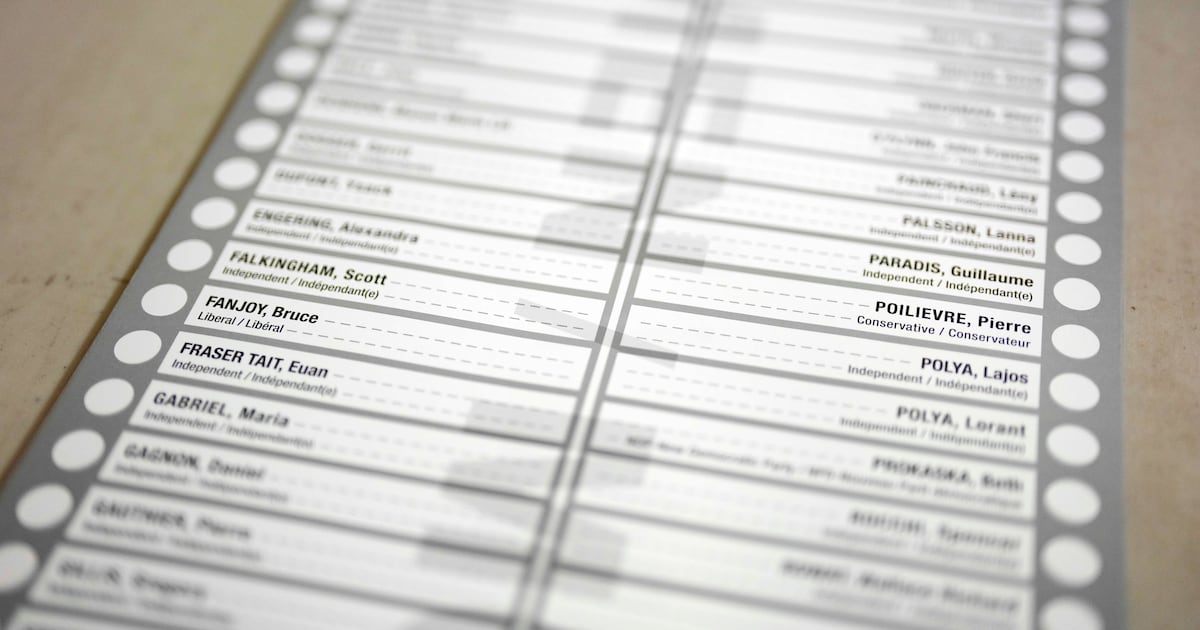

Over 200 Names Added Protest Group Challenges Poilievre In Alberta Byelection

May 06, 2025

Over 200 Names Added Protest Group Challenges Poilievre In Alberta Byelection

May 06, 2025 -

First Mass Produced Outdoor Exoskeleton Improved Hip Motion For Enhanced Mobility

May 06, 2025

First Mass Produced Outdoor Exoskeleton Improved Hip Motion For Enhanced Mobility

May 06, 2025 -

Astros Rout White Sox 8 3 In Mlb Gameday Showdown May 3 2025

May 06, 2025

Astros Rout White Sox 8 3 In Mlb Gameday Showdown May 3 2025

May 06, 2025