Bitcoin (BTC) Hits Record High: Market Analysis And Future Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin (BTC) Hits Record High: Market Analysis and Future Predictions

Bitcoin (BTC) has once again shattered its previous all-time high, sending shockwaves through the cryptocurrency market and sparking intense speculation about its future trajectory. This unprecedented surge has captivated investors and analysts alike, prompting a deep dive into the market forces driving this remarkable growth and the potential implications for the future of digital currencies.

What Fueled Bitcoin's Record-Breaking Ascent?

Several factors contributed to Bitcoin's latest record-breaking performance. Firstly, growing institutional adoption plays a crucial role. Major corporations and financial institutions are increasingly recognizing Bitcoin as a legitimate asset class, leading to significant investment inflows. This institutional interest lends credibility and stability to the market, attracting even more investors.

Secondly, inflationary pressures in traditional financial markets are pushing investors towards alternative assets, including Bitcoin. With fiat currencies losing purchasing power, Bitcoin, with its fixed supply of 21 million coins, is seen as a hedge against inflation. This "digital gold" narrative continues to gain traction, driving demand.

Thirdly, increasing regulatory clarity (although still evolving globally) is boosting investor confidence. While regulatory frameworks remain complex and vary across jurisdictions, a growing number of countries are developing clearer guidelines for cryptocurrencies, reducing uncertainty and attracting institutional participation.

Finally, technological advancements within the Bitcoin ecosystem, such as the Lightning Network, are improving scalability and transaction speeds, addressing some of the long-standing criticisms of Bitcoin's infrastructure.

Market Analysis: Deciphering the Current Trends

The current market demonstrates a strong bullish sentiment, but caution is warranted. While the recent price surge is impressive, it's important to remember that cryptocurrency markets are inherently volatile. Sudden price corrections are possible, and investors should be prepared for market fluctuations. Technical analysis, focusing on key support and resistance levels, remains crucial for informed decision-making.

- Support Levels: Identifying key support levels is vital for assessing potential price floor during market corrections.

- Resistance Levels: Monitoring resistance levels helps predict potential price ceilings and potential sell-offs.

- Trading Volume: High trading volume often accompanies significant price movements, providing insights into market momentum.

Future Predictions: Navigating the Uncertainties

Predicting the future price of Bitcoin is inherently challenging. However, based on current trends and expert opinions, several potential scenarios are worth considering:

- Continued Growth: Sustained institutional adoption, coupled with increasing global acceptance and technological advancements, could drive further price appreciation.

- Consolidation: After a significant price surge, a period of consolidation is common, with price fluctuations within a defined range.

- Correction: The possibility of a market correction remains, potentially driven by regulatory uncertainty, negative news cycles, or profit-taking by investors.

Conclusion: A Cautious Optimism

Bitcoin's recent record high marks a significant milestone in its history, highlighting its growing acceptance as a viable asset class. However, investors should approach the market with caution, acknowledging the inherent volatility and uncertainties. Thorough research, diversification, and a long-term perspective are crucial for navigating the complexities of the cryptocurrency market. While the future remains unpredictable, Bitcoin's enduring appeal and technological foundations suggest a potentially bright future, albeit one characterized by both exciting opportunities and considerable risks. Staying informed about market developments and engaging in responsible investment practices remain paramount for anyone venturing into the world of Bitcoin.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin (BTC) Hits Record High: Market Analysis And Future Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

East Finals Preview How A Viral Brunson Haliburton Confrontation Changed The Narrative

May 23, 2025

East Finals Preview How A Viral Brunson Haliburton Confrontation Changed The Narrative

May 23, 2025 -

Storm Rugby League Garlick To Exit In 2025

May 23, 2025

Storm Rugby League Garlick To Exit In 2025

May 23, 2025 -

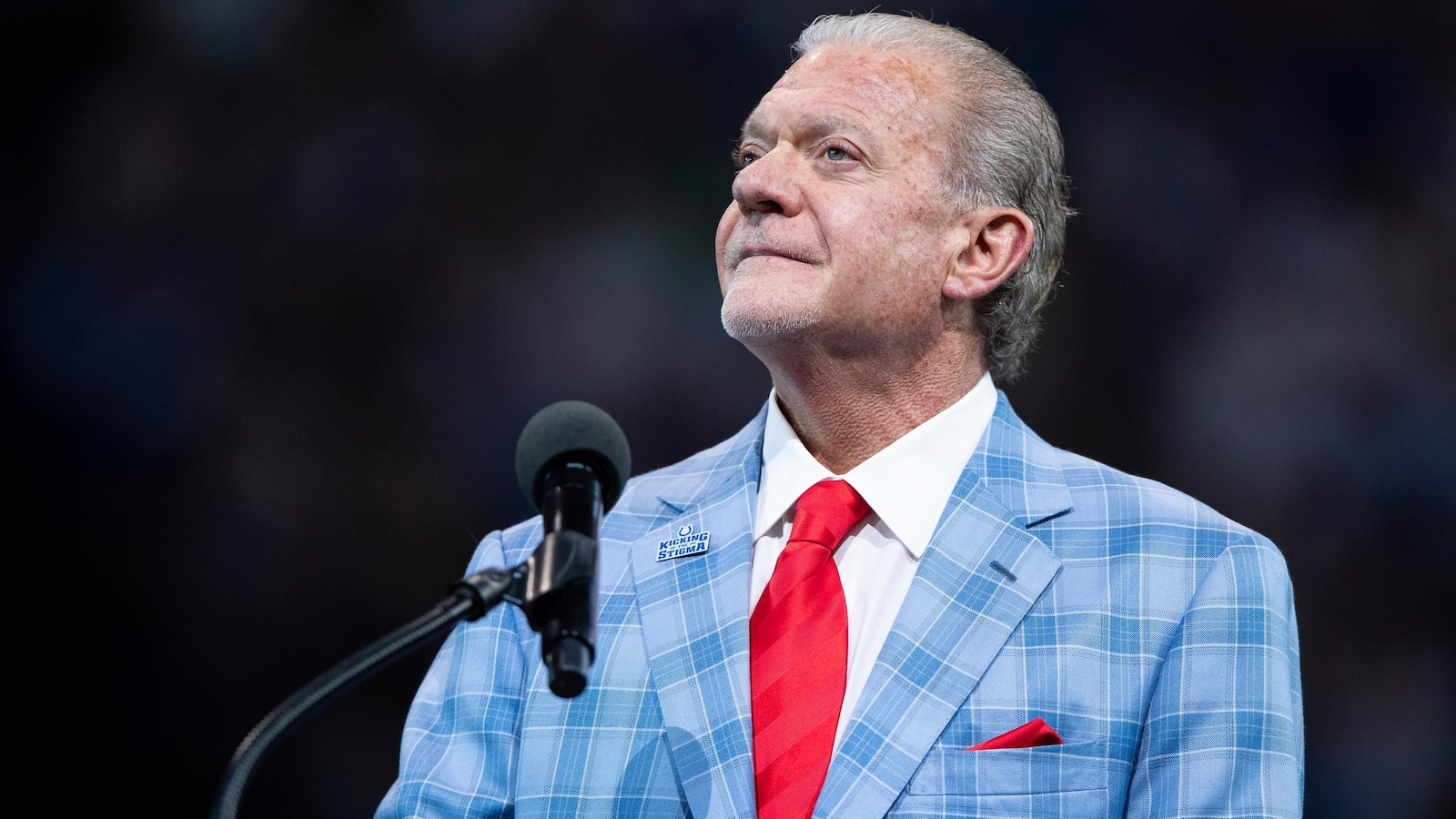

Music Loving Colts Owner Jim Irsay Dies At 65 A Life Celebrated

May 23, 2025

Music Loving Colts Owner Jim Irsay Dies At 65 A Life Celebrated

May 23, 2025 -

Pacers Vs Knicks The Under The Radar Edge For New Yorks Playoff Push

May 23, 2025

Pacers Vs Knicks The Under The Radar Edge For New Yorks Playoff Push

May 23, 2025 -

Haliburtons Last Second Shot Pacers Dramatic Game 1 Win Over Knicks

May 23, 2025

Haliburtons Last Second Shot Pacers Dramatic Game 1 Win Over Knicks

May 23, 2025

Latest Posts

-

Game Stops Bitcoin Strategy And Strong Financials A Deep Dive Analysis

May 23, 2025

Game Stops Bitcoin Strategy And Strong Financials A Deep Dive Analysis

May 23, 2025 -

Job Losses And Falling Living Standards In Laos The World Banks Inflation Analysis

May 23, 2025

Job Losses And Falling Living Standards In Laos The World Banks Inflation Analysis

May 23, 2025 -

Starlinks Australian Expansion Hit By Regulatory Warning

May 23, 2025

Starlinks Australian Expansion Hit By Regulatory Warning

May 23, 2025 -

Octopus Energy Ceo Targets Chinese Partnerships For Growth

May 23, 2025

Octopus Energy Ceo Targets Chinese Partnerships For Growth

May 23, 2025 -

Web3 Expansion Animoca Brands And Astar Network Secure Major Asian Ip Rights

May 23, 2025

Web3 Expansion Animoca Brands And Astar Network Secure Major Asian Ip Rights

May 23, 2025