Bitcoin (BTC) Or MicroStrategy (MSTR)? A Comparative Investment Analysis For 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin (BTC) or MicroStrategy (MSTR)? A Comparative Investment Analysis for 2025

The cryptocurrency market's volatility and the enduring appeal of established tech stocks present a compelling investment dilemma: Bitcoin (BTC) or MicroStrategy (MSTR)? Both have attracted significant attention, but which offers a better investment opportunity heading into 2025? This comparative analysis dives deep into the potential returns, risks, and long-term prospects of each.

Understanding the Contenders:

Bitcoin, the world's first and most dominant cryptocurrency, has captivated investors with its decentralized nature and potential for disruption. Its price is notoriously volatile, influenced by factors ranging from regulatory changes and technological advancements to market sentiment and macroeconomic conditions.

MicroStrategy (MSTR), a business intelligence company, has made a significant bet on Bitcoin, holding a substantial portion of its treasury reserves in BTC. This strategy has simultaneously boosted its profile and exposed it to the volatility of the cryptocurrency market. Investing in MSTR offers indirect exposure to Bitcoin, coupled with the performance of its core business.

Bitcoin (BTC): The Decentralized Powerhouse

-

Potential Upsides: Bitcoin's limited supply (21 million coins) and growing adoption as a store of value fuel its potential for significant price appreciation. Increased institutional adoption and broader regulatory clarity could further drive its price upwards. The underlying technology, blockchain, also holds immense potential for future applications beyond finance.

-

Potential Downsides: Bitcoin’s price volatility is a major concern. Regulatory uncertainty, security breaches, and competition from newer cryptocurrencies pose substantial risks. The speculative nature of the asset makes it unsuitable for risk-averse investors. Furthermore, its energy consumption remains a significant environmental consideration.

MicroStrategy (MSTR): The Bitcoin-Backed Tech Stock

-

Potential Upsides: MSTR offers a more traditional investment vehicle with exposure to the Bitcoin market. Its established business provides a degree of stability, mitigating some of the extreme volatility associated with directly holding BTC. Positive performance in its core business can boost returns independent of Bitcoin's price fluctuations.

-

Potential Downsides: MSTR's performance remains heavily reliant on Bitcoin's price. If Bitcoin's value declines significantly, MSTR's stock price will likely follow suit. The company’s focus on Bitcoin could also distract from its core business operations, potentially hindering long-term growth.

Comparative Analysis for 2025:

Predicting the future of either Bitcoin or MicroStrategy is inherently challenging. However, considering their potential trajectories:

-

Bitcoin: Reaching mainstream adoption and achieving price stability are crucial for sustained growth. Factors such as regulatory developments, technological advancements (e.g., Lightning Network scalability), and macroeconomic conditions will significantly impact its price by 2025. A bullish scenario sees Bitcoin surpassing its previous all-time high, while a bearish scenario could see it experience further consolidation or even decline.

-

MicroStrategy: The success of MicroStrategy in 2025 is inextricably linked to Bitcoin's performance. However, its core business performance will play a crucial role. If MSTR can demonstrate sustainable growth in its core business alongside Bitcoin's price appreciation, it could be a winning combination. However, if Bitcoin falters, MSTR's stock could be significantly impacted.

Which to Choose?

The optimal choice depends on individual risk tolerance and investment goals.

-

High-risk, high-reward: Direct Bitcoin investment offers potentially higher returns but carries substantial risk. This is suitable for investors with a long-term horizon and a high risk tolerance.

-

Moderate risk, moderate reward: Investing in MicroStrategy provides indirect exposure to Bitcoin while offering a degree of stability through its core business. This is a more balanced approach suitable for investors seeking moderate risk and return.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions. The cryptocurrency market is highly volatile and speculative.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin (BTC) Or MicroStrategy (MSTR)? A Comparative Investment Analysis For 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Crystal Palaces 1 0 Victory Over Man City Tactical Analysis May 17 2025

May 17, 2025

Crystal Palaces 1 0 Victory Over Man City Tactical Analysis May 17 2025

May 17, 2025 -

Can Belief Carry The Oilers Analyzing Edmontons Western Conference Final Chances

May 17, 2025

Can Belief Carry The Oilers Analyzing Edmontons Western Conference Final Chances

May 17, 2025 -

Rawalpindi Honors Pakistan Armed Forces In Special Ceremony

May 17, 2025

Rawalpindi Honors Pakistan Armed Forces In Special Ceremony

May 17, 2025 -

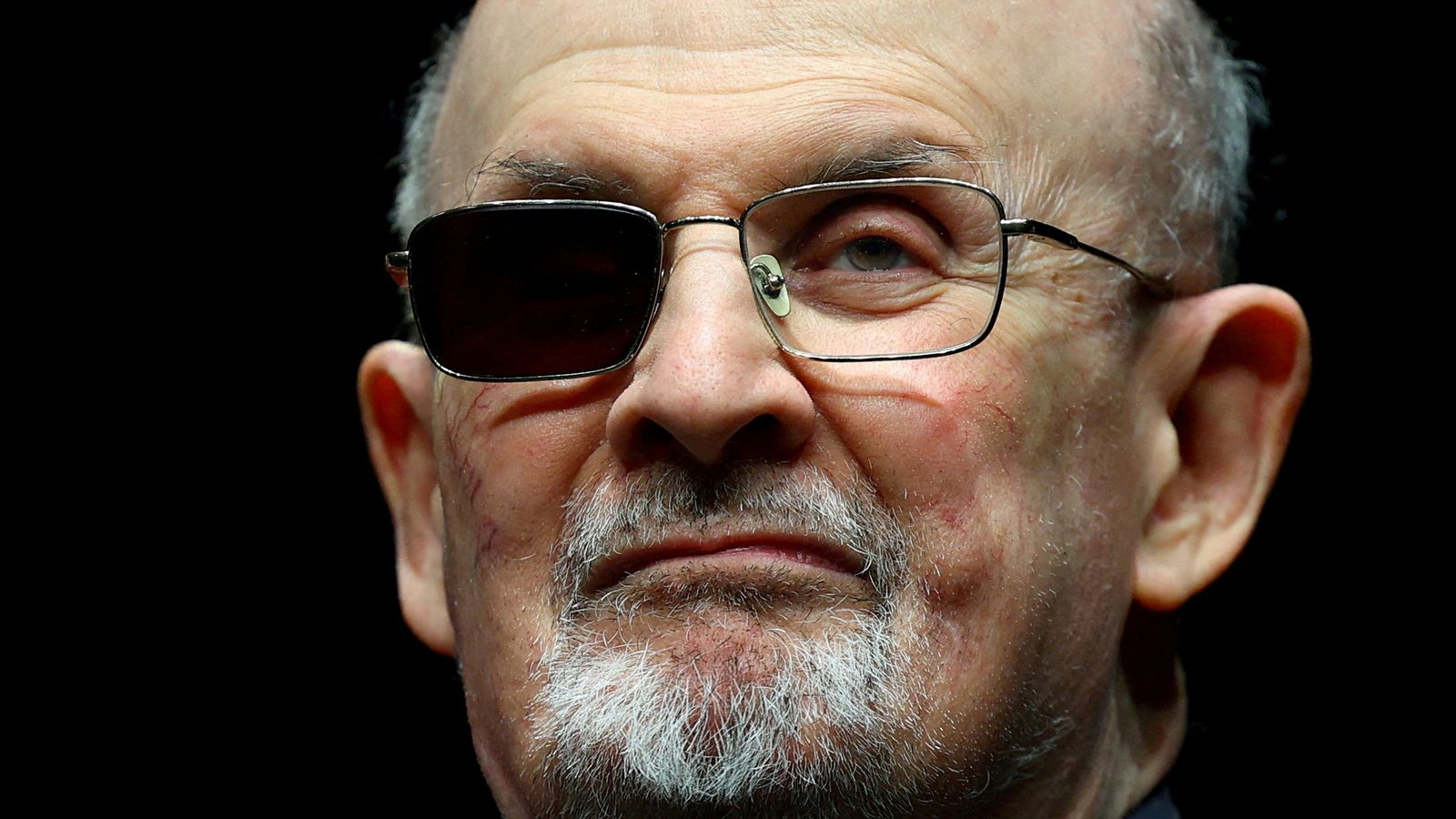

Hadi Matar Sentenced Salman Rushdies Attacker Receives Prison Time

May 17, 2025

Hadi Matar Sentenced Salman Rushdies Attacker Receives Prison Time

May 17, 2025 -

M6 Motorway Blocked Live Traffic Updates And Severe Delays

May 17, 2025

M6 Motorway Blocked Live Traffic Updates And Severe Delays

May 17, 2025