Bitcoin (BTC) Price Volatility: Understanding The Current Market Dynamics

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin (BTC) Price Volatility: Understanding the Current Market Dynamics

Bitcoin's price has always been known for its wild swings, captivating investors and sparking fervent debate. But understanding the current market dynamics behind this volatility is crucial for anyone considering investing in or holding BTC. Recent price fluctuations have left many wondering: what's driving this rollercoaster ride, and what does the future hold?

Understanding Bitcoin's inherent volatility:

Bitcoin's decentralized nature and relatively small market capitalization compared to traditional assets contribute significantly to its price volatility. Unlike established currencies backed by governments, Bitcoin's value is determined solely by supply and demand within a relatively nascent market. This makes it highly susceptible to external factors and speculative trading.

Key factors influencing current BTC price volatility:

Several interconnected factors are currently shaping Bitcoin's price movements:

-

Regulatory Uncertainty: Global regulatory landscapes surrounding cryptocurrencies remain unclear. Announcements from governments and regulatory bodies regarding Bitcoin's legal status and taxation significantly impact investor sentiment and, consequently, price. Positive news often fuels price increases, while negative news can trigger sharp declines.

-

Macroeconomic Conditions: Global economic conditions play a substantial role. Inflation, interest rate hikes, and recessionary fears often drive investors towards or away from riskier assets like Bitcoin. During periods of economic uncertainty, Bitcoin can experience heightened volatility as investors re-evaluate their portfolios.

-

Institutional Adoption and Investor Sentiment: Growing institutional adoption of Bitcoin, such as investments by large corporations and financial institutions, lends credibility and often boosts prices. Conversely, negative news or decreased institutional interest can trigger sell-offs. Overall investor sentiment, fueled by media coverage and social media trends, also heavily influences the market.

-

Technological Developments and Network Upgrades: Significant technological developments within the Bitcoin network, such as successful upgrades or the launch of new features, generally have a positive impact on price. However, setbacks or security concerns can severely impact investor confidence.

-

Supply and Demand Dynamics: The fixed supply of Bitcoin (21 million coins) creates scarcity, a key factor in its perceived value. However, fluctuations in demand, driven by factors mentioned above, create price volatility. Increased demand pushes prices up, while decreased demand leads to price drops.

H2: Navigating the Volatility: Strategies for Bitcoin Investors

The inherent volatility of Bitcoin presents both risks and opportunities. For investors, understanding these dynamics is paramount. Here are some strategies to consider:

-

Long-Term Perspective: Many experts advocate for a long-term investment strategy in Bitcoin, weathering short-term price fluctuations to potentially benefit from its long-term growth potential.

-

Diversification: Don't put all your eggs in one basket. Diversifying your investment portfolio across different asset classes can mitigate the risk associated with Bitcoin's volatility.

-

Risk Management: Establish clear risk tolerance levels and stick to them. Avoid emotional decision-making based on short-term price swings.

-

Stay Informed: Keep up-to-date on market news, regulatory changes, and technological advancements affecting the Bitcoin ecosystem.

H2: The Future of Bitcoin Price Volatility

Predicting the future of Bitcoin's price is impossible. However, it's likely that volatility will remain a characteristic feature of this asset class for the foreseeable future. As the cryptocurrency matures and adoption increases, the level of volatility may decrease, but significant price swings are likely to persist, particularly in response to macroeconomic events and regulatory shifts. Careful research, informed decision-making, and a long-term outlook are crucial for navigating the exciting but unpredictable world of Bitcoin investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin (BTC) Price Volatility: Understanding The Current Market Dynamics. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Road To The Stanley Cup Edmonton Oilers Belief In Western Conference Finals

May 17, 2025

Road To The Stanley Cup Edmonton Oilers Belief In Western Conference Finals

May 17, 2025 -

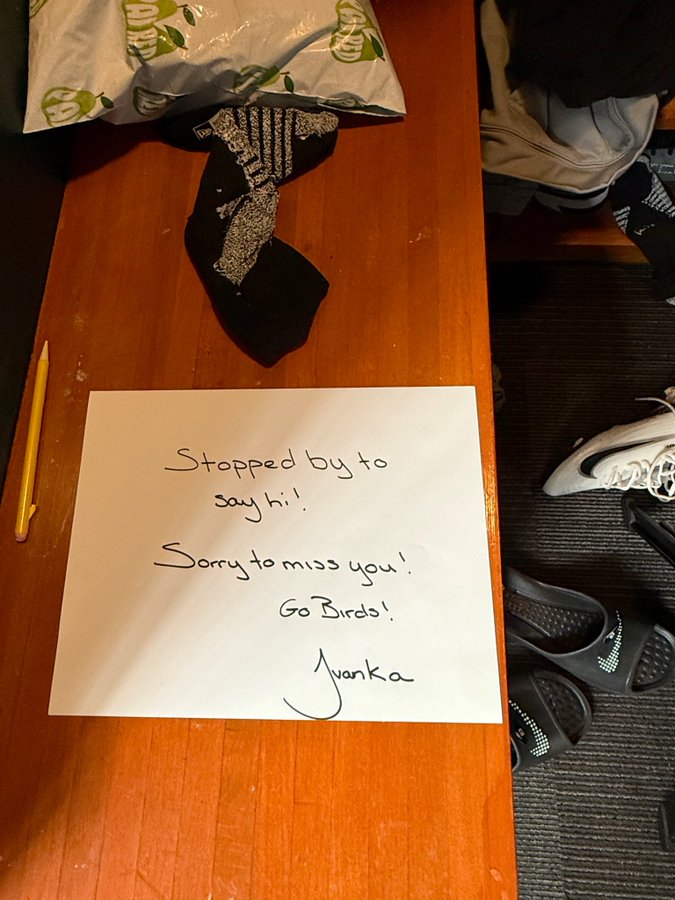

Mystery Message Ivanka Trumps Locker Note To Eli Ricks

May 17, 2025

Mystery Message Ivanka Trumps Locker Note To Eli Ricks

May 17, 2025 -

Boom Fantasy Promo Code Get The Best Deal Today

May 17, 2025

Boom Fantasy Promo Code Get The Best Deal Today

May 17, 2025 -

President Trumps Legal Strategy Why Delawares Chancery Court

May 17, 2025

President Trumps Legal Strategy Why Delawares Chancery Court

May 17, 2025 -

Cma Fest 2024 Fan Fair X Lineup Unveiled By So Fi

May 17, 2025

Cma Fest 2024 Fan Fair X Lineup Unveiled By So Fi

May 17, 2025