Bitcoin (BTC) Sellers Slow Down: $100K Target Threatened By Trade Wars?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin (BTC) Sellers Slow Down: $100K Target Threatened by Trade Wars?

The cryptocurrency market is buzzing with speculation as Bitcoin (BTC) sellers appear to be hitting the brakes. This slowdown in selling pressure, while initially celebrated by many as a bullish sign, now faces a significant headwind: escalating global trade tensions. Could the much-anticipated $100,000 Bitcoin price target be threatened by the looming shadow of trade wars?

The recent dip in selling volume suggests a growing confidence in Bitcoin's long-term potential amongst seasoned investors. However, the unpredictable nature of geopolitical events, particularly the escalating trade disputes between major global economies, casts a long shadow over this positive trend. Experts warn that uncertainty surrounding international trade could significantly impact the cryptocurrency market, potentially derailing the momentum towards the coveted $100,000 milestone.

The Impact of Trade Wars on Bitcoin's Price

Trade wars introduce significant macroeconomic uncertainty. When investors are unsure about the future economic landscape, they often seek safe haven assets like gold or, increasingly, Bitcoin. However, this isn't a simple equation. The impact of trade wars on Bitcoin is multifaceted:

-

Increased Volatility: Trade disputes often lead to increased market volatility. This can benefit short-term traders, but it can scare off long-term investors seeking stability, potentially dampening Bitcoin's price growth.

-

Reduced Investor Confidence: Negative news surrounding global trade can erode overall investor confidence, impacting not only traditional markets but also the cryptocurrency space. This could lead to a sell-off, pushing Bitcoin's price downwards.

-

Shifting Investment Strategies: Investors might divert funds away from riskier assets, including Bitcoin, towards more conservative options perceived as safer during times of economic uncertainty.

-

Regulatory Uncertainty: Trade disputes can also indirectly affect cryptocurrency regulation. Governments might prioritize domestic issues, leading to delays or changes in cryptocurrency policies, impacting investor sentiment.

The $100,000 Bitcoin Target: Still Achievable?

While the recent slowdown in selling pressure is encouraging, the looming threat of trade wars presents a formidable challenge to the $100,000 Bitcoin price target. Many analysts believe that achieving this ambitious goal requires a sustained period of stability and positive market sentiment. The current geopolitical climate, however, throws a wrench into this optimistic projection.

Several factors could still contribute to Bitcoin reaching $100,000:

-

Continued Institutional Adoption: Increased institutional investment remains a crucial driver of Bitcoin's price appreciation. Further adoption by large financial institutions could counteract the negative impact of trade wars.

-

Technological Advancements: Ongoing developments within the Bitcoin ecosystem, such as the Lightning Network's improvement, can enhance scalability and transaction speed, increasing its appeal and potentially driving up its price.

-

Halving Events: The upcoming Bitcoin halving events, which reduce the rate of new Bitcoin creation, are historically associated with price increases due to decreased supply.

Conclusion: Navigating Uncertainty

The Bitcoin market's current trajectory is a delicate balancing act. While the reduction in selling pressure is a positive sign, the potential negative impact of escalating trade wars cannot be ignored. Whether Bitcoin reaches the $100,000 target remains uncertain, contingent on several factors, including the resolution of global trade disputes and continued institutional adoption. Investors should closely monitor geopolitical developments and remain informed about market trends to make informed decisions. The journey to $100,000 will likely be far from smooth, requiring both resilience and patience from Bitcoin holders.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin (BTC) Sellers Slow Down: $100K Target Threatened By Trade Wars?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Angels Big Offensive Night Complete Rout Of Guardians

Apr 07, 2025

Angels Big Offensive Night Complete Rout Of Guardians

Apr 07, 2025 -

Ikn Terdampak Infestasi Tikus Besar Besaran Saat Lebaran Penjelasan Otorita

Apr 07, 2025

Ikn Terdampak Infestasi Tikus Besar Besaran Saat Lebaran Penjelasan Otorita

Apr 07, 2025 -

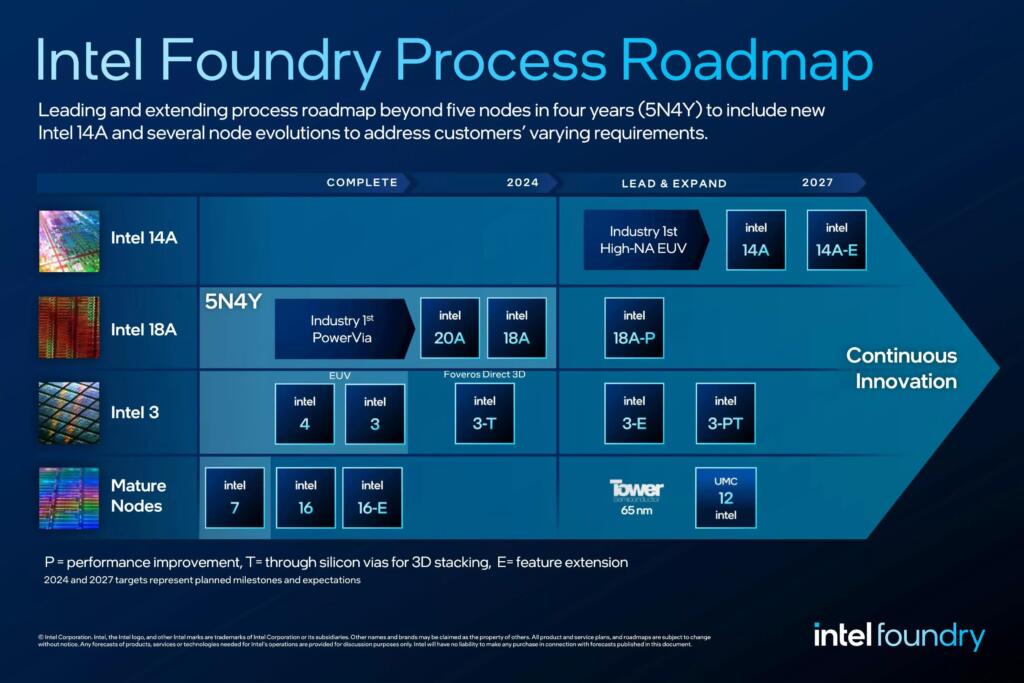

2025 Intel Targets Mass Production Of Its Revolutionary 18 Angstrom Chips

Apr 07, 2025

2025 Intel Targets Mass Production Of Its Revolutionary 18 Angstrom Chips

Apr 07, 2025 -

Gorka Marquezs Absence Gemma Atkinson Shares Her Thoughts On The Strictly Lineup

Apr 07, 2025

Gorka Marquezs Absence Gemma Atkinson Shares Her Thoughts On The Strictly Lineup

Apr 07, 2025 -

Nrl Live Hughes Return And Bellamys Storm Boost

Apr 07, 2025

Nrl Live Hughes Return And Bellamys Storm Boost

Apr 07, 2025