Bitcoin Bull Run 2.0: On-Chain Data And FOMO Point To Continued Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Bull Run 2.0: On-Chain Data and FOMO Point to Continued Growth

The cryptocurrency market is buzzing with excitement as Bitcoin (BTC) shows signs of a potential resurgence, leading many analysts to speculate about a "Bitcoin Bull Run 2.0." While predicting the future of any asset is inherently risky, compelling on-chain data and a palpable fear of missing out (FOMO) suggest a continued period of growth for the world's leading cryptocurrency. This isn't just hype; there's tangible evidence supporting a bullish outlook.

On-Chain Data: The Telltale Signs of a Bull Market

On-chain data, which analyzes the activity on the Bitcoin blockchain itself, provides crucial insights often overlooked by casual observers. Several key metrics are painting a positive picture:

-

Increased Network Activity: The number of active Bitcoin addresses and transaction volume are climbing steadily, indicating increased user engagement and trading activity. This is a significant indicator of growing adoption and potential price appreciation.

-

Accumulation by Large Holders: Whales, or large Bitcoin holders, are accumulating more BTC. This suggests confidence in the long-term value of the asset and a belief that the current price represents a buying opportunity. This accumulation phase often precedes significant price increases.

-

Decreased Supply on Exchanges: The amount of Bitcoin held on exchanges is shrinking. This indicates that investors are moving their holdings into cold storage, reducing the potential for selling pressure and suggesting a long-term holding strategy.

-

Rising Miner Revenue: Healthy miner revenue signifies a robust and profitable Bitcoin network. This indirectly supports the price, as profitable mining encourages continued network security and development.

FOMO: The Psychological Driver of Market Momentum

Beyond the hard data, a powerful psychological factor is at play: the fear of missing out (FOMO). As Bitcoin's price begins to climb, the potential for significant gains attracts new investors, fueling further price increases in a self-reinforcing cycle. This FOMO-driven momentum can significantly accelerate bull runs.

Challenges and Considerations

While the outlook is bullish, it's crucial to acknowledge potential challenges:

-

Regulatory Uncertainty: Government regulations continue to evolve, creating uncertainty for investors. Changes in regulatory landscapes can significantly impact market sentiment.

-

Macroeconomic Factors: Global economic conditions, inflation, and interest rate hikes can influence investor risk appetite and affect Bitcoin's price.

-

Market Volatility: Bitcoin remains a volatile asset. Sharp price corrections are possible, even within a bull market.

Investing Wisely: Risk Management is Crucial

Investing in Bitcoin, or any cryptocurrency, involves significant risk. It's essential to conduct thorough research, understand the risks, and only invest what you can afford to lose. Diversification is also key to mitigating risk within a broader investment portfolio.

Conclusion: A Cautiously Optimistic Outlook

The confluence of positive on-chain data and growing FOMO suggests a potential Bitcoin bull run is underway. However, investors should approach this with a balanced perspective, acknowledging the inherent risks and volatility associated with cryptocurrency markets. Careful analysis, risk management, and a long-term investment strategy are crucial for navigating this exciting, yet unpredictable, market. Stay informed, stay vigilant, and remember to always do your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Bull Run 2.0: On-Chain Data And FOMO Point To Continued Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Budget Day Brings Focus To Unconventional Pet Ownership Costs Raccoons

May 16, 2025

Budget Day Brings Focus To Unconventional Pet Ownership Costs Raccoons

May 16, 2025 -

Ryan Fox Triumphs New Zealand Golfer Claims Pga Championship At Myrtle Beach Classic

May 16, 2025

Ryan Fox Triumphs New Zealand Golfer Claims Pga Championship At Myrtle Beach Classic

May 16, 2025 -

Criticism Mounts Lucasfilms Ai Star Wars Experiment Fails

May 16, 2025

Criticism Mounts Lucasfilms Ai Star Wars Experiment Fails

May 16, 2025 -

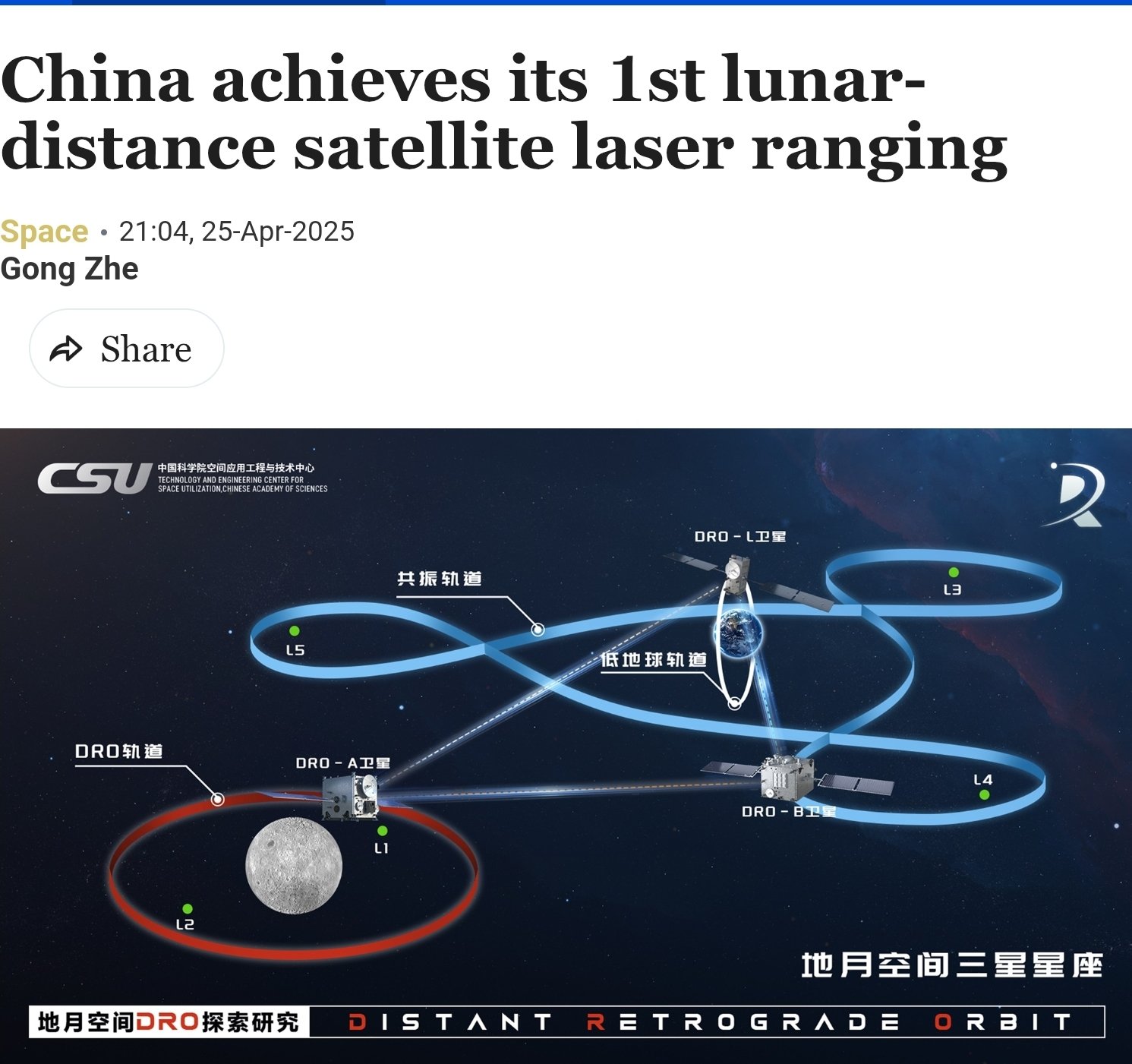

New Advancements In Lunar Distance Measurement Chinas Satellite Laser Technology

May 16, 2025

New Advancements In Lunar Distance Measurement Chinas Satellite Laser Technology

May 16, 2025 -

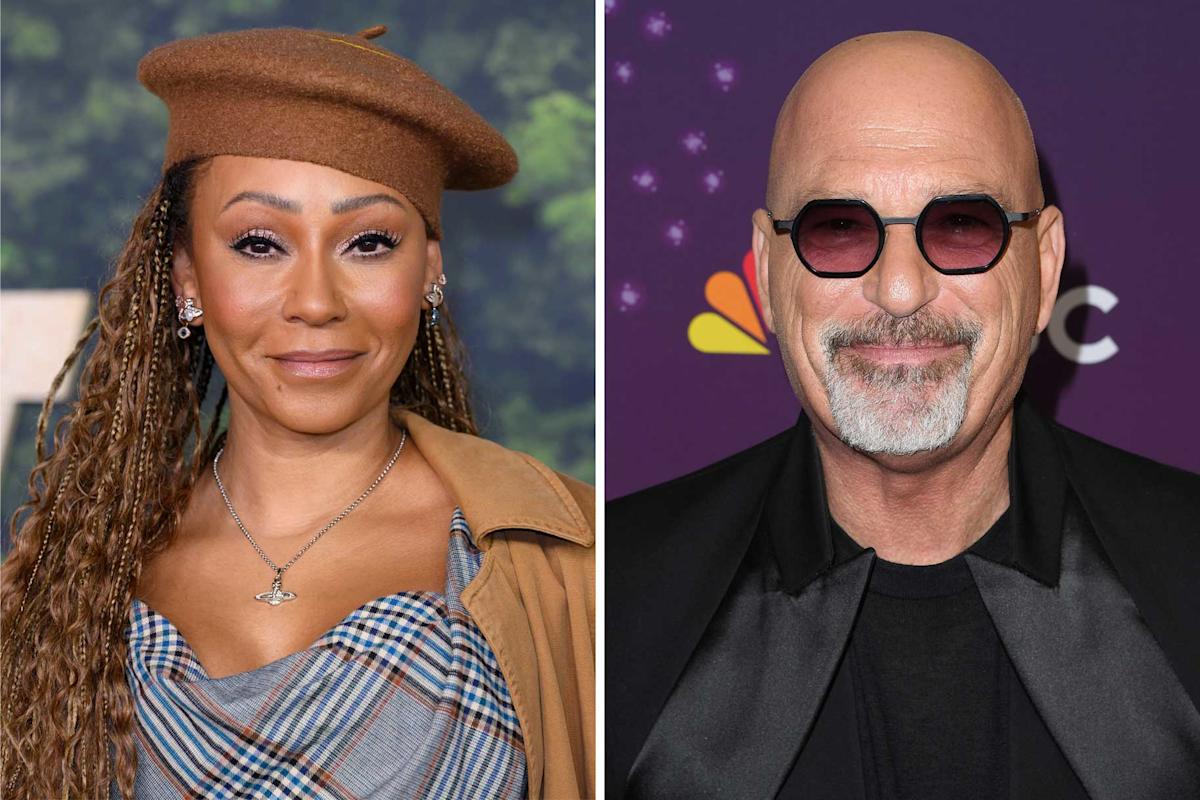

No Howie Mandel At Mel Bs Wedding The Comedians Candid Explanation

May 16, 2025

No Howie Mandel At Mel Bs Wedding The Comedians Candid Explanation

May 16, 2025