Bitcoin Dominance In The US Reaches New Peak: The Role Of ETFs And Institutional Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Dominance in the US Reaches New Peak: The Role of ETFs and Institutional Investors

Bitcoin's dominance in the US cryptocurrency market has surged to a new all-time high, sparking intense debate among analysts and investors. This remarkable climb isn't just a matter of price fluctuations; it reflects a significant shift in market dynamics, largely driven by the growing influence of exchange-traded funds (ETFs) and institutional investment.

The Numbers Speak for Themselves: Recent data reveals Bitcoin's market share within the US has eclipsed previous records, now accounting for over [Insert Percentage – replace with accurate, up-to-date data]% of the total cryptocurrency market capitalization. This signifies a dramatic shift away from altcoins and underlines Bitcoin's position as the preferred digital asset for many investors.

The Rise of Bitcoin ETFs: The approval of Bitcoin futures ETFs in the US has played a pivotal role in this surge. These ETFs offer a regulated and accessible entry point for institutional investors and retail traders alike, who were previously hesitant due to the complexities and regulatory uncertainty surrounding direct Bitcoin ownership. The ease of access and perceived lower risk associated with ETFs have significantly boosted Bitcoin's appeal.

- Reduced Barriers to Entry: ETFs simplify investment, making Bitcoin more accessible to a broader range of investors, including pension funds and other institutional players.

- Regulatory Compliance: The regulated nature of ETFs provides comfort to institutions wary of the regulatory landscape surrounding cryptocurrencies.

- Increased Liquidity: ETFs contribute to greater liquidity in the Bitcoin market, making it easier to buy and sell large volumes without significantly impacting the price.

Institutional Investors Embrace Bitcoin: Beyond ETFs, the growing acceptance of Bitcoin by institutional investors is another crucial factor. Large financial institutions are increasingly diversifying their portfolios to include digital assets, and Bitcoin, with its established track record and market dominance, remains the most attractive option.

- Portfolio Diversification: Bitcoin's low correlation with traditional assets makes it an appealing tool for hedging against market volatility.

- Inflation Hedge: Many investors see Bitcoin as a potential hedge against inflation, given its limited supply and decentralized nature.

- Long-Term Growth Potential: The belief in Bitcoin's long-term growth potential continues to attract significant institutional capital.

Challenges and Future Outlook: While the current dominance is impressive, challenges remain. Regulatory uncertainty continues to loom, and the potential for future regulatory crackdowns could impact market sentiment. Furthermore, the emergence of new cryptocurrencies and innovative blockchain technologies could potentially challenge Bitcoin's leading position in the long run.

Conclusion: Bitcoin's dominance in the US cryptocurrency market reaching a new peak is a significant development. The combined effect of Bitcoin ETFs providing easier access and the increasing embrace of Bitcoin by institutional investors are driving forces behind this trend. While challenges persist, the current trajectory suggests Bitcoin will continue to play a major role in the evolving landscape of digital assets. The future of Bitcoin's dominance will depend on several factors, including regulatory developments, technological advancements, and the overall evolution of the cryptocurrency market. This makes it a fascinating space to watch closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Dominance In The US Reaches New Peak: The Role Of ETFs And Institutional Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lim Tean Ge 2025 Pending Court Cases Wont Derail My Campaign Says Renowned Lawyer

Apr 28, 2025

Lim Tean Ge 2025 Pending Court Cases Wont Derail My Campaign Says Renowned Lawyer

Apr 28, 2025 -

Red Dot Uniteds First Rally Focusing On Employment And Public Expenditure Ahead Of Ge 2025

Apr 28, 2025

Red Dot Uniteds First Rally Focusing On Employment And Public Expenditure Ahead Of Ge 2025

Apr 28, 2025 -

Deadly Iran Port Blast 25 Killed 800 Injured In Massive Explosion

Apr 28, 2025

Deadly Iran Port Blast 25 Killed 800 Injured In Massive Explosion

Apr 28, 2025 -

Premier League And Fa Cup Predictions Liverpools Winning Run And Best Bets

Apr 28, 2025

Premier League And Fa Cup Predictions Liverpools Winning Run And Best Bets

Apr 28, 2025 -

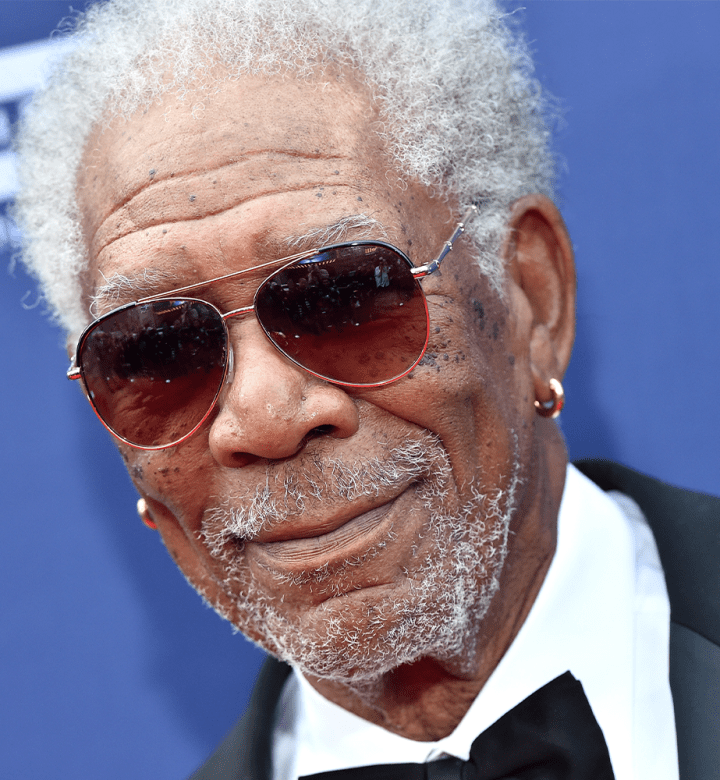

Chilling Trailer This Underrated Morgan Freeman Thriller On Netflix Will Keep You On The Edge

Apr 28, 2025

Chilling Trailer This Underrated Morgan Freeman Thriller On Netflix Will Keep You On The Edge

Apr 28, 2025

Latest Posts

-

2024 Election Trump And Bidens Strategic Facebook Targeting Of Older Women

Apr 30, 2025

2024 Election Trump And Bidens Strategic Facebook Targeting Of Older Women

Apr 30, 2025 -

Snooker Star Mark Williamss Pre Match Support Creates Unexpected Crucible Tension

Apr 30, 2025

Snooker Star Mark Williamss Pre Match Support Creates Unexpected Crucible Tension

Apr 30, 2025 -

Al Hilal Vs Al Ahli Cancelos Absence Confirmed For Asian Champions League Semi Final

Apr 30, 2025

Al Hilal Vs Al Ahli Cancelos Absence Confirmed For Asian Champions League Semi Final

Apr 30, 2025 -

Direct Arsenal Psg La Demi Finale De Ligue Des Champions Commence Dembele Et Doue Titulaires

Apr 30, 2025

Direct Arsenal Psg La Demi Finale De Ligue Des Champions Commence Dembele Et Doue Titulaires

Apr 30, 2025 -

Madrid Open Rublevs Exit Sabalenka Advances After Zverev Controversy

Apr 30, 2025

Madrid Open Rublevs Exit Sabalenka Advances After Zverev Controversy

Apr 30, 2025