Bitcoin ETF Investment Surges: BlackRock Sees $590 Million Influx

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Surges: BlackRock Sees $590 Million Influx

The wait is over for many Bitcoin investors. The recent approval filings for Bitcoin Exchange-Traded Funds (ETFs) have sparked a monumental surge in investment, with BlackRock alone witnessing a staggering $590 million influx into its iShares Bitcoin ETF. This unprecedented level of interest signals a major shift in the perception and accessibility of Bitcoin, potentially marking a pivotal moment for the cryptocurrency's mainstream adoption.

The news follows BlackRock's highly anticipated application for a spot Bitcoin ETF, a move that sent shockwaves through the financial world. This wasn't just another application; BlackRock, the world's largest asset manager, carries significant weight, and its entry into the Bitcoin ETF market legitimizes the asset in the eyes of many institutional investors previously hesitant to directly engage with cryptocurrencies.

This massive $590 million injection into BlackRock's Bitcoin ETF is more than just a headline-grabbing number; it represents a powerful vote of confidence in Bitcoin's future. This level of investment signifies a growing belief that Bitcoin is not just a volatile speculative asset, but a potentially valuable addition to diversified investment portfolios.

What Fuels This Bitcoin ETF Investment Boom?

Several factors contribute to this dramatic increase in investment:

- BlackRock's Reputation: The sheer size and reputation of BlackRock significantly reduces the perceived risk for many investors. Their involvement adds a layer of credibility and trustworthiness, attracting both institutional and individual investors.

- Increased Regulatory Clarity: While still evolving, the regulatory landscape surrounding cryptocurrencies is becoming clearer, particularly in the US. The ongoing ETF application reviews suggest a gradual shift towards greater acceptance and regulation of Bitcoin.

- Institutional Adoption: The involvement of major players like BlackRock encourages other large institutional investors to follow suit, leading to a snowball effect of increased investment.

- Accessibility: ETFs offer a convenient and regulated way for investors to gain exposure to Bitcoin without needing to navigate the complexities of directly purchasing and storing the cryptocurrency. This accessibility lowers the barrier to entry for a broader range of investors.

- Inflation Hedge Potential: Bitcoin's decentralized nature and limited supply make it an attractive asset for investors seeking protection against inflation.

What Does This Mean for the Future of Bitcoin?

The influx of $590 million into BlackRock's Bitcoin ETF is a significant milestone for the cryptocurrency. It signals a potential tipping point towards wider mainstream adoption, paving the way for further institutional investment and potentially increased price volatility.

This surge in investment underscores the growing maturity of the cryptocurrency market and the increasing recognition of Bitcoin as a legitimate asset class. However, it's crucial to remember that investing in cryptocurrencies, including Bitcoin ETFs, carries inherent risks. Potential investors should conduct thorough research and understand these risks before committing their funds.

The Road Ahead: Challenges and Opportunities

While the current outlook is positive, challenges remain. The SEC's final decision on the ETF applications remains crucial. Continued regulatory uncertainty could still impact future investment flows. Furthermore, the inherent volatility of the cryptocurrency market means fluctuations are to be expected.

Despite these challenges, the current surge in Bitcoin ETF investment, exemplified by BlackRock's impressive $590 million influx, paints a picture of a maturing and increasingly mainstream cryptocurrency market. The future remains bright, but careful consideration and informed decisions are paramount for any investor looking to participate in this exciting space. The Bitcoin ETF revolution is underway, and the implications are far-reaching.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Surges: BlackRock Sees $590 Million Influx. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kvaratskhelias Journey A Deep Dive Into The Kvaradona Phenomenon

Apr 30, 2025

Kvaratskhelias Journey A Deep Dive Into The Kvaradona Phenomenon

Apr 30, 2025 -

Acl Elite Decisive Battles Between Al Ahli And Al Hilal

Apr 30, 2025

Acl Elite Decisive Battles Between Al Ahli And Al Hilal

Apr 30, 2025 -

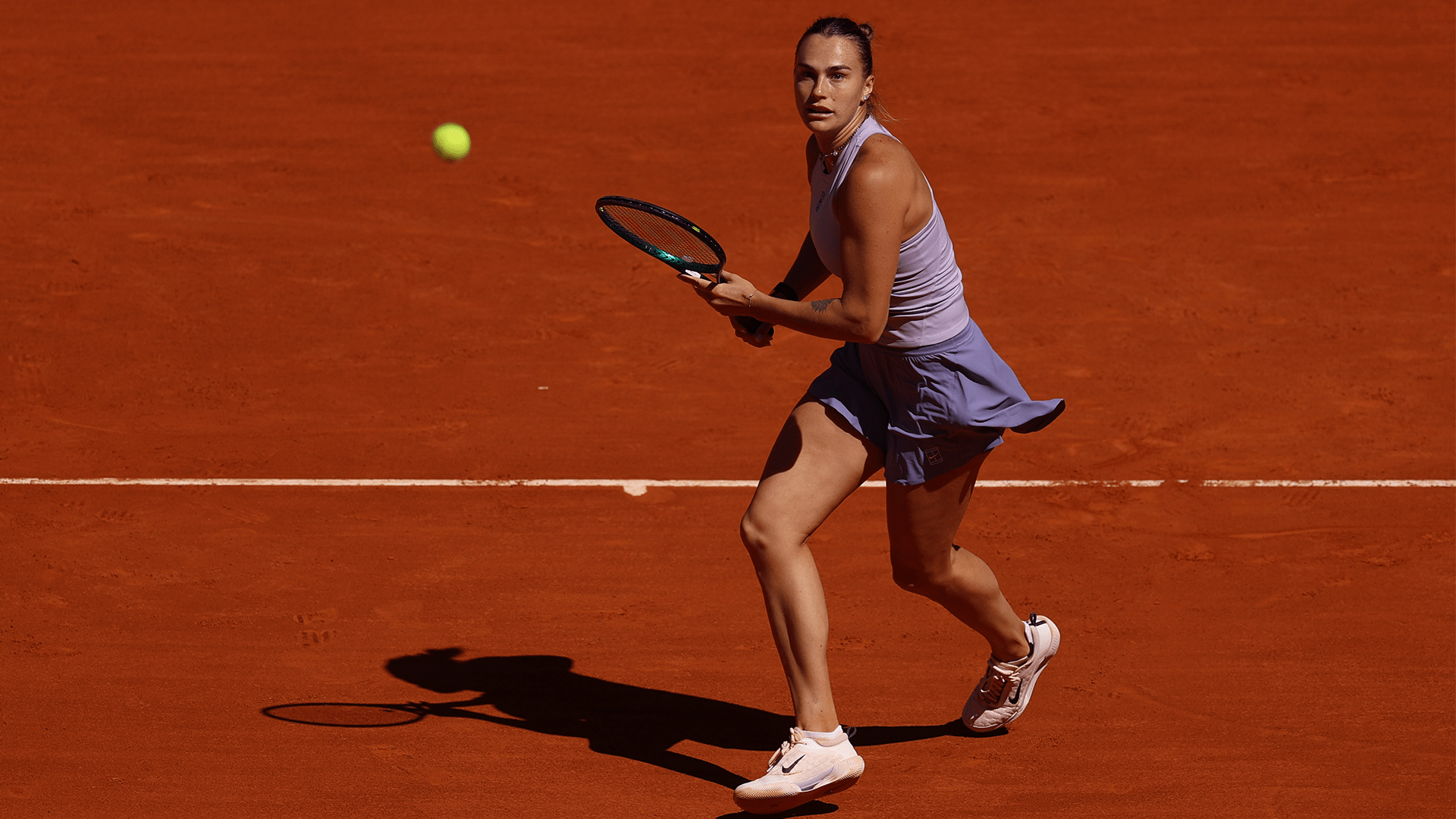

Watch Sabalenka Vs Stearns Madrid Open Live Stream Predictions And Betting

Apr 30, 2025

Watch Sabalenka Vs Stearns Madrid Open Live Stream Predictions And Betting

Apr 30, 2025 -

Epic Games Stores Android Launch A Case For App Store Competition On I Phone

Apr 30, 2025

Epic Games Stores Android Launch A Case For App Store Competition On I Phone

Apr 30, 2025 -

Us Automakers Receive Tariff Relief A Deeper Look At Trumps Policy Shift

Apr 30, 2025

Us Automakers Receive Tariff Relief A Deeper Look At Trumps Policy Shift

Apr 30, 2025

Latest Posts

-

Barcelonas Ucl Hopes Hinge On Veterans Proven Success Against Inter Milan

May 01, 2025

Barcelonas Ucl Hopes Hinge On Veterans Proven Success Against Inter Milan

May 01, 2025 -

Wsl Live Matchday Aston Villa Arsenal And Manchester United Chelsea Get The Scores Here

May 01, 2025

Wsl Live Matchday Aston Villa Arsenal And Manchester United Chelsea Get The Scores Here

May 01, 2025 -

Balancing Innovation And Security The Challenges Of Ai Models In Web3

May 01, 2025

Balancing Innovation And Security The Challenges Of Ai Models In Web3

May 01, 2025 -

Ge 2025 Controversy Sdp Leader Apologizes For Candidates Racist Language

May 01, 2025

Ge 2025 Controversy Sdp Leader Apologizes For Candidates Racist Language

May 01, 2025 -

Arsenal Psg Maci Sonucu Fransiz Devi Final Yolunda

May 01, 2025

Arsenal Psg Maci Sonucu Fransiz Devi Final Yolunda

May 01, 2025