Bitcoin Future: Experts Debate The End Of The Bullish Trend

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Future: Experts Debate the End of the Bullish Trend

Bitcoin's price has seen significant fluctuations recently, leaving investors wondering: is the bullish trend over? The cryptocurrency market, known for its volatility, is currently witnessing a heated debate among experts regarding the future trajectory of Bitcoin. While some predict a continuation of the upward trend, others foresee a potential correction or even a prolonged bear market. This article delves into the arguments fueling this ongoing discussion, examining the factors contributing to the uncertainty surrounding Bitcoin's future.

Conflicting Signals in the Market

The cryptocurrency market is notoriously complex, influenced by a multitude of intertwined factors. Currently, several conflicting signals are adding to the uncertainty. While Bitcoin has shown periods of impressive growth, reaching new all-time highs in the past, recent price drops have sparked concerns about a potential market correction.

-

Regulatory Uncertainty: The evolving regulatory landscape across the globe continues to be a significant factor influencing Bitcoin's price. Increased scrutiny from governments and regulatory bodies creates uncertainty, potentially impacting investor confidence. Different jurisdictions are adopting varying approaches, leading to a complex and unpredictable regulatory environment.

-

Macroeconomic Factors: Global macroeconomic conditions, such as inflation and interest rate hikes, also play a crucial role. These factors can significantly impact investor sentiment towards riskier assets like Bitcoin, leading to price fluctuations. A looming recession could further dampen investor appetite for cryptocurrencies.

-

Technological Advancements: While innovation within the Bitcoin ecosystem is generally considered positive, the rapid pace of development can also create uncertainty. New technologies and competing cryptocurrencies constantly emerge, potentially impacting Bitcoin's market dominance.

Bullish Arguments: Why Bitcoin Could Continue its Ascent

Despite the concerns, some experts remain bullish on Bitcoin's long-term prospects. They cite several reasons for their optimism:

-

Limited Supply: Bitcoin's fixed supply of 21 million coins is often highlighted as a key factor contributing to its potential for long-term value appreciation. This scarcity, unlike fiat currencies, is viewed as a hedge against inflation.

-

Institutional Adoption: The increasing adoption of Bitcoin by institutional investors, such as large corporations and hedge funds, is considered a positive sign. This growing institutional interest lends credibility and contributes to market stability.

-

Technological Advantages: Bitcoin's underlying blockchain technology continues to evolve, offering potential applications beyond simple currency transactions. This ongoing development fuels innovation and potential for future growth.

Bearish Arguments: Predicting a Market Correction

Conversely, several experts are voicing concerns about a potential Bitcoin price correction or even a prolonged bear market. Their arguments include:

-

Overvaluation: Some analysts believe Bitcoin is currently overvalued, based on various valuation models. This perceived overvaluation suggests a potential price correction to reflect a more realistic market price.

-

Historical Precedents: Bitcoin's price history is characterized by significant booms and busts. Past cycles of rapid growth followed by sharp corrections serve as a cautionary tale for investors.

-

Market Sentiment: Negative news and declining investor confidence can trigger a sell-off, potentially leading to a substantial price decline. Market sentiment is a powerful force influencing Bitcoin's price trajectory.

Navigating the Uncertainty: Advice for Investors

The conflicting opinions highlight the inherent risks and uncertainties associated with investing in Bitcoin. Investors should proceed with caution, conducting thorough research and understanding their own risk tolerance. Diversification across different asset classes is crucial, mitigating potential losses associated with Bitcoin's volatility. It's also important to stay updated on the latest market developments and regulatory changes, which can significantly impact Bitcoin's price.

The future of Bitcoin remains a subject of ongoing debate. While its potential for long-term growth is undeniable, navigating the inherent risks and uncertainties requires careful consideration and a well-informed investment strategy. Only time will tell whether the current bullish trend will continue or if a correction is imminent.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Future: Experts Debate The End Of The Bullish Trend. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

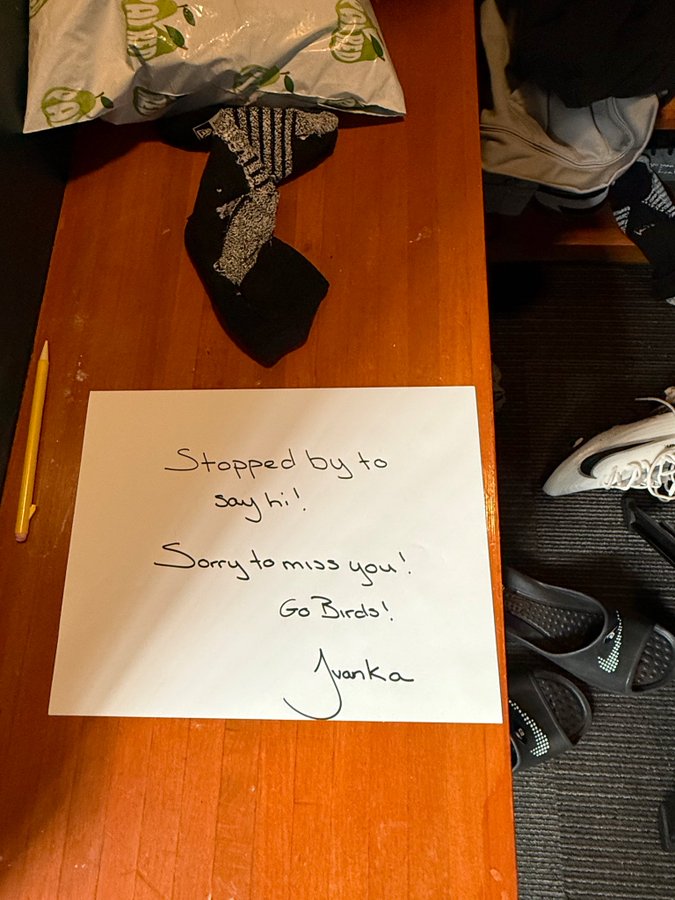

Eli Ricks Receives Unexpected Note From Ivanka Trump

May 17, 2025

Eli Ricks Receives Unexpected Note From Ivanka Trump

May 17, 2025 -

Hadi Matar Sentenced 25 Years For Salman Rushdie Stabbing

May 17, 2025

Hadi Matar Sentenced 25 Years For Salman Rushdie Stabbing

May 17, 2025 -

Economic Pessimism Soars A New Low For American Confidence

May 17, 2025

Economic Pessimism Soars A New Low For American Confidence

May 17, 2025 -

Cma Fest Events Tickets And More

May 17, 2025

Cma Fest Events Tickets And More

May 17, 2025 -

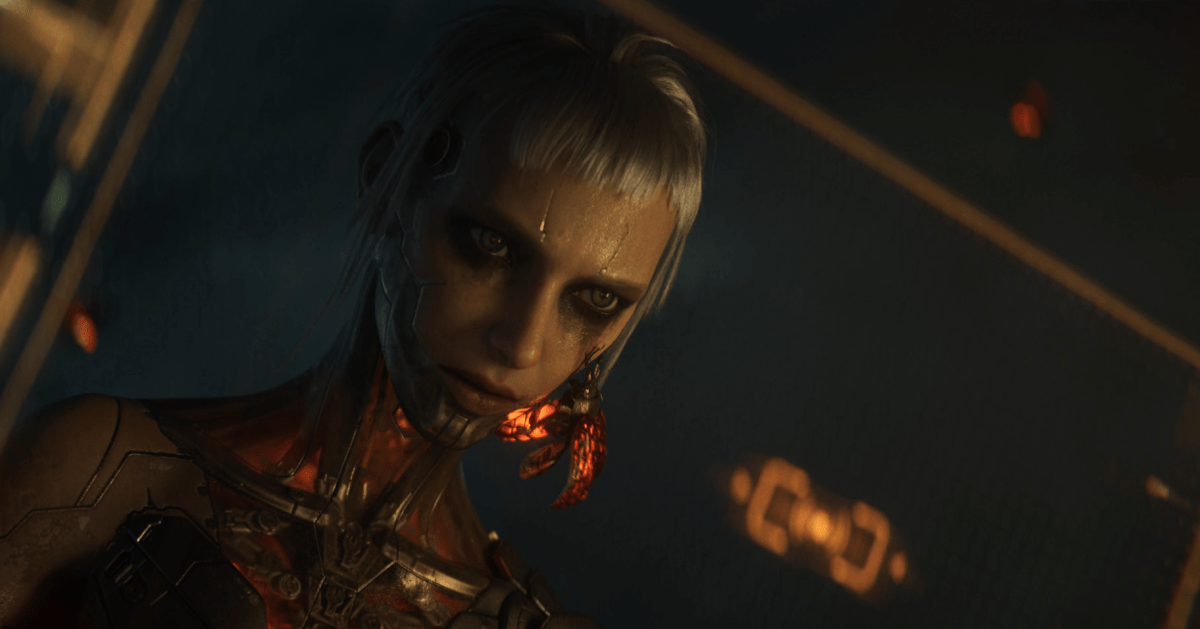

Analyzing Love Death And Robots Season 4s Narrative And Animation

May 17, 2025

Analyzing Love Death And Robots Season 4s Narrative And Animation

May 17, 2025