Bitcoin Hits Record High As Stock Market Tanks: Dow, S&P 500 Losses Mount

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Hits Record High as Stock Market Tanks: Dow, S&P 500 Losses Mount

The cryptocurrency market is defying gravity, with Bitcoin soaring to a new all-time high as traditional markets experience a significant downturn. While the Dow Jones Industrial Average and S&P 500 plummet, investors are increasingly turning to Bitcoin as a safe haven asset and a hedge against inflation. This unexpected divergence is raising questions about the future of finance and the growing acceptance of digital currencies.

The dramatic contrast between the plummeting stock market and Bitcoin's record-breaking performance is capturing global headlines. As fears of recession and rising interest rates grip Wall Street, Bitcoin's price has surged, surpassing its previous record high. This surge highlights the evolving relationship between traditional finance and the burgeoning cryptocurrency market.

Understanding the Market Divergence:

Several factors contribute to this fascinating market dynamic:

-

Inflation Hedge: Many investors see Bitcoin as a hedge against inflation, believing its limited supply protects its value against currency devaluation. With inflation at multi-decade highs in many countries, this perceived safety net is driving demand.

-

Safe Haven Asset: Amidst economic uncertainty, investors are seeking alternative assets perceived as less risky than traditional stocks. Bitcoin, despite its volatility, is increasingly viewed as a store of value, especially by younger generations.

-

Increased Institutional Adoption: The growing adoption of Bitcoin by institutional investors, including large corporations and hedge funds, is lending credibility and stability to the cryptocurrency. This influx of institutional money is pushing prices higher.

-

Technological Advancement: Continuous development and innovation within the Bitcoin ecosystem, including the Lightning Network for faster transactions, are also contributing to its appeal.

Dow and S&P 500 Losses Deepen:

Meanwhile, the traditional stock market is grappling with significant losses. The Dow Jones Industrial Average and S&P 500 have experienced substantial declines, driven by factors such as:

-

Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes to combat inflation are dampening economic growth and impacting corporate earnings.

-

Geopolitical Uncertainty: Ongoing geopolitical tensions and the war in Ukraine are further exacerbating market volatility and investor anxieties.

-

Recession Fears: Growing concerns about a potential recession are causing investors to become more risk-averse and pull back from equity markets.

The Future of Finance:

The contrasting performance of Bitcoin and the traditional stock market underscores a fundamental shift in the global financial landscape. The rise of cryptocurrencies challenges the dominance of fiat currencies and traditional financial institutions. While Bitcoin's volatility remains a concern, its growing adoption and performance during market downturns suggest a significant role for cryptocurrencies in the future of finance. This trend warrants close observation by investors and policymakers alike. The long-term implications of this divergence remain to be seen, but one thing is clear: the cryptocurrency market is here to stay, and its influence on the global economy is only going to grow.

Keywords: Bitcoin, record high, stock market crash, Dow Jones, S&P 500, cryptocurrency, inflation, recession, safe haven asset, institutional adoption, financial markets, economic uncertainty, crypto investment, digital currency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Hits Record High As Stock Market Tanks: Dow, S&P 500 Losses Mount. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Oklahoma City Thunders Shai Gilgeous Alexander Crowned Nba Mvp

May 23, 2025

Oklahoma City Thunders Shai Gilgeous Alexander Crowned Nba Mvp

May 23, 2025 -

Laotian Economy Under Pressure World Bank Survey Reveals Inflations Devastating Effects

May 23, 2025

Laotian Economy Under Pressure World Bank Survey Reveals Inflations Devastating Effects

May 23, 2025 -

Postecoglous Future Italian Move Confirmed

May 23, 2025

Postecoglous Future Italian Move Confirmed

May 23, 2025 -

Investigation Launched Into Chicago Sun Timess Ai Reporting Discrepancies

May 23, 2025

Investigation Launched Into Chicago Sun Timess Ai Reporting Discrepancies

May 23, 2025 -

Nba Highlights Obi Toppins Hilarious Dunk Fail And Reaction

May 23, 2025

Nba Highlights Obi Toppins Hilarious Dunk Fail And Reaction

May 23, 2025

Latest Posts

-

June School Holidays Ica Predicts Heavy Traffic At Woodlands And Tuas Checkpoints

May 23, 2025

June School Holidays Ica Predicts Heavy Traffic At Woodlands And Tuas Checkpoints

May 23, 2025 -

Exploring The Ministry Of Magic A Deep Dive Into The Wizarding World Of Harry Potter

May 23, 2025

Exploring The Ministry Of Magic A Deep Dive Into The Wizarding World Of Harry Potter

May 23, 2025 -

Euphoria Season 3 Sydney Sweeney Offers Cryptic Teasers

May 23, 2025

Euphoria Season 3 Sydney Sweeney Offers Cryptic Teasers

May 23, 2025 -

Planning Your Vivid Sydney 2025 Trip Essential Events

May 23, 2025

Planning Your Vivid Sydney 2025 Trip Essential Events

May 23, 2025 -

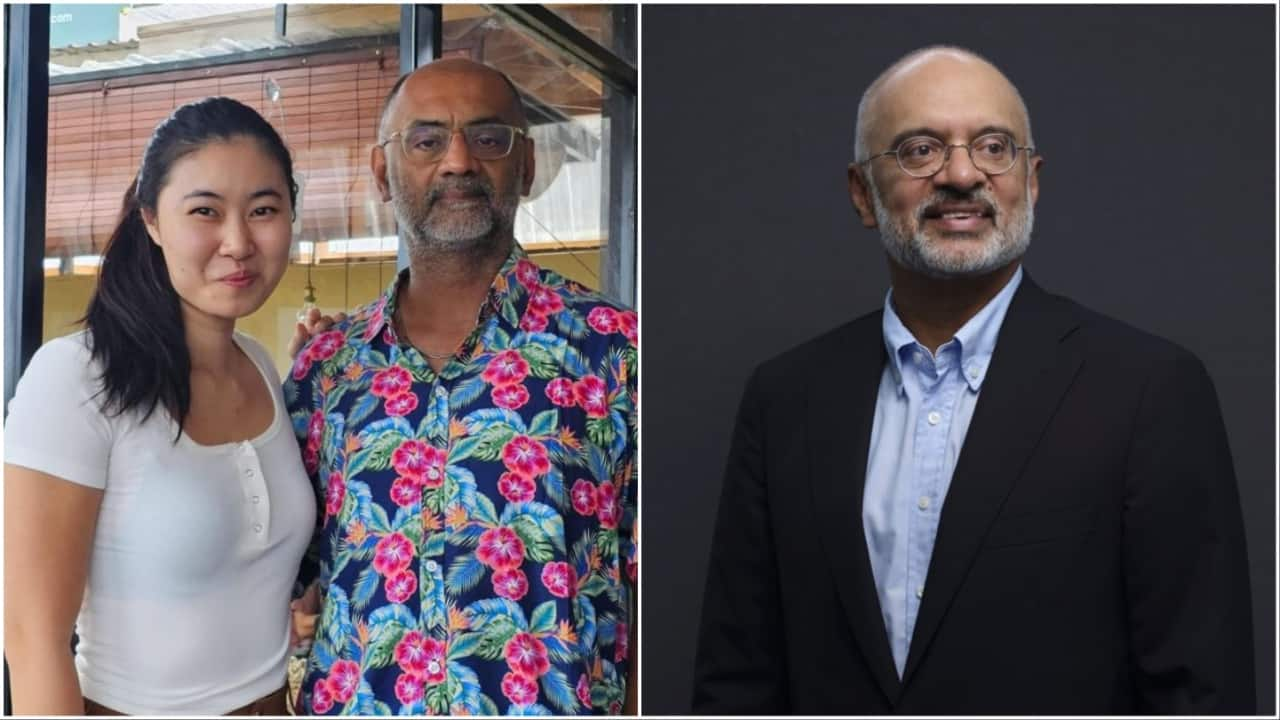

Bali Encounter Ex Dbs Employees Allegation Against Piyush Gupta Creates Buzz

May 23, 2025

Bali Encounter Ex Dbs Employees Allegation Against Piyush Gupta Creates Buzz

May 23, 2025