Bitcoin In 2025: Panic Or Calculated Strategy? A Data-Driven Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin in 2025: Panic or Calculated Strategy? A Data-Driven Analysis

Bitcoin's price volatility has always been a rollercoaster, leaving investors questioning whether future movements represent irrational panic or a carefully orchestrated strategy. Predicting the future is inherently risky, but by analyzing current trends and historical data, we can paint a more informed picture of what Bitcoin might look like in 2025. This data-driven analysis explores the potential scenarios, weighing the factors that could drive both bullish and bearish outcomes.

The Bearish Case: Navigating the Uncertainties

Several factors could contribute to a bearish Bitcoin market in 2025. These include:

-

Regulatory Uncertainty: Increased government regulation globally could significantly impact Bitcoin's adoption and price. Stringent rules surrounding trading, taxation, and overall legality could dampen investor enthusiasm. The ongoing debate surrounding cryptocurrency regulation in the US and the EU remains a key uncertainty.

-

Economic Downturn: A global recession or prolonged economic stagnation could negatively affect risk assets, including Bitcoin. Investors might flock to safer havens like gold, leading to a Bitcoin price decline. The correlation between Bitcoin's price and traditional market indices remains a significant factor to consider.

-

Technological Disruptions: The emergence of new, more efficient, or more environmentally friendly cryptocurrencies could challenge Bitcoin's dominance. Competition from altcoins and potential improvements in blockchain technology could affect Bitcoin's market share.

-

Security Concerns: High-profile hacks or security breaches could erode investor confidence and lead to a price drop. Maintaining robust security infrastructure remains crucial for Bitcoin's long-term viability.

The Bullish Case: Factors Fueling Potential Growth

Despite the potential headwinds, several factors suggest a bullish scenario for Bitcoin in 2025:

-

Increased Institutional Adoption: More institutional investors, including hedge funds and corporations, are showing increasing interest in Bitcoin as a store of value and a diversification tool. This growing institutional adoption could drive up demand and price.

-

Growing Global Adoption: Bitcoin adoption continues to expand globally, particularly in emerging markets. Increased usage as a means of payment and store of value could fuel future price appreciation.

-

Technological Advancements: Developments like the Lightning Network aim to enhance Bitcoin's scalability and transaction speed, addressing some of its current limitations. These advancements could attract more users and investors.

-

Scarcity and Deflationary Nature: Bitcoin's fixed supply of 21 million coins makes it a deflationary asset. As more people recognize its scarcity, demand could outweigh supply, leading to price increases.

Data-Driven Insights: What the Numbers Suggest

While predicting the exact price is impossible, analyzing historical price trends, trading volume, and market capitalization provides valuable insights. Studying past Bitcoin halving events, for example, reveals patterns that can help in projecting future price movements, though these are not guarantees. Examining on-chain metrics like transaction volume and active addresses can also offer clues about overall market sentiment and adoption rates.

Conclusion: Navigating the Future of Bitcoin

Predicting Bitcoin's price in 2025 remains a challenge. The interplay between regulatory hurdles, economic conditions, technological innovations, and investor sentiment will shape its trajectory. Both bearish and bullish scenarios are plausible, highlighting the inherent risk involved in Bitcoin investment. Investors should conduct thorough research, diversify their portfolios, and understand their own risk tolerance before making any investment decisions. The future of Bitcoin is not solely about panic or calculated strategy, but rather a complex interplay of numerous factors. Staying informed and carefully analyzing market data is crucial for navigating this dynamic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin In 2025: Panic Or Calculated Strategy? A Data-Driven Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dimanche 27 Avril 2025 Decouvrez Les Invites De Guy A Lepage A Tout Le Monde En Parle

Apr 27, 2025

Dimanche 27 Avril 2025 Decouvrez Les Invites De Guy A Lepage A Tout Le Monde En Parle

Apr 27, 2025 -

574 Million Rate Increase Proposed By Dte Second Largest In Decades

Apr 27, 2025

574 Million Rate Increase Proposed By Dte Second Largest In Decades

Apr 27, 2025 -

Unravel Nyt Strands April 27th Puzzle Solutions

Apr 27, 2025

Unravel Nyt Strands April 27th Puzzle Solutions

Apr 27, 2025 -

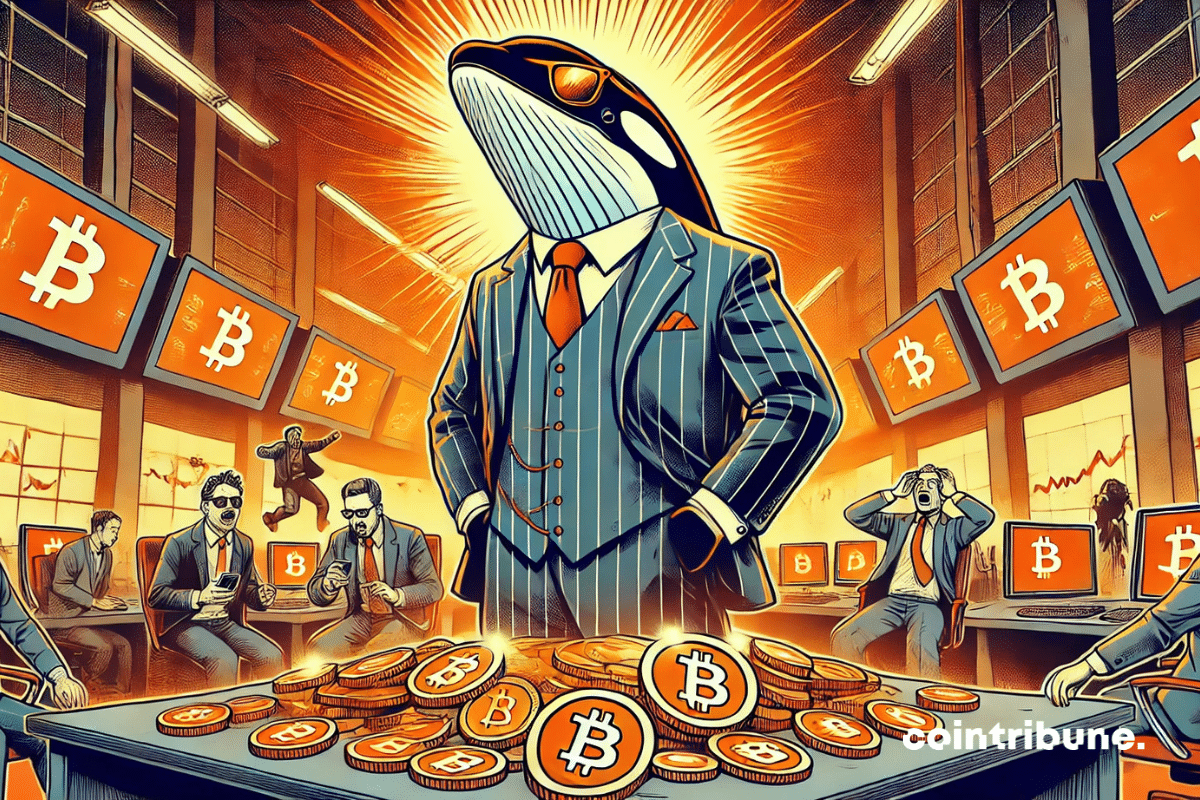

Stream You Season 5 With Netflixs New Free Feature

Apr 27, 2025

Stream You Season 5 With Netflixs New Free Feature

Apr 27, 2025 -

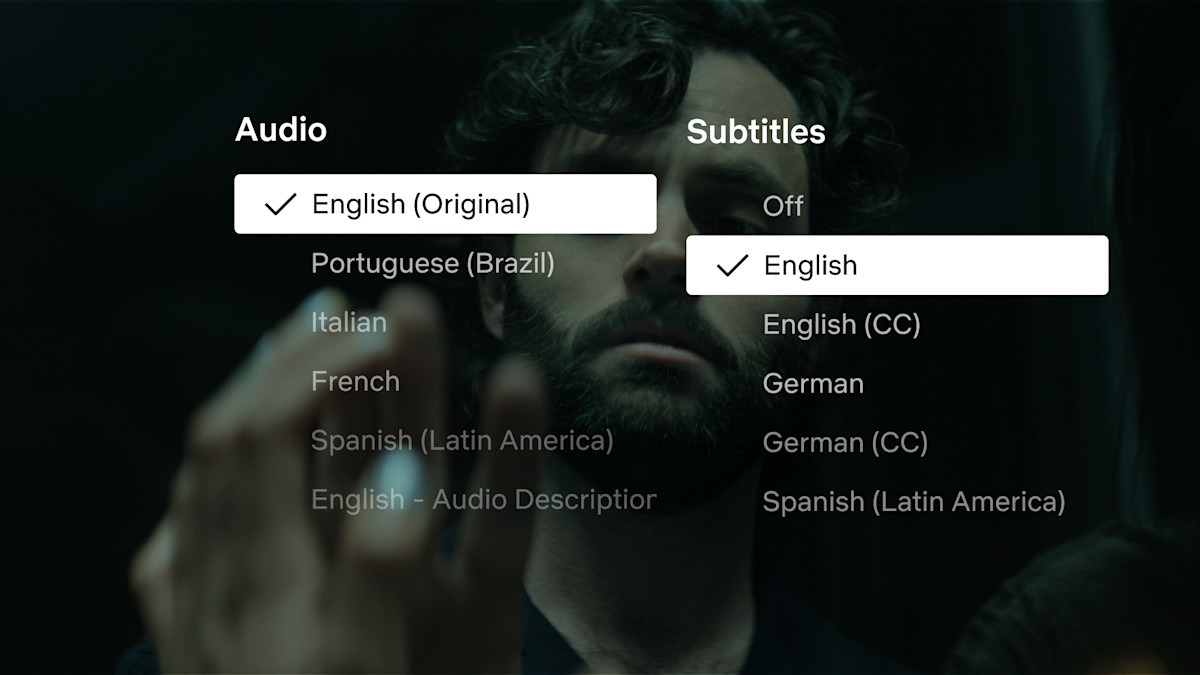

Madison Keys Advances To Madrid Open Third Round

Apr 27, 2025

Madison Keys Advances To Madrid Open Third Round

Apr 27, 2025