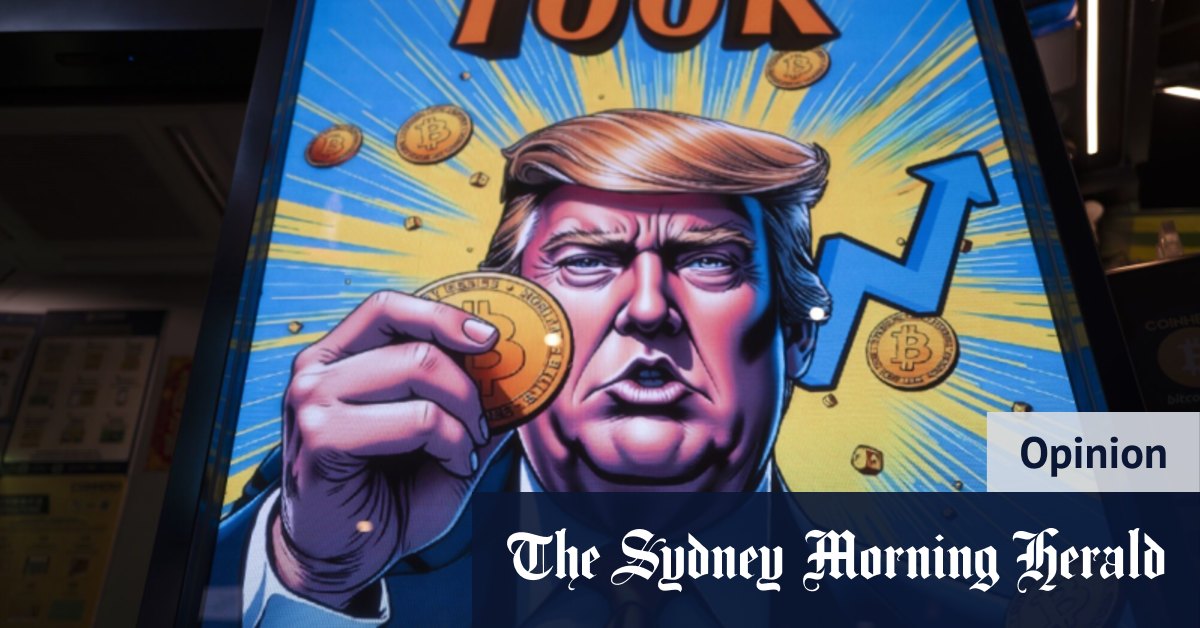

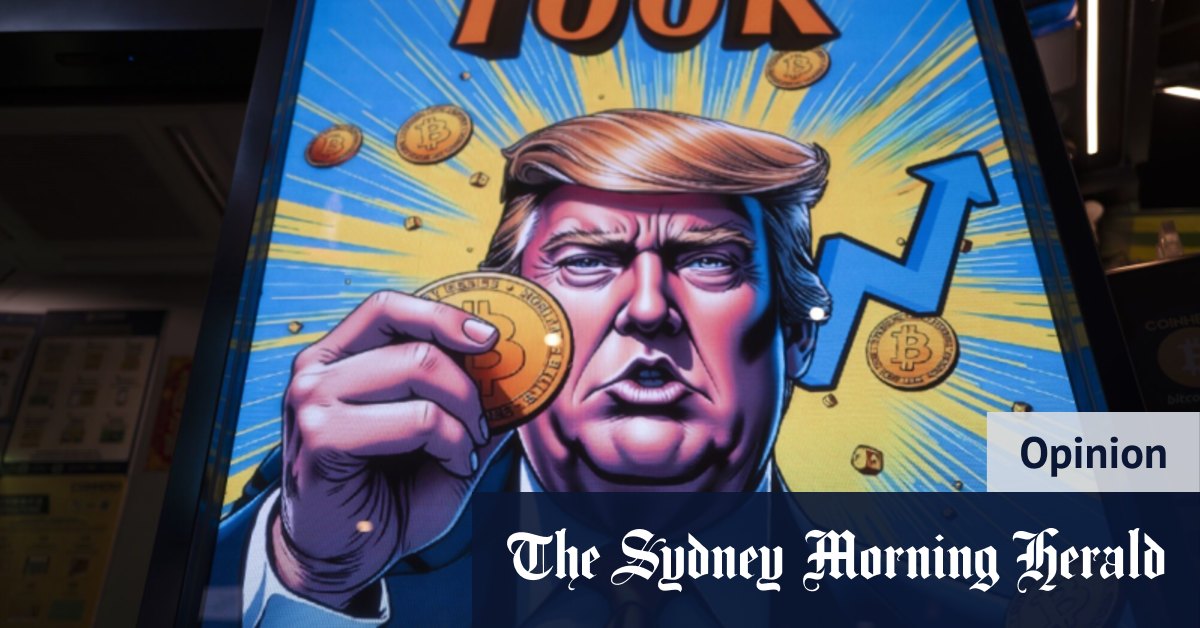

Bitcoin Investment Strategy: Considering Trump's Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Investment Strategy: Navigating the Trump Wildcard

Donald Trump's return to the political stage significantly impacts global markets, and Bitcoin is no exception. While cryptocurrencies are often touted as decentralized and immune to political influence, the reality is far more nuanced. Understanding Trump's potential influence on Bitcoin requires a careful analysis of his past policies and their potential future iterations. This article explores a Bitcoin investment strategy considering the Trump factor, offering insights for both seasoned investors and newcomers to the crypto space.

Trump's Historical Impact on Crypto:

Trump's previous presidency saw a mixed bag for cryptocurrencies. While he didn't directly address Bitcoin regulation extensively, his administration's focus on deregulation generally created a more favorable environment for technological innovation. Conversely, his administration's tough stance on China, a major player in the Bitcoin mining landscape, introduced geopolitical uncertainties that could affect the price.

Potential Scenarios Under a Trump Presidency (or Significant Influence):

- Increased Regulatory Scrutiny: A more protectionist Trump administration might prioritize stricter regulation of cryptocurrencies, potentially hindering their growth. This could lead to price volatility and decreased investor confidence.

- Fiscal Policy and Inflation: Trump's emphasis on fiscal stimulus could lead to inflation, potentially driving investors towards Bitcoin as a hedge against inflation. This scenario could boost Bitcoin's value.

- Geopolitical Instability: Trump's unpredictable foreign policy could create global uncertainty, potentially increasing the demand for Bitcoin as a safe haven asset. This is a double-edged sword, as uncertainty can also trigger widespread sell-offs.

- Technological Advancement Focus: While not guaranteed, a Trump administration might continue to support technological innovation, potentially indirectly boosting the cryptocurrency sector through supportive policies towards blockchain technology.

Developing Your Bitcoin Investment Strategy:

Considering the potential impacts outlined above, a robust Bitcoin investment strategy should incorporate the following:

- Diversification: Never put all your eggs in one basket. Diversify your portfolio across various asset classes, including traditional investments and alternative assets. Bitcoin should be a part of a broader investment strategy, not its entirety.

- Risk Assessment: Bitcoin is inherently volatile. Understand your risk tolerance before investing. Only invest what you can afford to lose.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk associated with market timing.

- Long-Term Perspective: Bitcoin's price is susceptible to short-term market swings. A long-term perspective is crucial for weathering these fluctuations and benefiting from potential long-term growth.

- Stay Informed: Keep up-to-date on political developments, regulatory changes, and technological advancements in the crypto space.

Conclusion:

A Trump presidency, or significant Trump influence on policy, presents both opportunities and challenges for Bitcoin investors. A well-informed, diversified, and risk-managed approach is essential for navigating this complex landscape. Remember, this is not financial advice; conduct thorough research and consult with a financial advisor before making any investment decisions. The information provided here is for educational purposes only.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Investment Strategy: Considering Trump's Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Real Madrid Star Set For Arsenal Move Gunners Make Serious Bid

May 22, 2025

Real Madrid Star Set For Arsenal Move Gunners Make Serious Bid

May 22, 2025 -

Game Stops Future Profitability Bitcoin And A Restructured Balance Sheet

May 22, 2025

Game Stops Future Profitability Bitcoin And A Restructured Balance Sheet

May 22, 2025 -

Hidden In Plain Sight A Critical Flaw In The New Gta 6 Trailer

May 22, 2025

Hidden In Plain Sight A Critical Flaw In The New Gta 6 Trailer

May 22, 2025 -

The Talking Point Skinners Future And The Critics Doubts

May 22, 2025

The Talking Point Skinners Future And The Critics Doubts

May 22, 2025 -

Shai Gilgeous Alexander The Nbas Next Face

May 22, 2025

Shai Gilgeous Alexander The Nbas Next Face

May 22, 2025