Bitcoin Investment Strategy: Considering Trump's Recent Impact.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

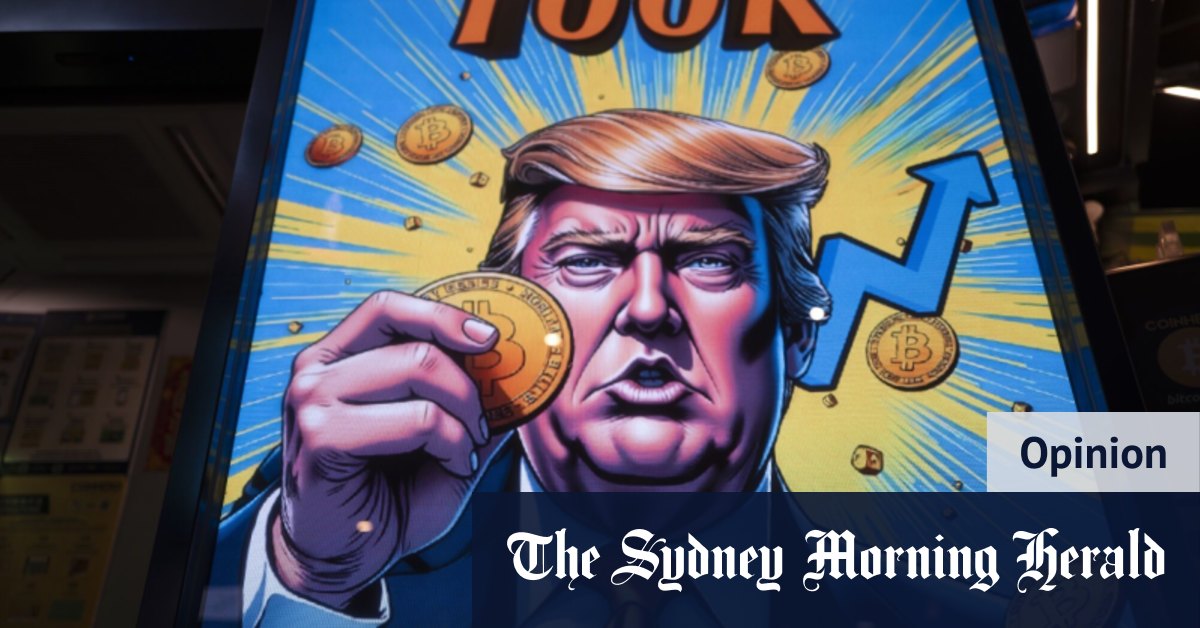

Bitcoin Investment Strategy: Navigating the Trump Impact

Donald Trump's re-emergence onto the political scene is sending ripples through various markets, and Bitcoin is no exception. His pronouncements on economic policy and cryptocurrency have investors wondering: how should we adjust our Bitcoin investment strategies? This article explores the potential impacts of Trump's influence and offers insights for navigating this turbulent landscape.

Trump's Stance on Crypto: A History of Volatility

Trump's past statements on Bitcoin and cryptocurrency have been, to put it mildly, inconsistent. While he hasn't explicitly endorsed Bitcoin, his criticisms of the Federal Reserve and the dollar's weakening position have, ironically, fueled interest in alternative assets like Bitcoin. His unpredictable nature means any future pronouncements could trigger significant price swings. This inherent uncertainty makes a robust Bitcoin investment strategy crucial.

Key Considerations for Your Bitcoin Strategy:

-

Increased Regulatory Scrutiny?: A Trump presidency could lead to increased regulatory scrutiny of the cryptocurrency market. While some see this as a potential negative, others argue that clearer regulations could enhance Bitcoin's legitimacy and long-term stability. Investors should stay informed about potential changes in regulatory landscapes.

-

Economic Uncertainty & Safe-Haven Status: Economic uncertainty, a potential hallmark of a Trump administration, often drives investors towards "safe haven" assets. Bitcoin, despite its volatility, has shown signs of acting as a safe haven during times of global market instability. This potential could be a factor in your investment decisions.

-

Dollar's Strength (or Weakness): Trump's economic policies could significantly impact the dollar's strength. A weakening dollar often leads to increased demand for alternative assets like Bitcoin, potentially boosting its price. Conversely, a strong dollar could put downward pressure on Bitcoin's value.

-

Technological Advancements: Regardless of Trump's influence, the underlying technology of Bitcoin continues to evolve. Factors like the Lightning Network's development and broader adoption of blockchain technology remain crucial long-term considerations.

H2: Building a Resilient Bitcoin Investment Strategy:

Considering the complexities of Trump's potential impact, a diversified and well-researched investment strategy is paramount. Here are some key elements:

-

Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a large sum at a market peak.

-

Risk Tolerance: Honestly assess your risk tolerance. Bitcoin is a highly volatile asset. Don't invest more than you can afford to lose.

-

Diversification: Don't put all your eggs in one basket. Diversify your portfolio across various asset classes to reduce overall risk.

-

Stay Informed: Keep abreast of political developments, regulatory changes, and technological advancements in the cryptocurrency space.

H2: The Bottom Line:

Trump's potential influence on the Bitcoin market is undeniable. However, focusing solely on political factors would be a mistake. A robust Bitcoin investment strategy requires a comprehensive understanding of macroeconomic trends, technological advancements, and your own risk tolerance. By combining careful analysis with a well-defined strategy, investors can navigate the complexities of the market and potentially capitalize on opportunities. Remember to conduct thorough research and consider consulting with a financial advisor before making any investment decisions. The information provided here is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Investment Strategy: Considering Trump's Recent Impact.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official Confirmation Qatar Provides New Plane For Us Air Force One

May 22, 2025

Official Confirmation Qatar Provides New Plane For Us Air Force One

May 22, 2025 -

Bitcoin Cash Bch Price Action Is A Breakout Imminent

May 22, 2025

Bitcoin Cash Bch Price Action Is A Breakout Imminent

May 22, 2025 -

North Harris County Amber Alert Police Search For Missing Teenager

May 22, 2025

North Harris County Amber Alert Police Search For Missing Teenager

May 22, 2025 -

Stephen A Smiths Take Oklahoma Citys Potential Sam Prestis Strategy And The West

May 22, 2025

Stephen A Smiths Take Oklahoma Citys Potential Sam Prestis Strategy And The West

May 22, 2025 -

Retail Rocket One Businesss Incredible Overnight Expansion

May 22, 2025

Retail Rocket One Businesss Incredible Overnight Expansion

May 22, 2025