Bitcoin Investment Strategy: How 21 Capital Inspired Cantor, Tether, And SoftBank

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Investment Strategy: How 21 Capital Inspired Cantor, Tether, and SoftBank

The cryptocurrency market, particularly Bitcoin, has seen a surge in institutional investment, with major players like Cantor Fitzgerald, Tether, and SoftBank reportedly influenced by the strategic moves of 21 Capital. This article delves into 21 Capital's Bitcoin investment strategy and how its success has inspired these financial giants to jump into the crypto game.

21 Capital: A Pioneer in Bitcoin Investment

21 Capital, a relatively young but highly influential investment firm, has carved a niche for itself by focusing heavily on Bitcoin and related blockchain technologies. Their approach isn't simply about buying and holding; it's a sophisticated strategy built around fundamental analysis, market timing, and a long-term vision for Bitcoin's adoption. While specific details of their strategies remain confidential, their impressive returns have attracted significant attention within the financial world. This success is attributed to a combination of factors:

- Deep Fundamental Analysis: 21 Capital invests heavily in rigorous research, understanding the underlying technology and the broader macroeconomic factors influencing Bitcoin's value. They don't simply react to market trends; they anticipate them.

- Strategic Partnerships: Building strong relationships within the Bitcoin ecosystem, including developers, miners, and other key players, provides 21 Capital with valuable insights and opportunities.

- Long-Term Vision: Unlike many short-term traders, 21 Capital demonstrates a commitment to a long-term strategy, betting on Bitcoin's continued growth and eventual mainstream adoption.

The Ripple Effect: Cantor, Tether, and SoftBank

The success of 21 Capital's Bitcoin investment strategy has undoubtedly influenced other major players to reconsider their approach to cryptocurrencies.

Cantor Fitzgerald: This established financial services firm, traditionally focused on more conventional markets, has reportedly increased its Bitcoin holdings, possibly inspired by 21 Capital's success and the growing institutional acceptance of Bitcoin as a legitimate asset class. Their entry signifies a significant shift in the perception of Bitcoin within the established financial community.

Tether: The issuer of the USDT stablecoin, Tether, has been increasingly intertwined with the Bitcoin market. While their relationship isn't directly linked to 21 Capital's strategy, the overall growth and institutionalization of the Bitcoin market, partially driven by firms like 21 Capital, has undoubtedly boosted Tether's relevance and importance in the crypto space.

SoftBank: This Japanese multinational conglomerate has made several significant investments in the cryptocurrency space, demonstrating a growing interest in the potential of digital assets. While their investment strategy differs from 21 Capital's, the overall trend towards institutional adoption of Bitcoin, catalyzed by companies like 21 Capital, likely contributed to SoftBank's decision to enter the market.

The Future of Bitcoin Investment

The influence of 21 Capital highlights a crucial shift in the perception of Bitcoin. It's no longer just a speculative asset for early adopters; it's increasingly viewed as a viable investment option by established financial institutions. This trend is likely to continue, with more institutional investors following in the footsteps of Cantor, Tether, and SoftBank, inspired by the success of firms like 21 Capital. The future of Bitcoin investment looks promising, fueled by growing institutional adoption and a belief in its long-term potential.

Keywords: Bitcoin investment, 21 Capital, Cantor Fitzgerald, Tether, SoftBank, cryptocurrency investment, institutional investors, Bitcoin strategy, blockchain technology, crypto market, digital assets, Bitcoin adoption.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Investment Strategy: How 21 Capital Inspired Cantor, Tether, And SoftBank. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Humanitarian Aid And Science A Focus On War Zones Episode 3

Apr 24, 2025

Humanitarian Aid And Science A Focus On War Zones Episode 3

Apr 24, 2025 -

Ge 2025 Candidate Announcement Chan Chun Sing To Lead Restructured Tanjong Pagar Grc

Apr 24, 2025

Ge 2025 Candidate Announcement Chan Chun Sing To Lead Restructured Tanjong Pagar Grc

Apr 24, 2025 -

Sandberg And Dauberman A Comparative Analysis Of Their Horror Film Styles

Apr 24, 2025

Sandberg And Dauberman A Comparative Analysis Of Their Horror Film Styles

Apr 24, 2025 -

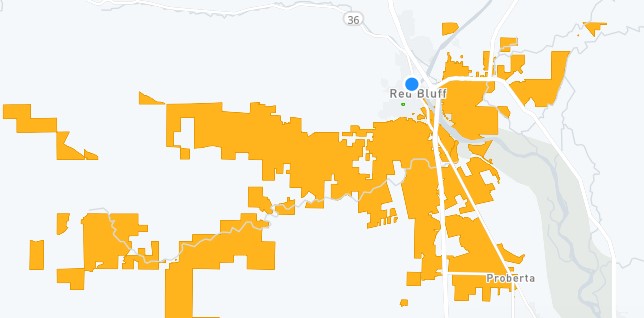

Red Bluff County Power Outage Resolved Official Statement

Apr 24, 2025

Red Bluff County Power Outage Resolved Official Statement

Apr 24, 2025 -

Google Messages Adds Crucial Safety Feature Teasing A Missing Functionality

Apr 24, 2025

Google Messages Adds Crucial Safety Feature Teasing A Missing Functionality

Apr 24, 2025