Bitcoin Legal Tender: Assessing El Salvador's Experience And Its Relevance To The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Legal Tender: El Salvador's Pioneering Experiment and its Implications for the US

El Salvador's bold move to adopt Bitcoin as legal tender in September 2021 sent shockwaves through the global financial landscape. Nearly three years later, the experiment remains a contentious topic, sparking debate about the potential – and pitfalls – of cryptocurrency adoption on a national scale. While the US remains hesitant, examining El Salvador's experience offers crucial insights into the challenges and opportunities presented by Bitcoin's integration into a national economy. This analysis explores El Salvador's journey, highlighting key takeaways and their potential relevance to the United States.

El Salvador's Bitcoin Law: A Mixed Bag of Results

The initial rollout of Bitcoin as legal tender in El Salvador was met with both enthusiasm and skepticism. Proponents touted its potential to boost financial inclusion, attract foreign investment, and reduce reliance on the US dollar. However, the reality proved far more complex.

-

Increased Financial Inclusion (Partial Success): While some citizens embraced Bitcoin for remittances and everyday transactions, particularly in areas with limited banking access, widespread adoption has been slower than anticipated. The digital divide and lack of cryptocurrency literacy remain significant hurdles.

-

Foreign Investment (Limited Impact): The hoped-for influx of foreign investment hasn't materialized to the extent predicted. While some Bitcoin-related businesses have emerged, the overall economic impact has been modest and difficult to isolate from other economic factors.

-

Volatility and Economic Instability (Significant Challenges): Bitcoin's inherent volatility has significantly impacted El Salvador's economy. The value of the national currency fluctuated wildly, creating uncertainty and impacting businesses. The government's purchase of Bitcoin at high prices also resulted in substantial losses.

-

Transparency and Regulatory Concerns (Ongoing Issues): Concerns regarding transparency and regulatory oversight persist. The lack of clear regulations and the potential for illicit activities using Bitcoin remain significant challenges.

Lessons for the US: Cautious Optimism and Strategic Planning

El Salvador's experience underscores the importance of meticulous planning and robust regulatory frameworks before adopting Bitcoin as legal tender. While the US is unlikely to follow El Salvador's path directly, several lessons are relevant:

-

Gradual Integration: A phased approach, focusing on specific use cases like cross-border payments or pilot programs in limited regions, could minimize risks and allow for better monitoring.

-

Robust Regulatory Framework: Clear regulations addressing taxation, consumer protection, and anti-money laundering are crucial to mitigate the potential risks associated with cryptocurrency adoption.

-

Digital Literacy and Infrastructure: Significant investments in digital literacy programs and infrastructure development are necessary to ensure equitable access to cryptocurrency technologies.

-

Focus on Specific Use Cases: Instead of aiming for widespread adoption as legal tender immediately, the US could explore leveraging blockchain technology and cryptocurrencies for specific applications, such as improving supply chain transparency or streamlining government services.

The Future of Bitcoin in the US: A Cautious Outlook

The US's approach to Bitcoin is likely to remain cautious and measured. While the Federal Reserve is exploring the potential of Central Bank Digital Currencies (CBDCs), a full-scale adoption of Bitcoin as legal tender remains improbable in the near future. However, understanding the successes and failures of El Salvador's experiment is crucial for informed policymaking regarding the integration of cryptocurrencies into the US financial system. The future of Bitcoin in the US will likely involve a balanced approach, prioritizing innovation while mitigating risks through comprehensive regulation and strategic planning. The key is not simply embracing or rejecting Bitcoin, but harnessing its potential while mitigating its inherent vulnerabilities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Legal Tender: Assessing El Salvador's Experience And Its Relevance To The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Vivid Sydneys Martin Place Changes A Food Charitys Struggle For Relocation

May 24, 2025

Vivid Sydneys Martin Place Changes A Food Charitys Struggle For Relocation

May 24, 2025 -

The Growing Threat Exploring The Rise Of Colorectal Cancer Among Young People

May 24, 2025

The Growing Threat Exploring The Rise Of Colorectal Cancer Among Young People

May 24, 2025 -

The Future Of Cleaning Dysons Compact Vacuum Revolution

May 24, 2025

The Future Of Cleaning Dysons Compact Vacuum Revolution

May 24, 2025 -

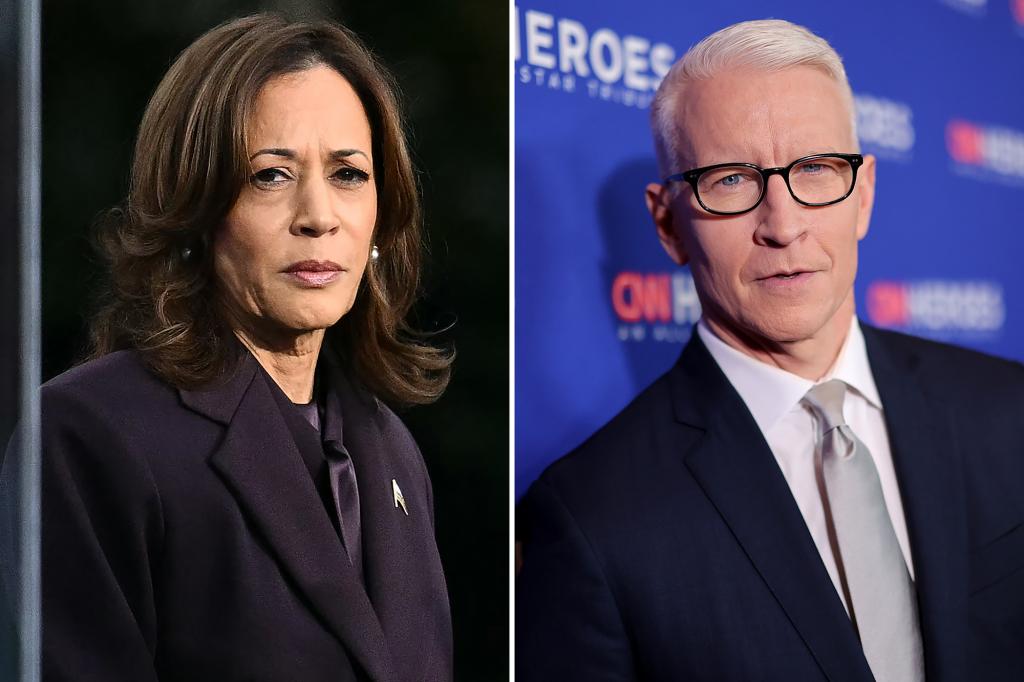

Kamala Harriss Heated Exchange Full Story On Motherf Er Remark To Anderson Cooper

May 24, 2025

Kamala Harriss Heated Exchange Full Story On Motherf Er Remark To Anderson Cooper

May 24, 2025 -

Qwen 2 5 Coder And Qwen 3 Leading Open Source Llms Outperform Deep Seek And Meta

May 24, 2025

Qwen 2 5 Coder And Qwen 3 Leading Open Source Llms Outperform Deep Seek And Meta

May 24, 2025