Bitcoin Legal Tender: Comparing El Salvador's Experience To The US Context

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Legal Tender: El Salvador's Rocky Road and the US's Cautious Stance

Bitcoin's rise as a digital currency has sparked global debate, culminating in landmark decisions like El Salvador's adoption of Bitcoin as legal tender in September 2021. This bold move, unprecedented for a sovereign nation, offers a fascinating case study – a stark contrast to the more cautious approach taken by the United States. This article compares and contrasts the experiences of these two nations, examining the successes, failures, and implications for the future of cryptocurrency regulation.

El Salvador: A Bitcoin Pioneer (with Challenges)

El Salvador's adoption of Bitcoin was touted as a way to boost financial inclusion and attract foreign investment. President Nayib Bukele championed the move, arguing it would reduce reliance on the US dollar and empower the unbanked population. The government launched the "Chivo" wallet, aiming to facilitate Bitcoin transactions.

However, the reality has been far more complex. The initial rollout faced technical glitches and widespread skepticism. The price volatility of Bitcoin resulted in significant losses for many Salvadorans, particularly those who adopted it without a full understanding of the risks. Furthermore, the lack of robust regulatory frameworks and consumer protection measures exacerbated the challenges. Critics point to a lack of transparency and concerns about the potential for money laundering.

Key Challenges Faced by El Salvador:

- Price Volatility: Bitcoin's unpredictable price swings caused significant financial losses for citizens.

- Lack of Infrastructure: Insufficient internet access and technological literacy hindered widespread adoption.

- Regulatory Uncertainty: The absence of clear regulations created a vulnerable environment for exploitation.

- Environmental Concerns: Bitcoin mining's high energy consumption clashed with El Salvador's environmental goals.

The US: A Cautious Approach to Cryptocurrency

In contrast to El Salvador's enthusiastic embrace, the United States has adopted a far more measured approach to Bitcoin and other cryptocurrencies. While not outright banning Bitcoin, the US government has focused on regulation and risk mitigation. Various regulatory bodies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), are actively working to establish frameworks for cryptocurrency trading and investment.

The US approach prioritizes consumer protection, preventing market manipulation, and combating illicit financial activities. This cautious stance reflects a commitment to stability and preventing potential systemic risks associated with the volatile nature of cryptocurrencies. However, this regulatory uncertainty also creates challenges for innovation and hinders the growth of the cryptocurrency sector within the US.

US Focus on Regulation:

- Combating Financial Crime: Preventing money laundering and terrorist financing remains a top priority.

- Investor Protection: Safeguarding investors from fraud and manipulation is paramount.

- Taxation: Clear guidelines on the taxation of cryptocurrency transactions are being developed.

- Stablecoin Regulation: Focus on regulating stablecoins to mitigate potential systemic risks.

Comparing and Contrasting the Approaches

The contrasting approaches of El Salvador and the US highlight the complex issues surrounding Bitcoin's integration into national economies. El Salvador's experiment, while bold, demonstrates the potential pitfalls of rapid and unregulated adoption. The US's more measured approach, while potentially hindering innovation in the short term, prioritizes long-term stability and consumer protection.

The Future of Bitcoin as Legal Tender

The long-term viability of Bitcoin as legal tender remains uncertain. While El Salvador's experience serves as a cautionary tale, it also highlights the potential for cryptocurrencies to revolutionize financial systems, particularly in developing nations with limited access to traditional banking. The US approach, focused on carefully calibrated regulation, may ultimately prove to be a more sustainable model for integrating cryptocurrencies into the global financial landscape. The ongoing debate, however, highlights the need for a nuanced and globally coordinated approach to cryptocurrency regulation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Legal Tender: Comparing El Salvador's Experience To The US Context. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bbc En Zayif Takimlarin Finali Beklenmedik Bir Sonuc

May 23, 2025

Bbc En Zayif Takimlarin Finali Beklenmedik Bir Sonuc

May 23, 2025 -

Is Gavin Newsom A Moderate Examining Californias Policy Under His Leadership

May 23, 2025

Is Gavin Newsom A Moderate Examining Californias Policy Under His Leadership

May 23, 2025 -

Tiffany Hayes Leaves Court After Head Injury In Valkyries Game

May 23, 2025

Tiffany Hayes Leaves Court After Head Injury In Valkyries Game

May 23, 2025 -

Kanye West Seeks Forgiveness After Antisemitic Controversy A Face Time Call With His Kids

May 23, 2025

Kanye West Seeks Forgiveness After Antisemitic Controversy A Face Time Call With His Kids

May 23, 2025 -

Ana De Armas Attends John Wick Ballerina Premiere Solo Wheres Tom Cruise

May 23, 2025

Ana De Armas Attends John Wick Ballerina Premiere Solo Wheres Tom Cruise

May 23, 2025

Latest Posts

-

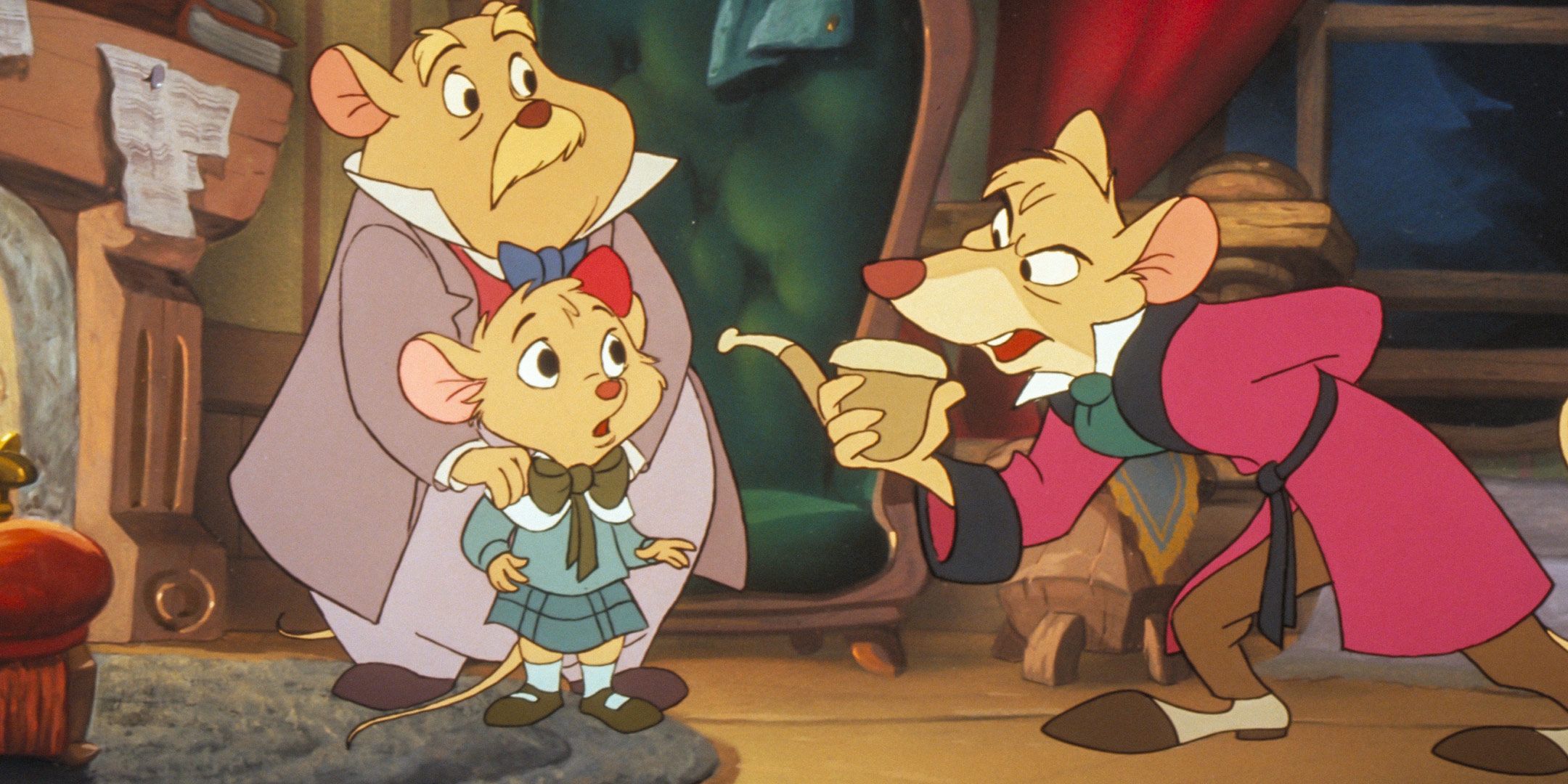

10 Underrated Disney Films Sequels We Wish We Had

May 23, 2025

10 Underrated Disney Films Sequels We Wish We Had

May 23, 2025 -

Is Netflixs Revenge Thriller Worth The Hype A Divided Audience Weighs In

May 23, 2025

Is Netflixs Revenge Thriller Worth The Hype A Divided Audience Weighs In

May 23, 2025 -

Hands On With The Fujifilm X Half Retro Compact Camera Impressions

May 23, 2025

Hands On With The Fujifilm X Half Retro Compact Camera Impressions

May 23, 2025 -

Eiza Gonzalez Y Guy Ritchie Colaboracion En Fountain Of Youth

May 23, 2025

Eiza Gonzalez Y Guy Ritchie Colaboracion En Fountain Of Youth

May 23, 2025 -

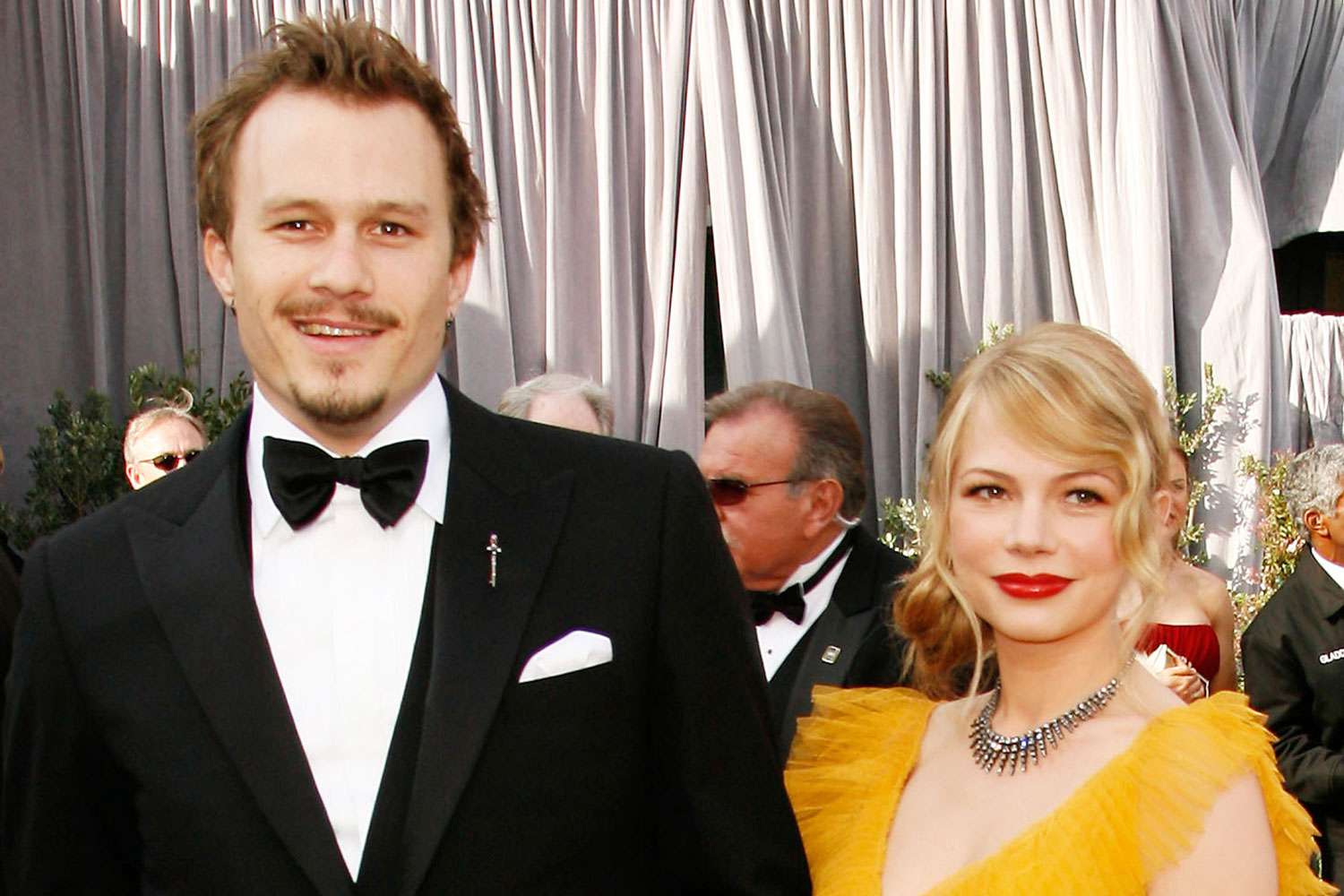

Matilda Ledger Michelle Williams Heartfelt Tribute To Her Daughter And Heath Ledger

May 23, 2025

Matilda Ledger Michelle Williams Heartfelt Tribute To Her Daughter And Heath Ledger

May 23, 2025