Bitcoin Price Explodes To $93K: Is Trump's Economic Policy To Blame?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Price Explodes to $93K: Is Trump's Economic Policy to Blame?

The cryptocurrency market is ablaze! Bitcoin, the world's most popular digital currency, has just surged past the $93,000 mark, shattering previous all-time highs and sending shockwaves through the financial world. While several factors contribute to this dramatic price spike, many analysts are pointing a finger at a surprising culprit: the economic policies enacted during the Trump administration.

This unprecedented surge has left investors reeling, with some celebrating massive profits while others grapple with the volatility. But the question on everyone's mind is: why? And could the legacy of Trump's economic agenda hold the key?

The Trump Effect: A Looser Monetary Policy?

One primary argument connecting Trump's economic policies to the Bitcoin boom centers on the significant tax cuts implemented during his presidency. These cuts, critics argue, fueled a surge in government debt and a more expansive monetary policy from the Federal Reserve. This, in turn, led to increased money supply and inflation, creating a climate ripe for alternative assets like Bitcoin to thrive.

-

Increased Money Supply: The influx of money into the system, combined with persistently low interest rates, made traditional investment options less attractive. As a result, investors began seeking higher-yield, less regulated options, driving up demand for cryptocurrencies like Bitcoin.

-

Inflation Hedge: With inflation on the rise, many investors see Bitcoin as a potential hedge against the erosion of fiat currency purchasing power. Its limited supply of 21 million coins makes it an attractive asset in times of economic uncertainty.

-

Deregulation: While not directly attributable to Trump's administration, the relative lack of stringent regulatory frameworks around cryptocurrencies during this period could have contributed to increased investor interest and market growth.

Beyond Trump: Other Contributing Factors

It's crucial to acknowledge that attributing the Bitcoin price surge solely to Trump's economic policies would be an oversimplification. Several other factors are at play:

-

Increased Institutional Adoption: Major financial institutions are increasingly embracing Bitcoin and other cryptocurrencies, legitimizing them and boosting demand.

-

Technological Advancements: Developments in blockchain technology and the increasing sophistication of cryptocurrency infrastructure are making them more accessible and user-friendly.

-

Global Uncertainty: Geopolitical instability and economic uncertainty often drive investors towards alternative, decentralized assets like Bitcoin, providing a safe haven for their investments.

The Future of Bitcoin: A Rollercoaster Ride Ahead?

The future of Bitcoin's price remains uncertain. While the $93,000 milestone is a significant achievement, the cryptocurrency market is notoriously volatile. Experts predict further price swings, both up and down, as the market matures and regulatory landscapes evolve.

The relationship between Trump's economic policies and the Bitcoin price explosion is a complex issue requiring further analysis. However, the correlation between looser monetary policy, inflation, and increased demand for alternative assets like Bitcoin is undeniable. This latest surge serves as a powerful reminder of the interconnectedness of global economics and the disruptive potential of decentralized technologies. The question of whether this marks a new era for Bitcoin or just another peak in its volatile history remains to be seen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Price Explodes To $93K: Is Trump's Economic Policy To Blame?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nintendo Switch 2 Pre Orders Begin Us Facing Delays June Release Date Confirmed

Apr 24, 2025

Nintendo Switch 2 Pre Orders Begin Us Facing Delays June Release Date Confirmed

Apr 24, 2025 -

Transicao Na Berkshire Buffett Delega Decisoes De Investimento A Greg Abel

Apr 24, 2025

Transicao Na Berkshire Buffett Delega Decisoes De Investimento A Greg Abel

Apr 24, 2025 -

Agora Mesmo Cobertura Ao Vivo Da Reuniao Anual Berkshire Hathaway 2024 Pelo Info Money

Apr 24, 2025

Agora Mesmo Cobertura Ao Vivo Da Reuniao Anual Berkshire Hathaway 2024 Pelo Info Money

Apr 24, 2025 -

Rising Star Forgotten Tiger Cubs Afl Debut Imminent

Apr 24, 2025

Rising Star Forgotten Tiger Cubs Afl Debut Imminent

Apr 24, 2025 -

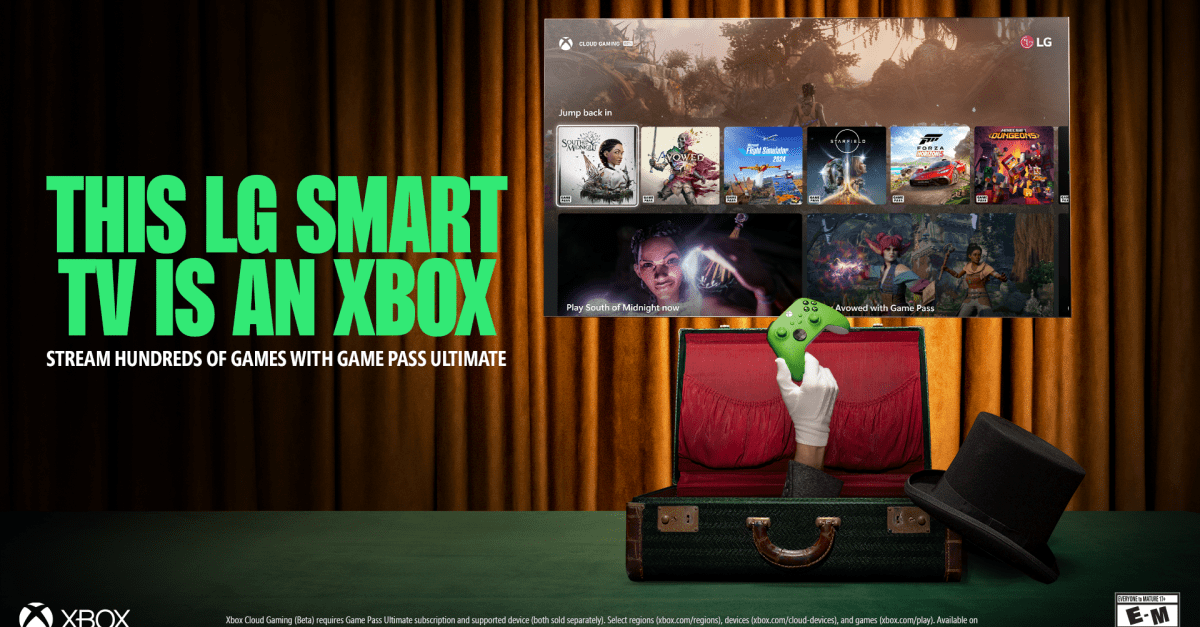

Game On Your Lg Tv Microsoft Xbox App Officially Launches

Apr 24, 2025

Game On Your Lg Tv Microsoft Xbox App Officially Launches

Apr 24, 2025