Bitcoin Price Rally: Are Whales Behind The Recent Market Upswing?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Price Rally: Are Whales Behind the Recent Market Upswing?

Bitcoin's price has seen a significant surge recently, leaving many wondering about the driving forces behind this unexpected rally. While various factors contribute to Bitcoin's volatility, a compelling theory points to the potential influence of large-scale investors, often referred to as "whales," manipulating the market. This article delves into the evidence and explores whether these crypto behemoths are truly orchestrating this bullish Bitcoin price movement.

The Recent Bitcoin Price Surge: A Closer Look

Over the past [Insert timeframe, e.g., week/month], Bitcoin's price has climbed from [Insert previous price] to [Insert current price], representing a remarkable [Insert percentage]% increase. This rapid appreciation has caught the attention of both seasoned investors and newcomers alike, sparking intense speculation about the underlying reasons. While positive macroeconomic news and regulatory developments undoubtedly play a role, the sheer magnitude and speed of this rally have fueled suspicions of significant institutional involvement.

The Whale Factor: Accumulating and Influencing the Market

"Whales," defined as entities holding substantial amounts of Bitcoin (typically millions of dollars worth), possess the market power to significantly influence price movements. Their buying and selling activities can create ripple effects, triggering cascading price changes that impact smaller investors. Several pieces of evidence suggest whales might be contributing to the current upswing:

- On-chain analysis: Data from blockchain explorers reveals unusual patterns in large Bitcoin transactions, suggesting significant accumulations by specific wallets in the lead-up to the price surge. These large-scale purchases can artificially inflate demand, pushing prices higher.

- Decreased sell-off pressure: Despite the price increase, the volume of Bitcoin being sold hasn't correspondingly risen, indicating that whales are holding onto their assets rather than capitalizing on the rally. This suggests a long-term bullish outlook and a deliberate strategy to further increase the price.

- Correlation with other market indicators: Analyzing the price movement of Bitcoin in relation to other cryptocurrencies and traditional assets might reveal a pattern indicating whale manipulation. For example, if Bitcoin's price surge doesn't correlate with overall market trends, it could hint at a more concentrated influence.

Beyond Whales: Other Contributing Factors

It's crucial to note that attributing the Bitcoin price rally solely to whale activity would be an oversimplification. Other factors are at play, including:

- Growing institutional adoption: More institutional investors are allocating funds to Bitcoin, signifying increasing confidence in the cryptocurrency's long-term viability.

- Positive regulatory developments: Positive news regarding Bitcoin regulation in key markets can bolster investor sentiment and drive price increases.

- Macroeconomic conditions: Global economic uncertainty often drives investors towards Bitcoin as a safe haven asset.

The Implications and Future Outlook

While the extent of whale influence remains debatable, understanding their potential impact is vital for navigating the Bitcoin market. Investors need to remain cautious and avoid impulsive decisions based solely on short-term price fluctuations. Diversification and thorough due diligence are crucial for mitigating risks associated with this volatile asset.

Conclusion:

The recent Bitcoin price rally is a complex phenomenon, and while whales likely play a role, it's far from the sole determinant. A comprehensive understanding of various contributing factors, including macroeconomic conditions, regulatory changes, and institutional adoption, is essential for a nuanced perspective on the future trajectory of Bitcoin's price. Continuous monitoring of on-chain data and market trends is crucial for navigating the complexities of this dynamic market. The debate continues, but one thing is clear: the Bitcoin market remains incredibly fascinating and influential in the world of finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Price Rally: Are Whales Behind The Recent Market Upswing?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Isabela Merceds Dina A New Chapter In The Last Of Us

Apr 28, 2025

Isabela Merceds Dina A New Chapter In The Last Of Us

Apr 28, 2025 -

Ryanair Passenger Warning Uk Travel Plans Under Threat Due To External Issues

Apr 28, 2025

Ryanair Passenger Warning Uk Travel Plans Under Threat Due To External Issues

Apr 28, 2025 -

St Engineerings Q1 2025 Contract Wins Total 4 4 Billion

Apr 28, 2025

St Engineerings Q1 2025 Contract Wins Total 4 4 Billion

Apr 28, 2025 -

Ge 2025 Examining The Potential Outcomes Of The Singapore Election

Apr 28, 2025

Ge 2025 Examining The Potential Outcomes Of The Singapore Election

Apr 28, 2025 -

Cotas De Casas Acesso A Praia E Campo Sem Comprar A Propriedade Inteira

Apr 28, 2025

Cotas De Casas Acesso A Praia E Campo Sem Comprar A Propriedade Inteira

Apr 28, 2025

Latest Posts

-

The Dogecoin Effect How Cryptocurrencies Threaten Public Data Security

Apr 30, 2025

The Dogecoin Effect How Cryptocurrencies Threaten Public Data Security

Apr 30, 2025 -

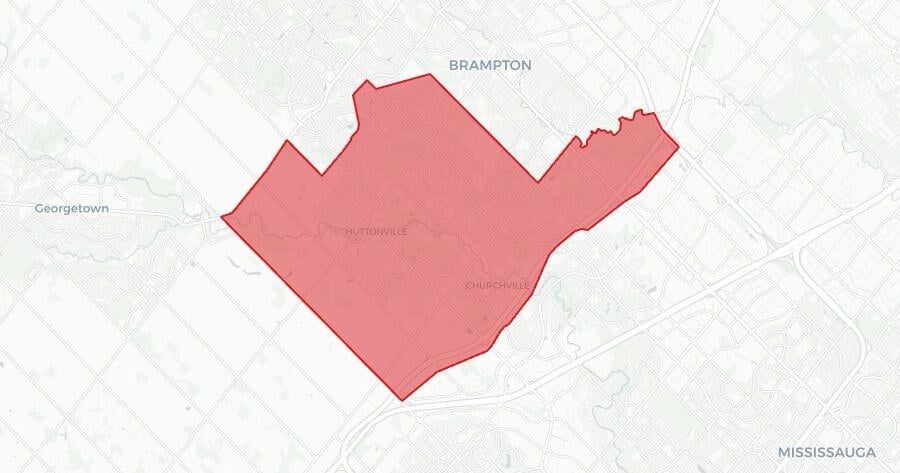

2023 Brampton South Federal Election Real Time Results And Winners

Apr 30, 2025

2023 Brampton South Federal Election Real Time Results And Winners

Apr 30, 2025 -

Thunderstorm Watch Calgary Faces Windy Cloudy Conditions Tuesday

Apr 30, 2025

Thunderstorm Watch Calgary Faces Windy Cloudy Conditions Tuesday

Apr 30, 2025 -

Brampton South Votes Sonia Sidhu Secures Liberal Victory

Apr 30, 2025

Brampton South Votes Sonia Sidhu Secures Liberal Victory

Apr 30, 2025 -

Sonia Sidhu Wins Brampton South Liberal Candidate Re Elected

Apr 30, 2025

Sonia Sidhu Wins Brampton South Liberal Candidate Re Elected

Apr 30, 2025