Bitcoin Price Surge Following Trump Statements: An Investor's Guide.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Price Surge Following Trump Statements: An Investor's Guide

Bitcoin's price experienced a significant jump following recent statements from former US President Donald Trump, leaving investors wondering about the implications and future trajectory. This unexpected surge highlights the complex interplay between political rhetoric, social media influence, and cryptocurrency markets. Understanding the factors driving this price movement is crucial for navigating the volatile world of Bitcoin investment.

This article serves as a comprehensive guide for investors seeking to understand the recent surge and make informed decisions. We will explore the connection between Trump's comments and the Bitcoin price increase, analyze the market sentiment, and provide insights into potential future scenarios.

Trump's Statements and the Bitcoin Rally

The recent price surge in Bitcoin followed statements made by Donald Trump regarding his views on Bitcoin and other cryptocurrencies. While the exact nature of these statements varies depending on the source, the common thread is a generally positive sentiment towards Bitcoin, either directly or indirectly through comments about the US dollar or the current economic climate. This positive sentiment, amplified across social media, sparked a wave of buying activity, pushing the Bitcoin price higher. However, it's crucial to remember that correlation doesn't equal causation. While Trump's statements may have acted as a catalyst, other underlying market forces were likely at play.

Analyzing Market Sentiment and Volatility

The Bitcoin market is known for its volatility. The price can swing wildly in short periods based on various factors, including regulatory changes, technological advancements, and macroeconomic conditions. The current surge, while partly influenced by Trump's comments, also reflects a broader sentiment within the cryptocurrency community. Many believe Bitcoin offers a hedge against inflation and economic uncertainty, making it an attractive investment during times of geopolitical instability.

- Increased Institutional Adoption: Growing adoption of Bitcoin by institutional investors continues to bolster market confidence.

- Technological Developments: Ongoing developments within the Bitcoin network, such as the Lightning Network, are improving scalability and transaction speeds.

- Global Economic Uncertainty: Concerns about inflation and economic downturns are driving investors towards alternative assets like Bitcoin.

Potential Future Scenarios and Investor Strategies

Predicting the future price of Bitcoin is impossible. However, based on current trends and market analysis, several scenarios are plausible:

- Continued Upward Trend: If positive sentiment persists and institutional adoption continues, the upward trend could continue.

- Consolidation and Correction: After a sharp price increase, a period of consolidation or correction is common. This would involve a period of sideways trading or a slight decline before resuming an upward trajectory.

- Significant Price Drop: Negative news, regulatory crackdowns, or a sudden shift in market sentiment could trigger a significant price drop.

For investors, a cautious approach is recommended. It's crucial to diversify your portfolio, avoid investing more than you can afford to lose, and conduct thorough research before making any investment decisions. Consider the following strategies:

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money at regular intervals, regardless of price fluctuations.

- Long-Term Investment: Bitcoin is often considered a long-term investment, requiring patience and a tolerance for volatility.

- Risk Management: Implement stop-loss orders to limit potential losses.

Conclusion: Navigating the Bitcoin Landscape

The recent Bitcoin price surge following Trump's statements highlights the unpredictable nature of cryptocurrency markets. While political statements can act as catalysts, underlying market forces and investor sentiment play a crucial role in shaping price movements. By understanding these factors and employing sound investment strategies, investors can navigate the volatile Bitcoin landscape more effectively and potentially capitalize on future opportunities. Remember to always conduct thorough research and seek professional financial advice before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Price Surge Following Trump Statements: An Investor's Guide.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How To Watch Ipl Cricket In The Usa A Comprehensive Guide

May 23, 2025

How To Watch Ipl Cricket In The Usa A Comprehensive Guide

May 23, 2025 -

Wwe 2 K25 Haliburtons Inclusion As Playable Character Sparks Fan Debate

May 23, 2025

Wwe 2 K25 Haliburtons Inclusion As Playable Character Sparks Fan Debate

May 23, 2025 -

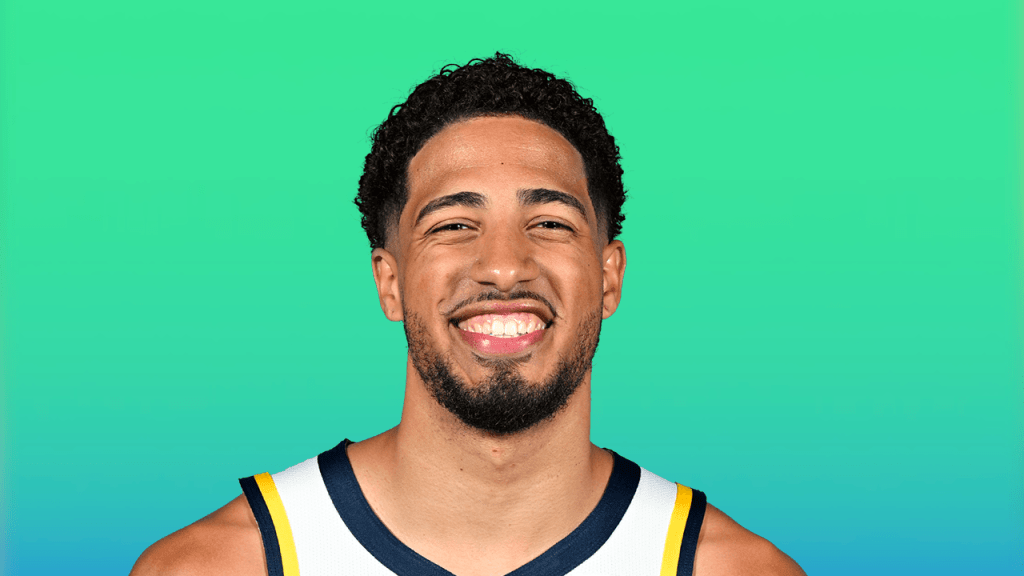

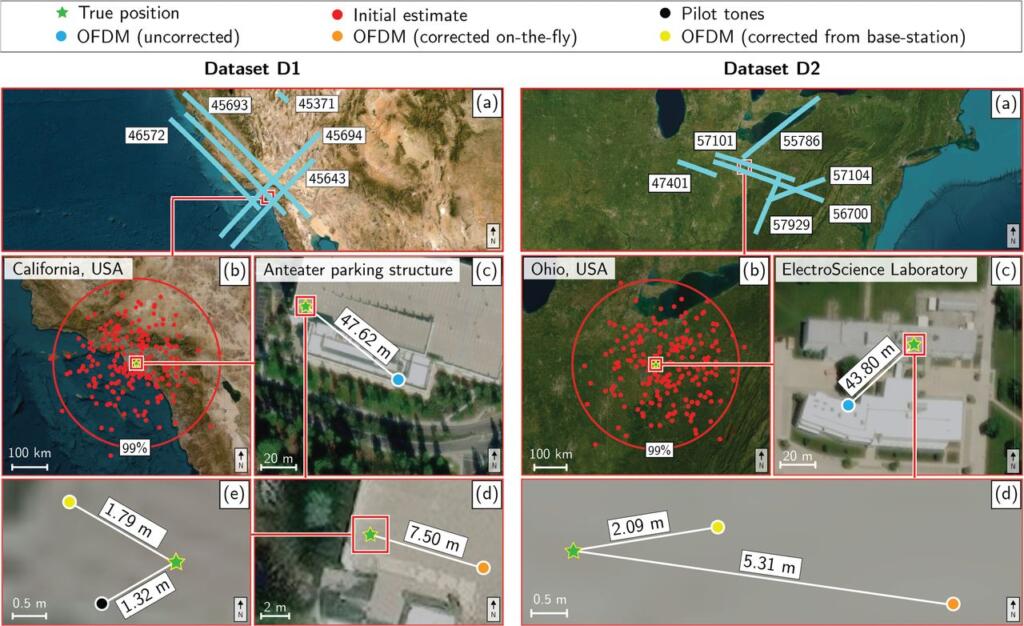

Space X Starlink Aims For Gps Revolution Fcc Spectrum Decision Holds The Key

May 23, 2025

Space X Starlink Aims For Gps Revolution Fcc Spectrum Decision Holds The Key

May 23, 2025 -

Postecoglou Nun Takimina Yoenelttigi Gurur Mesaji

May 23, 2025

Postecoglou Nun Takimina Yoenelttigi Gurur Mesaji

May 23, 2025 -

Deepfake Cryptocurrency Scams Exploding Ripple Issues Urgent Warning

May 23, 2025

Deepfake Cryptocurrency Scams Exploding Ripple Issues Urgent Warning

May 23, 2025

Latest Posts

-

Cine De Aventura Y Ciencia Ficcion Localizaciones En Bangkok Y Egipto

May 23, 2025

Cine De Aventura Y Ciencia Ficcion Localizaciones En Bangkok Y Egipto

May 23, 2025 -

Tom Cruise Skips Ana De Armas John Wick Ballerina Premiere Fueling Relationship Speculation

May 23, 2025

Tom Cruise Skips Ana De Armas John Wick Ballerina Premiere Fueling Relationship Speculation

May 23, 2025 -

Accc Slaps Starlink With Warning What It Means For Australian Consumers

May 23, 2025

Accc Slaps Starlink With Warning What It Means For Australian Consumers

May 23, 2025 -

Analyzing Google I O 2025 Key Trends And Future Implications

May 23, 2025

Analyzing Google I O 2025 Key Trends And Future Implications

May 23, 2025 -

Expect Delays Ica Issues June School Holiday Traffic Alert For Woodlands And Tuas

May 23, 2025

Expect Delays Ica Issues June School Holiday Traffic Alert For Woodlands And Tuas

May 23, 2025