Bitcoin Reaches $91,000 As Trade Tensions Ease: Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Reaches $91,000 as Trade Tensions Ease: Market Analysis

Bitcoin's meteoric rise continues, shattering the $91,000 barrier following a significant easing of US-China trade tensions. This unexpected surge has sent shockwaves through the cryptocurrency market, leaving analysts scrambling to understand the driving forces behind this dramatic price jump. The news comes as a welcome surprise to many, particularly after a period of relative market consolidation.

The recent positive developments in US-China trade negotiations have injected a wave of optimism into global financial markets, boosting investor confidence across the board. This positive sentiment has spilled over into the cryptocurrency market, with Bitcoin experiencing a particularly dramatic increase in value. But is this simply a short-term rally fueled by geopolitical events, or a sign of sustained bullish momentum for Bitcoin?

Understanding the Surge: Key Factors

Several key factors contributed to Bitcoin's astonishing rise to $91,000:

-

Easing Trade Tensions: The reduction in trade tariffs and the promise of further cooperation between the US and China have created a more stable global economic outlook, encouraging investors to seek higher-risk, higher-reward assets like Bitcoin. This reduced uncertainty is a significant catalyst for investment.

-

Increased Institutional Adoption: The growing acceptance of Bitcoin by institutional investors, including large hedge funds and corporations, continues to fuel demand. This institutional interest adds significant weight and legitimacy to the cryptocurrency, driving up its price.

-

Halving Effect: While the next Bitcoin halving is still some time away, anticipation of this event, which reduces the rate of new Bitcoin creation, is already impacting the market. This scarcity effect contributes to increasing value.

-

FOMO (Fear Of Missing Out): As Bitcoin’s price climbs, the fear of missing out drives more investors into the market, creating a self-fulfilling prophecy of rising prices. This psychological factor plays a significant role in rapid price movements.

Market Analysis and Future Predictions

While the current price surge is undeniably impressive, it’s crucial to approach future predictions with caution. The cryptocurrency market is inherently volatile, and unforeseen events can drastically impact prices. However, several analysts believe that the recent surge reflects a broader shift towards digital assets and a growing recognition of Bitcoin's potential as a store of value and a hedge against inflation.

Short-Term Outlook: Many analysts predict a period of consolidation around the $91,000 mark, followed by further, albeit potentially more gradual, growth. However, a correction is always possible, and investors should be prepared for potential volatility.

Long-Term Outlook: The long-term outlook for Bitcoin remains positive for many experts, based on factors such as increasing adoption, limited supply, and growing institutional investment. However, regulatory uncertainty and technological advancements could still significantly impact its future trajectory.

Risks and Considerations

Investors should always remember that investing in Bitcoin and other cryptocurrencies carries significant risk. The market is highly speculative, and price fluctuations can be dramatic. Before investing, it's crucial to:

- Conduct thorough research: Understand the technology, the risks, and the potential rewards.

- Diversify your portfolio: Don't put all your eggs in one basket.

- Only invest what you can afford to lose: Cryptocurrency investments are inherently risky.

Bitcoin's remarkable journey to $91,000 is a testament to its growing acceptance and potential. However, navigating this volatile market requires careful consideration, thorough research, and a well-defined investment strategy. The future of Bitcoin remains unwritten, but the current surge undoubtedly marks a significant milestone in its history.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Reaches $91,000 As Trade Tensions Ease: Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Top Pap Teams Servicing East Coast Grc Clients

Apr 24, 2025

Top Pap Teams Servicing East Coast Grc Clients

Apr 24, 2025 -

Prove It Joe Biden Under Fire For Terrorism And Gang Member Label On Deportations

Apr 24, 2025

Prove It Joe Biden Under Fire For Terrorism And Gang Member Label On Deportations

Apr 24, 2025 -

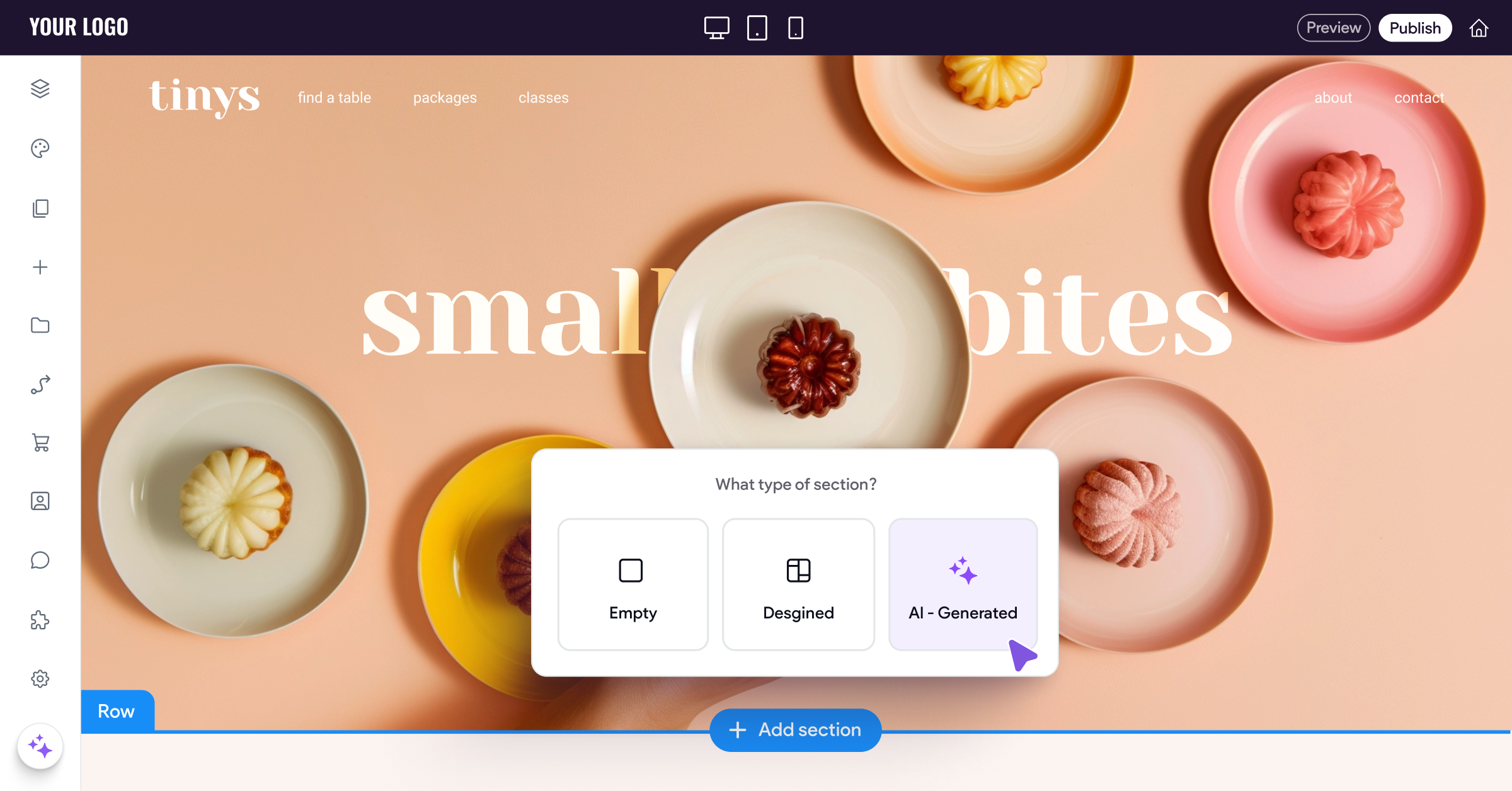

New Ai Powered Tool From Duda Targets Major Agency Challenges

Apr 24, 2025

New Ai Powered Tool From Duda Targets Major Agency Challenges

Apr 24, 2025 -

Unthinkable Accusation An Obama Staffers Take On Joe Rogan

Apr 24, 2025

Unthinkable Accusation An Obama Staffers Take On Joe Rogan

Apr 24, 2025 -

Buenos Aires O La Ia Elige Una Nueva Capital Para Argentina

Apr 24, 2025

Buenos Aires O La Ia Elige Una Nueva Capital Para Argentina

Apr 24, 2025