Bitcoin Reaches $93,000 Following Trump's China Tariff And Fed Chair Announcements

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Soars to $93,000: Trump's Trade War and Powell's Pivot Fuel Crypto Rally

Bitcoin (BTC) has exploded past the $93,000 mark, marking a staggering surge fueled by a confluence of major economic events. The cryptocurrency's dramatic price increase follows closely on the heels of former President Trump's renewed pronouncements on imposing significant tariffs on Chinese goods and the Federal Reserve Chair Jerome Powell's unexpected shift in monetary policy. This unprecedented jump has sent shockwaves through both the cryptocurrency and traditional financial markets.

This dramatic rally represents a significant milestone for Bitcoin, surpassing previous all-time highs and solidifying its position as a potential safe haven asset during times of economic uncertainty. The surge highlights the growing interconnectedness between traditional finance and the crypto market, with macroeconomic events significantly impacting cryptocurrency prices.

Trump's China Tariff Threat: A Catalyst for Bitcoin's Rise?

Former President Trump's recent statements regarding renewed tariffs on Chinese imports have injected significant uncertainty into the global economy. Investors, fearing escalating trade tensions and potential economic slowdown, are increasingly looking towards alternative assets, including Bitcoin, as a hedge against inflation and market volatility. This flight to safety, coupled with Bitcoin's decentralized nature, is widely believed to be a key driver behind its recent price surge. The perceived security and scarcity of Bitcoin are making it an attractive option for those seeking to protect their investments.

- Increased Demand: The uncertainty surrounding trade relations is driving increased demand for Bitcoin, pushing its price higher.

- Safe Haven Asset: Bitcoin is increasingly viewed as a safe haven asset, similar to gold, during times of economic instability.

- Decentralization: Bitcoin's decentralized nature makes it attractive to those seeking to diversify their portfolios beyond traditional assets.

Powell's Policy Shift: Another Contributing Factor

Federal Reserve Chair Jerome Powell's recent announcements regarding a potential pivot in monetary policy have also contributed to the Bitcoin rally. Any shift away from aggressive interest rate hikes could signal a potential easing of inflation, potentially boosting investor confidence and driving capital into riskier assets, including cryptocurrencies. This unexpected shift has further fueled speculation and investment in the cryptocurrency market.

- Inflation Concerns: The potential easing of inflation could alleviate investor concerns and boost demand for riskier assets.

- Market Sentiment: Powell's statements have significantly improved market sentiment, creating a more favorable environment for Bitcoin investment.

- Reduced Risk Aversion: A more accommodative monetary policy could decrease risk aversion, encouraging investment in volatile assets like Bitcoin.

The Future of Bitcoin: Sustained Growth or Short-Lived Rally?

While the recent price surge is undeniably impressive, the question remains: is this sustained growth or a short-lived rally? Analysts are divided, with some predicting further increases based on continued macroeconomic uncertainty and increasing institutional adoption, while others warn of potential corrections given the volatility inherent in the cryptocurrency market.

Only time will tell if Bitcoin can maintain its momentum at these unprecedented levels. The interconnectedness of global economic events and the cryptocurrency market remains a key factor to consider. Continuous monitoring of macroeconomic indicators and regulatory developments will be crucial in predicting the future trajectory of Bitcoin's price. This unexpected surge highlights the increasingly significant role cryptocurrencies are playing in the global financial landscape. Further research into the correlation between geopolitical events and cryptocurrency price movements is essential for investors seeking to navigate this complex and evolving market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Reaches $93,000 Following Trump's China Tariff And Fed Chair Announcements. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

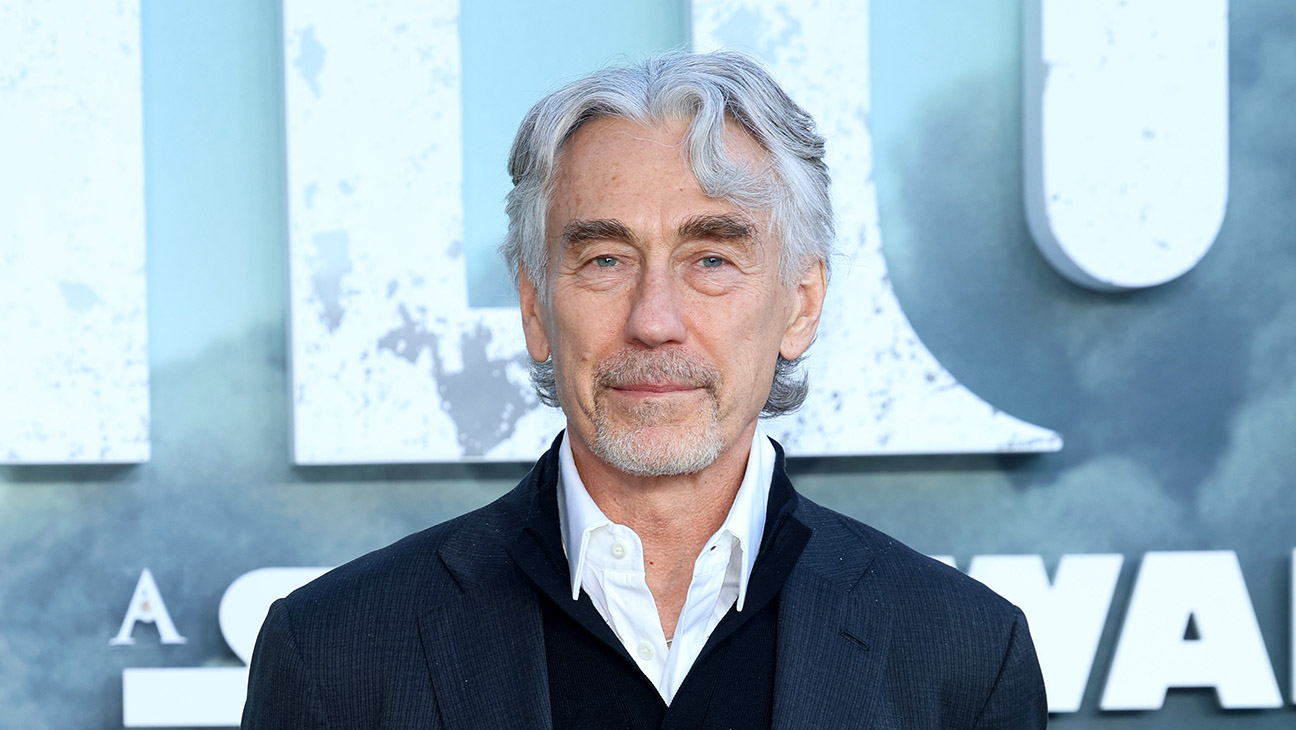

Andor Season 2 Tony Gilroy On The Challenges Of Maintaining Success

Apr 24, 2025

Andor Season 2 Tony Gilroy On The Challenges Of Maintaining Success

Apr 24, 2025 -

New Clothing Line Game 7 Partners With Centric Brands

Apr 24, 2025

New Clothing Line Game 7 Partners With Centric Brands

Apr 24, 2025 -

Boeing 737 Max And Other Aircraft Back In The Air Following Chinas Ban

Apr 24, 2025

Boeing 737 Max And Other Aircraft Back In The Air Following Chinas Ban

Apr 24, 2025 -

Criminal Ip Showcases Advanced Threat Intelligence Rsac 2025 Highlights

Apr 24, 2025

Criminal Ip Showcases Advanced Threat Intelligence Rsac 2025 Highlights

Apr 24, 2025 -

Liverpools Path To Premier League Glory A Sunday Showdown

Apr 24, 2025

Liverpools Path To Premier League Glory A Sunday Showdown

Apr 24, 2025