Bitcoin Reserve Rejected: UK Declares Crypto Not Suitable

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Reserve Rejected: UK Declares Cryptocurrencies Unsuitable for Official Reserves

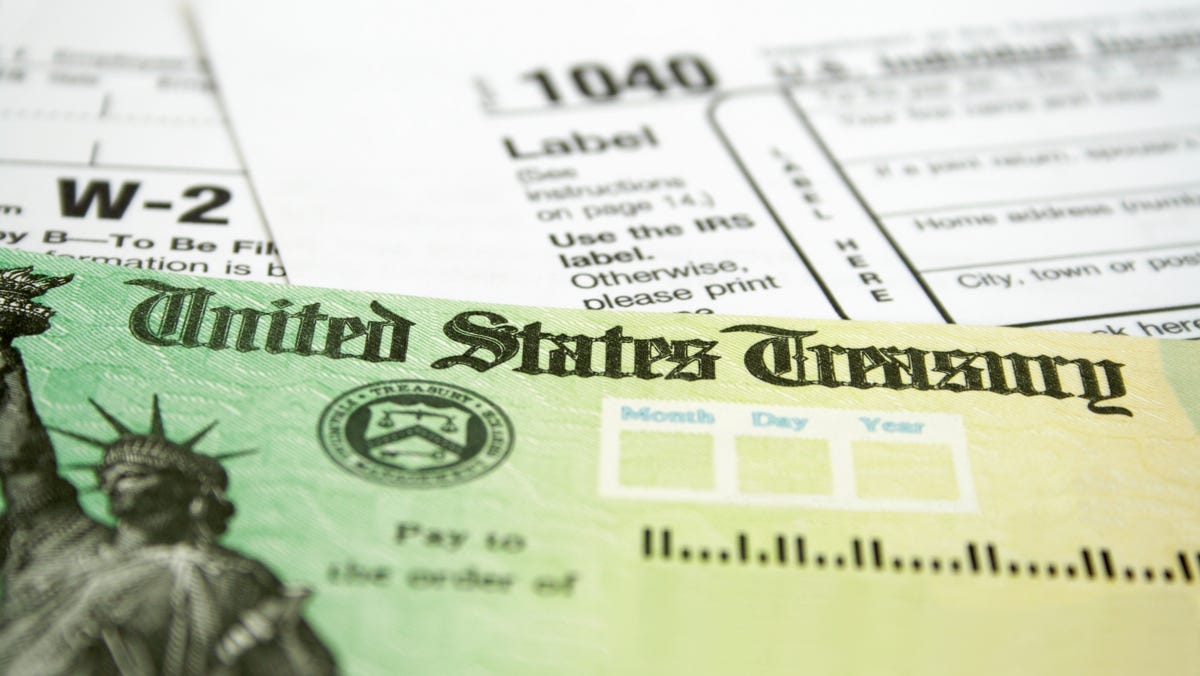

The UK government has officially declared cryptocurrencies, including Bitcoin, unsuitable for inclusion in its official foreign exchange reserves. This decisive move marks a significant shift in the UK's stance on digital assets and highlights growing concerns regarding the volatility and regulatory uncertainties surrounding the cryptocurrency market. The announcement, made [Insert Date and Source of Announcement Here], sent ripples through the global crypto community, prompting renewed debate about the long-term viability and acceptance of digital currencies as legitimate financial instruments.

Why the Rejection? Understanding the UK's Concerns

The Treasury's decision stems from a comprehensive assessment of the risks associated with holding cryptocurrencies as part of its reserves. Several key factors contributed to this rejection:

-

Extreme Volatility: Bitcoin's price is notoriously volatile, subject to dramatic swings driven by speculation, regulatory announcements, and market sentiment. This inherent instability makes it an unsuitable asset for a reserve intended to maintain financial stability and act as a buffer against economic shocks. The UK government prioritizes predictability and stability in its reserve management.

-

Regulatory Uncertainty: The lack of a globally consistent regulatory framework for cryptocurrencies poses significant risks. The ever-evolving regulatory landscape introduces uncertainty regarding taxation, legal ownership, and potential future restrictions, all of which could negatively impact the value of any crypto holdings.

-

Security Risks: Cryptocurrency exchanges and wallets are susceptible to hacking and theft. The potential for significant losses due to security breaches further underscores the risks associated with holding cryptocurrencies in large quantities.

-

Lack of Transparency and Traceability: Compared to traditional assets, tracking and auditing cryptocurrency transactions can be challenging. This opacity contradicts the UK government's commitment to transparency and accountability in its financial dealings.

Implications for the Crypto Market and the UK's Financial Strategy

This decision by the UK government sends a strong signal to other nations considering similar strategies. It reinforces the perception of cryptocurrencies as high-risk, speculative assets rather than stable stores of value. This could potentially impact the adoption of cryptocurrencies globally and further solidify the dominance of traditional fiat currencies in official reserves.

For the UK, the focus remains on traditional assets such as gold, US dollars, and other established currencies. This conservative approach prioritizes financial stability and minimizes exposure to the risks associated with the still-developing cryptocurrency market.

The Future of Crypto in Official Reserves: A Global Perspective

While the UK's decision represents a significant rejection, other nations may adopt different approaches. The debate surrounding the role of cryptocurrencies in official reserves is likely to continue, with ongoing discussions regarding the potential benefits and drawbacks weighed against the risks. The development of more robust regulatory frameworks and improvements in cryptocurrency technology might eventually alter this perspective, but for now, the UK’s stance underscores the prevailing caution towards digital currencies in official financial management.

Keywords: Bitcoin, Cryptocurrency, UK Government, Official Reserves, Foreign Exchange Reserves, Crypto Regulation, Bitcoin Volatility, Digital Assets, Financial Stability, Treasury, Risk Management, Crypto Investment, Global Economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Reserve Rejected: UK Declares Crypto Not Suitable. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pennsylvania Stimulus Check Am I Too Late To Claim My 2nd And 3rd Payments

May 08, 2025

Pennsylvania Stimulus Check Am I Too Late To Claim My 2nd And 3rd Payments

May 08, 2025 -

Ukraines Naval Drone Strikes Confirmation Of Russian Su 30 Downed

May 08, 2025

Ukraines Naval Drone Strikes Confirmation Of Russian Su 30 Downed

May 08, 2025 -

28 Years Later Filming Locations A Comprehensive Guide

May 08, 2025

28 Years Later Filming Locations A Comprehensive Guide

May 08, 2025 -

First Confirmed Ukrainian Navy Drone Successfully Targets Russian Su 30

May 08, 2025

First Confirmed Ukrainian Navy Drone Successfully Targets Russian Su 30

May 08, 2025 -

1 400 Refund For U S Expats Comply With Irs Regulations Now

May 08, 2025

1 400 Refund For U S Expats Comply With Irs Regulations Now

May 08, 2025

Latest Posts

-

Analyzing Andor The Impact Of Explicitly Naming The Genocide

May 08, 2025

Analyzing Andor The Impact Of Explicitly Naming The Genocide

May 08, 2025 -

Berubes Underdog Mentality Hurricanes Face Panthers In Playoffs

May 08, 2025

Berubes Underdog Mentality Hurricanes Face Panthers In Playoffs

May 08, 2025 -

Live Tv Fact Check Exposes Pakistan Minister Tarars Claim

May 08, 2025

Live Tv Fact Check Exposes Pakistan Minister Tarars Claim

May 08, 2025 -

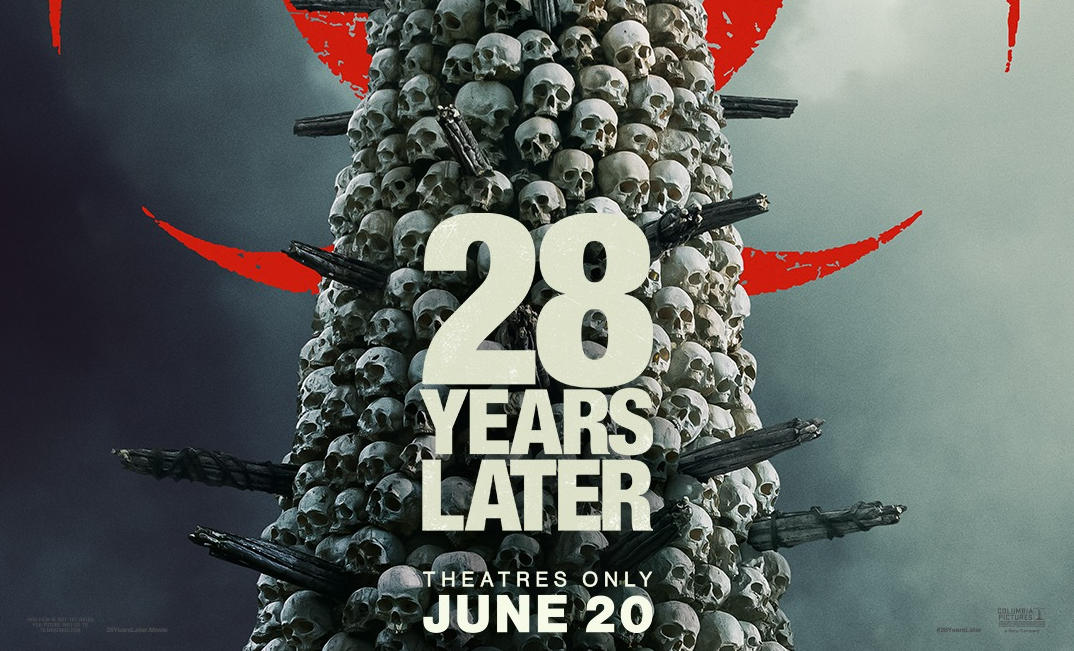

New 28 Years Later Poster Hints At Bone Temples Mysteries

May 08, 2025

New 28 Years Later Poster Hints At Bone Temples Mysteries

May 08, 2025 -

Road To Victory Firebirds Prospects For The Upcoming Season

May 08, 2025

Road To Victory Firebirds Prospects For The Upcoming Season

May 08, 2025