Bitcoin Surges Past $106,000: Institutional Investors Drive Market Rally

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Surges Past $106,000: Institutional Investors Drive Market Rally

Bitcoin (BTC) has exploded past the $106,000 mark, marking a stunning surge that has sent shockwaves through the cryptocurrency market. This dramatic price increase, largely attributed to a renewed influx of institutional investment, signifies a potential turning point in Bitcoin's trajectory and reignites discussions about its long-term viability as a major asset class. The rapid ascent has left many analysts scrambling to understand the driving forces behind this remarkable rally.

The Role of Institutional Investors:

The primary catalyst for this Bitcoin price surge appears to be the increasing involvement of institutional investors. Hedge funds, asset management firms, and even some corporations are allocating significant portions of their portfolios to Bitcoin, viewing it as a hedge against inflation and a potential store of value. This institutional adoption is a stark contrast to the earlier days of Bitcoin, when it was primarily driven by individual investors and enthusiasts.

- Increased Regulatory Clarity: Growing regulatory clarity in various jurisdictions is boosting institutional confidence. While regulations continue to evolve, a more predictable regulatory landscape encourages larger players to enter the market.

- Demand Outpacing Supply: The fixed supply of 21 million Bitcoins continues to exert upward pressure on price as demand from institutional investors increases. This inherent scarcity is a key factor driving Bitcoin's value proposition.

- Positive Market Sentiment: The overall positive sentiment surrounding Bitcoin and the broader cryptocurrency market is fueling the rally. Positive news, successful integrations into financial systems, and technological advancements all contribute to this sentiment.

Analyzing the Market Rally:

The speed and magnitude of this price increase are unprecedented. Many market analysts are pointing to several key factors:

- Technological Advancements: Continued development and improvements within the Bitcoin ecosystem, such as the Lightning Network for faster transactions, enhance Bitcoin's functionality and appeal.

- Macroeconomic Factors: Global economic uncertainty and inflationary pressures are pushing investors towards alternative assets like Bitcoin, seen as a potential safe haven.

- FOMO (Fear Of Missing Out): The rapid price increase itself can create a FOMO effect, drawing in more investors who fear missing out on potential profits. This further fuels the upward momentum.

What Does the Future Hold for Bitcoin?

While this surge is incredibly bullish, it's crucial to remember that the cryptocurrency market is inherently volatile. Predicting future price movements with certainty is impossible. However, the sustained institutional interest suggests a more mature and potentially stable future for Bitcoin.

Key Takeaways:

- Institutional investment is a major driver of Bitcoin's price surge.

- Regulatory clarity and macroeconomic factors are contributing to the positive market sentiment.

- Bitcoin's limited supply continues to exert upward pressure on price.

- While volatile, Bitcoin's long-term prospects appear increasingly positive due to institutional adoption.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you should conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Surges Past $106,000: Institutional Investors Drive Market Rally. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoin As Legal Tender Feasibility Study Comparing El Salvador And The United States

May 22, 2025

Bitcoin As Legal Tender Feasibility Study Comparing El Salvador And The United States

May 22, 2025 -

Bbc Zayif Takimlarin Finalini Anlatti Sasirtici Gercekler

May 22, 2025

Bbc Zayif Takimlarin Finalini Anlatti Sasirtici Gercekler

May 22, 2025 -

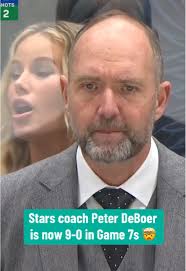

From Ahl To Nhl Tracing Peter De Boers Coaching Journey

May 22, 2025

From Ahl To Nhl Tracing Peter De Boers Coaching Journey

May 22, 2025 -

Tonights Lotto Results Check The Winning Numbers For May 21 2025

May 22, 2025

Tonights Lotto Results Check The Winning Numbers For May 21 2025

May 22, 2025 -

Samsung S25 Edge Exceeding Expectations With Extended Battery Performance

May 22, 2025

Samsung S25 Edge Exceeding Expectations With Extended Battery Performance

May 22, 2025