Bitcoin To Hit $1M In Three Years? Arthur Hayes' Bold Prediction Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin to Hit $1 Million in Three Years? Arthur Hayes' Bold Prediction Explained

Crypto markets are abuzz with a fresh prediction from Arthur Hayes, the former CEO of BitMEX, who believes Bitcoin (BTC) could skyrocket to a staggering $1 million within the next three years. This bold forecast, while audacious, isn't entirely out of left field, considering Bitcoin's historical volatility and recent market trends. But what's the reasoning behind Hayes' optimistic – some might say audacious – prediction? Let's delve into the details.

Hayes' Rationale: A Perfect Storm Brewing for Bitcoin?

Hayes' prediction, made in a recent blog post, hinges on several interconnected factors. He doesn't simply posit a random number; instead, he builds his case upon several key market indicators and macroeconomic conditions.

-

The Fed's Monetary Policy: Hayes argues that the Federal Reserve's continued quantitative easing and potential further monetary expansion will inevitably lead to a devaluation of the US dollar. This, he believes, will drive investors seeking refuge towards alternative assets, including Bitcoin. The narrative points to Bitcoin as a hedge against inflation and a store of value, bolstering its appeal.

-

Bitcoin's Halving Cycle: The Bitcoin halving event, which reduces the rate of new Bitcoin creation, is another crucial element in Hayes' forecast. Historically, these halvings have been followed by significant price increases. The next halving is anticipated in 2024, potentially acting as a catalyst for a bullish market.

-

Institutional Adoption and Growing Demand: The increasing institutional adoption of Bitcoin, with major corporations and financial institutions adding BTC to their balance sheets, signifies a growing level of acceptance and legitimacy. This, coupled with steadily rising demand from individual investors, contributes to the upward pressure on price.

-

Scarcity and Limited Supply: Bitcoin's inherent scarcity, with a fixed maximum supply of 21 million coins, is often cited as a key driver of its long-term value proposition. As demand increases, and supply remains constant, the price naturally tends to rise.

The Skeptics' Counterarguments: A Necessary Perspective

While Hayes' prediction is undeniably exciting for Bitcoin bulls, it's crucial to acknowledge the counterarguments and potential risks. Critics point to:

-

Market Volatility: Bitcoin's price is notoriously volatile, subject to sharp fluctuations influenced by regulatory changes, market sentiment, and technological developments. Predicting a specific price point with such precision is inherently challenging.

-

Regulatory Uncertainty: The evolving regulatory landscape surrounding cryptocurrencies globally presents a significant wildcard. Stringent regulations could dampen investor enthusiasm and potentially impact Bitcoin's price negatively.

-

Technological Risks: The potential for unforeseen technological issues or security breaches within the Bitcoin network could also trigger price drops.

-

Alternative Investments: The emergence of competing cryptocurrencies and other alternative investment options could potentially divert investor interest away from Bitcoin.

Conclusion: A High-Stakes Gamble?

Arthur Hayes' $1 million Bitcoin prediction is undoubtedly a bold claim. Whether it materializes remains to be seen. His argument, however, highlights the confluence of factors potentially driving Bitcoin's price upward. While his prediction might be overly optimistic for some, it underscores the ongoing debate about Bitcoin's long-term potential and its role in a rapidly evolving financial landscape. Investors should approach such predictions with caution, conduct thorough research, and manage risk appropriately. The cryptocurrency market remains inherently volatile, and substantial gains are often accompanied by significant risks. Remember to always invest responsibly and only what you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin To Hit $1M In Three Years? Arthur Hayes' Bold Prediction Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

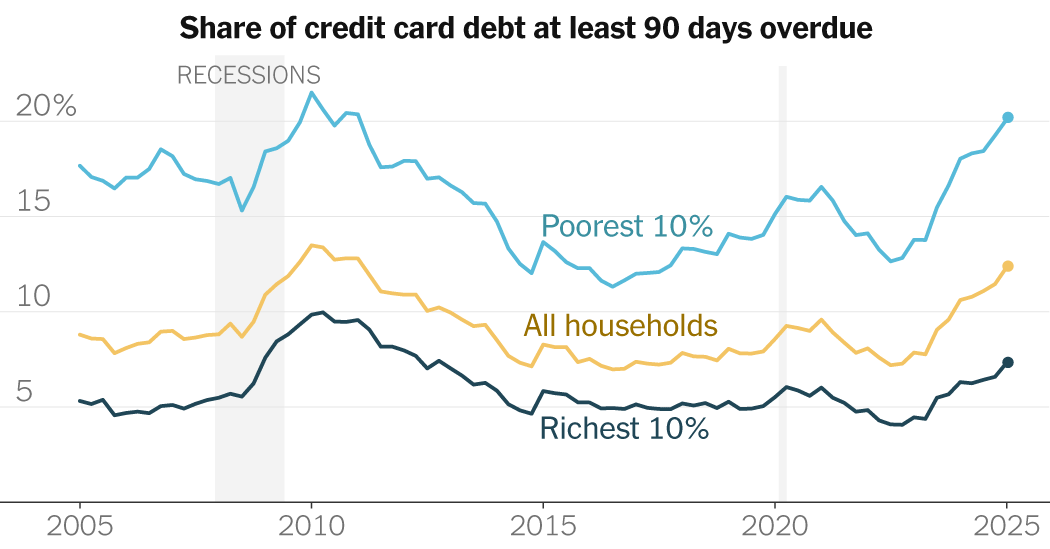

Rising Prices And Falling Confidence The Impact Of Trumps Tariffs On Consumers

May 16, 2025

Rising Prices And Falling Confidence The Impact Of Trumps Tariffs On Consumers

May 16, 2025 -

Critics Agree Murderbot Is A Hilarious New Comedy For 2025

May 16, 2025

Critics Agree Murderbot Is A Hilarious New Comedy For 2025

May 16, 2025 -

Gracie Abrams Tour 2024 Your Ultimate Guide

May 16, 2025

Gracie Abrams Tour 2024 Your Ultimate Guide

May 16, 2025 -

The Synergistic Power Of Teslas Dojo And 4680 Technology A Competitive Analysis

May 16, 2025

The Synergistic Power Of Teslas Dojo And 4680 Technology A Competitive Analysis

May 16, 2025 -

Trump Declares Taylor Swift Not Hot Igniting Maga Celebration

May 16, 2025

Trump Declares Taylor Swift Not Hot Igniting Maga Celebration

May 16, 2025